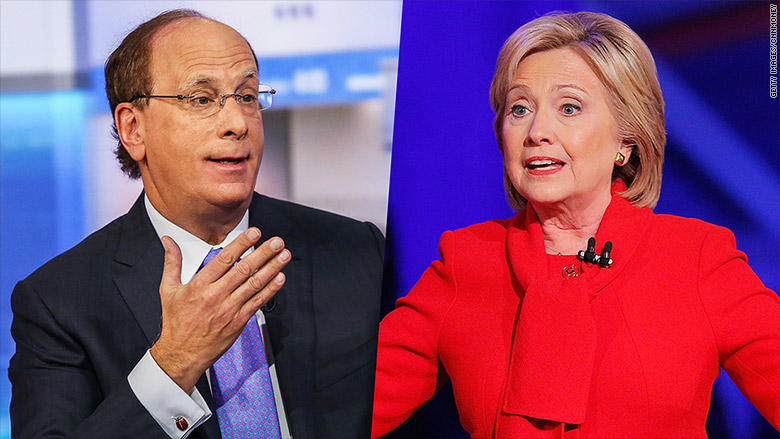

A prominent Wall Street CEO sounds a lot like Hillary Clinton.

Larry Fink, CEO of the world's largest money management firm BlackRock (BLK), just sent out his annual letter to top business leaders. In it, he urges CEOs to resist "the powerful forces of short-termism."

It's a term Clinton uses often on the campaign trail. She argues short-termism is a major problem and vows to "put an end to quarterly capitalism."

"This letter indeed has similar themes to what Secretary Clinton has been saying," notes Ronnie Chatterji, a professor at Duke University's Fuqua School of Business and an adviser to the Clinton campaign.

Fink has donated mainly to Democrats in past election cycles. He supported President Obama in 2008 and again in 2012, telling CNN's Fareed Zakaria, "I believe he is the right man for the next four years."

Now there's talk that Fink may be positioning himself as a possible Treasury Secretary if Clinton wins the White House. BlackRock put Clinton's former chief of staff, Cheryl Mills, on its board in 2013, shortly after she left the State Department.

Related: Wall Street has made Hillary Clinton a millionaire

Fink and Clinton agree that one of the country's top problems is that CEOs -- and Washington -- are too focused on short-term gain instead of long-term growth.

Take a look at excerpts from Fink's letter juxtaposed against Clinton's speeches. They make five key points.

1. Stop the short-term hysteria

Fink letter: "Today's culture of quarterly earnings hysteria is totally contrary to the long-term approach we need."

Clinton: America needs to break free "from the tyranny of today's earnings report."

"It's time to start measuring value in terms of years -- or the next decade -- not just the next quarter."

Related: America's problem: 'quarterly capitalism'?

2. Dividends are suspiciously high

Fink letter: "Dividends paid out by S&P 500 companies in 2015 amounted to the highest proportion of their earnings since 2009...we certainly support returning excess cash to shareholders, but not at the expense of value-creating investment."

Clinton: "In recent years some of our biggest companies have spent more than half their earnings to buy back their own stock and another third or more to pay dividends. That doesn't leave a lot left to raise pay or invest in the workers who made those profits possible or to make new investments necessary to ensure a company's future success."

Related: Hillary Clinton wins Iowa

3. Washington isn't any better than Wall Street

Fink letter: "In Washington (and other capitals), long-term is often defined as simply the next election cycle, an attitude that is eroding the economic foundations of our country."

Clinton: "So government has to be smarter, simpler, more focused itself on long-term investments than short-term politics and be a better partner to cities, states and the private sector."

4. Activist investors often do a disservice

Fink letter: The BlackRock CEO says that when companies don't have a clear long-term plan, it makes it easy for activist investors who "focus on maximizing near-term profit" to come in and force management to adopt their plan.

Clinton: The Democratic hopeful calls activist investors "cut and run shareholders" looking for a quick buck. She wants to discourage anyone who isn't focused on the long-term.

Related: 56% of Americans think their kids will be worse off

5. Reform the capital gains tax

Fink letter: "With capital gains...one year shouldn't qualify as a long-term holding period. As I wrote last year, we need a capital gains regime that rewards long-term investment -- with the long-term treatment only after three years."

Clinton: Her plan is to raise capital gains rates from 20% almost 40% for Americans in the top income tax bracket who hold an investment for under two years. The 20% rate wouldn't kick in until a wealthy investor held onto an asset for six years. The goal is to "encourage long-term investment."