The fabled FANG stocks of tech -- Facebook, Amazon, Netflix and Google -- have lost their bite.

All four surged in 2015. But none of them are up this year.

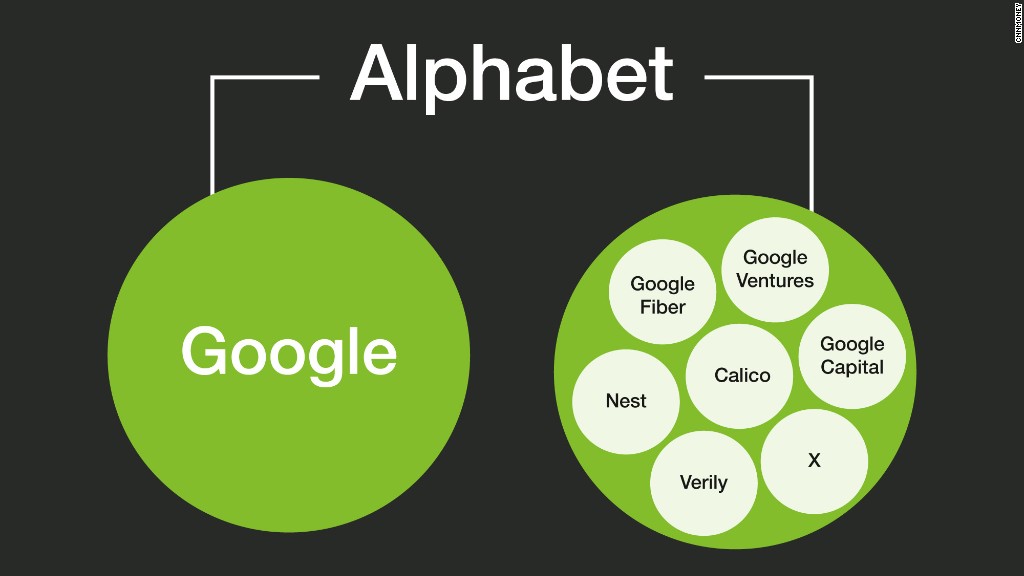

So is this the end of the big bull run for the FANG foursome? (Yes. Google is now technically Alphabet. But its ticker still starts with a G. And FANA just doesn't sound as awesome as FANG.)

Facebook (FB) is down 1% but it recently hit an all-time high thanks to its strong earnings. It should remain a market leader as long as it continues to dominate the social media world and rack up even more mobile ad revenue.

Amazon (AMZN) is down 25% this year. Its latest earnings were a bit of a mess. Investors are once again worried about the company's big investments weighing down profits. And it still trades at a sky-high valuation after more than doubling last year.

Related: Alphabet was briefly worth more than Apple

Netflix (NFLX) is down 26%. It was the only S&P 500 stock to top Amazon in 2015. Netflix wowed investors with its latest results, posting strong subscriber growth. But it is spending a lot to keep growing -- particularly on new content and international expansion.

Google (GOOGL) is down 9%. Its slide is a bit of a head-scratcher. Alphabet reported amazing results this week, enough to push it ahead of Apple (AAPL) in market value. But it has slid sharply in the past few days. And Apple is now worth more than Alphabet again.

Related: Facebook making more money off you than ever before

So if FANG is sooo last year, then who will wind up being the big momentum stocks of 2016? More importantly, can we come up with a too cool for school acronym for the group?

RBC Capital Markets analyst Mark Mahaney suggested in December that FANG would be replaced by BAGEL.

The A and the G are still Amazon and Google. But the B is for Alibaba (BABA). (Its ticker starts with a B.) Expedia (EXPE) and LinkedIn (LNKD) are the other two Internet stocks in Mahaney's Fab 5.

Uhhh. That hasn't worked out so well. You might say that this BAGEL is full of holes. (Sorry. I really have no shame.)

Alibaba's stock is down 22% this year. Expedia has plunged 25%.

And LinkedIn? More like LinkedOut! LinkedIn has lost nearly half its value in 2016, including a 40% drop on Friday after the social network for professionals stunned Wall Street with guidance that was well below forecasts.

Related: LinkedIn plunges on tepid outlook

So you can forget about the cream cheese and lox. But I think I've come up with another food-themed acronym for this year's market leaders.

These are the top-five gainers in the S&P 500 so far this year. There isn't really a trend to tie all five of them together unfortunately. It's three natural gas companies, a gold miner and a fashion retailer.

Southwestern Energy (SWN)

Newmont Mining (NEM)

Michael Kors (KORS)

Range Resources (RRC)

Spectra Energy (SE)

Ladies and gentlemen, may I present to you .... SNKRS! (Remember, it's the K in the KORS ticker that counts.)

Pronounce it like Snickers.

Not Sinkers. (They're all up at least 20% after all!) Or Sneakers. (No Nike (NKE) or Under Armour (UA) here.)

Oh well. I tried. Vanna, I'd like to buy a vowel?