Global currencies are crashing left and right.

Russia's ruble and Mexico's peso recently hit all-time lows against the dollar. The currencies of Colombia, Argentina and Brazil are all down 28% or more in the past 12 months. Turkey and South Africa have also fallen by double digits over that time.

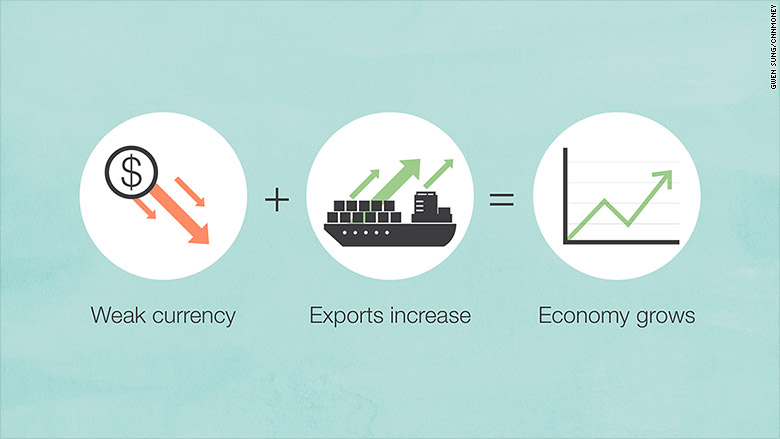

Weak currencies are often a sign of an economic slowdown. China posted its worst growth last year in a quarter century, and Brazil is in its longest recession since the 1930s.

These huge currency shifts have also created opportunities and challenges.

When a currency falls, it makes a country's exports cheaper and more attractive to foreign buyers. At the same time imports get more expensive, which can entice locals to buy products made in their own country. Some countries and companies benefit, others lose.

At the same time, international travel from countries with higher valued currencies rise, while those from devalued currencies fall.

American travelers: Winner

Pack your bags: That vacation outside the U.S. is getting cheap. American travelers going to weak-currency countries, from Brazil to South Africa to Indonesia, are getting more for their dollar.

Through November, over 66 million Americans traveled outside the U.S., according to government statistics. That's up nearly 8% from the previous year.

Walmart, Target, Gap and other retailers: Winner

A strong dollar is good news for box stores like Walmart (WMT) and Target (TGT), fashion retailers like the Gap (GPS), and toy sellers like Toys 'R' Us. All do a lot of importing, which has become a lot cheaper.

Of course, Walmart has a lot of international stores. That means the value of sales from those overseas locations will be lower when converted to U.S. dollars. But overall, Walmart gains more than it loses from the strong dollar.

U.S. multinationals, manufacturers: Loser

Sales outside the U.S. make up most of the revenue at well-known American behemoths like Apple (AAPL), IBM (IBM) and Nike (NKE). A strong dollar makes sneakers, computers and iPhones more expensive to foreign buyers.

Apple estimates its sales in the current quarter will drop for the first time in 13 years. In recent weeks Johnson & Johnson (JNJ), Tiffany (TIF) and Ralph Lauren (RL) too cited the strong dollar as a headwind.

The dollar is hurting American factories even harder. U.S. manufacturing has slowed in recent months, leading to cuts in jobs and production.

Mexico, South Korea, Taiwan: Winner

Countries that benefit from falling currencies have a few key characteristics:

1. They export lots of manufactured products -- as opposed to mostly commodities like oil.

2. They do not have high amounts of foreign debt or soaring inflation.

3. They are not politically unstable.

Mexico is one example. It stands to gain from the peso crashing to an all-time low. One peso is now worth about a nickel.

"We think that Mexico is probably one of the countries that is best positioned to benefit from devaluation," says Edward Glossop, emerging markets economist at Capital Economics, a research firm.

Mexico has a strong manufacturing sector compared to many developing countries. Manufacturers price their products in the local currency -- so if the peso weakens, Mexico's products look a lot more attractive to foreign buyers.

Other countries that broadly fall in this category are Taiwan, South Korea and Vietnam.

Turkey, Russia: Loser

A country's foreign debt is a big problem when its currency falls.

Look at Turkey -- its manufacturing sector is sizable compared to others in developing countries, but it owes lots of foreign debt.

Turkey's foreign debt load is equivalent to nearly half its economic size, compared to Mexico's 22%, according to auditor PwC.

If Turkey's currency falls further, all that foreign debt will be harder to pay back and the nation could risk defaulting on its debt.

Russia is similar in that it too has a lot of foreign debt.

For many of these countries, a devalued currency would help boost their exports. But they have to first get their own house in order and grow their economies. From Brazil to Turkey to Mexico -- there are pros and cons. However, this ongoing currency collapse is starting to separate some of the winners and losers.