Never wager excessively on one stock. That's investing 101.

It's too risky. If that stock tanks, you lose big time. A great example of just how wrong it can go is playing out right now on Wall Street.

Several of Wall Street's star investors (sometimes called "masters of the universe") bet a lot of money -- billions of dollars -- on a Canadian drug company called Valeant.

Unfortunately for them, Valeant (VRX)stock plummeted from over $260 a share in early August to $31 now, a nearly 90% drop.

The company just admitted "improper conduct," fired its CEO and warned that it might default in April.

On top of that, Valeant is under investigation by the U.S. Congress, the Securities and Exchange Commission and a few state attorneys general. The company's strategy to buy older drugs and raise the prices isn't sitting well with regulators.

The stock's stunning fall is tarnishing the reputations of hedge fund kings Bill Ackman of Pershing Square and John Paulson of Paulson & Co., and mutual fund manager Robert Goldfarb, among others.

After a stellar 45-year career, Goldfarb is suddenly retiring because of the bad bet. Investors in his Sequoia Fund aren't pleased with the losses.

Related: I went from Wall Street...to working at Waffle House

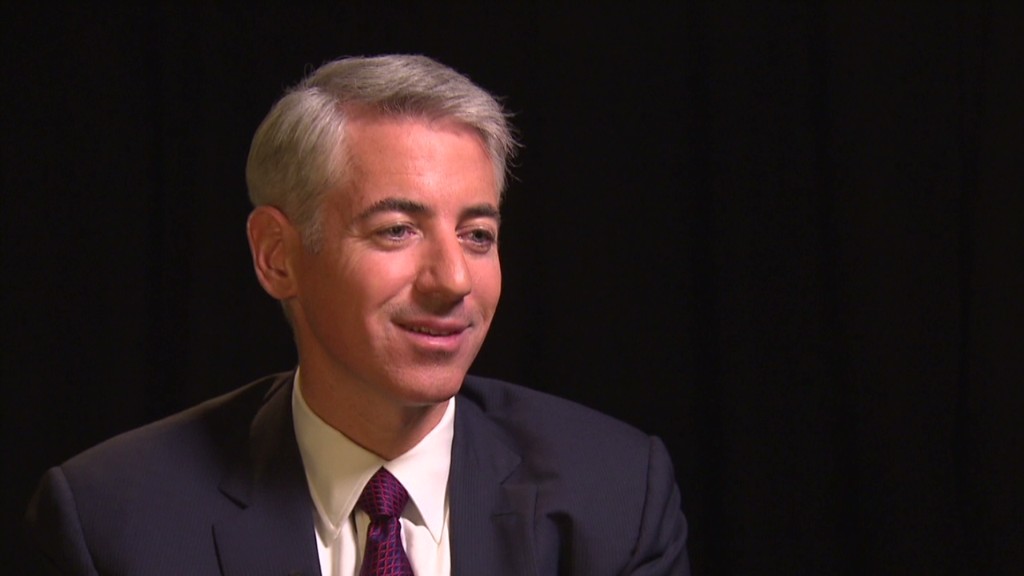

Bill Ackman's very bad year

These masters of the universe command Cadillac-style fees. In return, investors expect turbo-charged performance.

Ackman's fund Pershing Square is down 40% in the past year.

"He has wiped out three years of performance," says Raul Moreno, the founder of iBillionaire, an app that tracks the investments and performance of many high-profile investors like Warren Buffett and Ackman.

What sets Ackman's fund apart is that he is a "high conviction" investor. That's a fancy way of saying he only owns 10 stocks or less in his fund. A typical fund owns 40 to 50 stocks.

When one of Ackman's stocks soars or tanks, it has a huge impact on performance. Ackman bought most of his Valeant shares at an average price of nearly $200 a share.

"I have always had my reservations since he has a very concentrated portfolio," says Moreno. "He's one of the riskiest managers in the industry for sure."

Paulson's flagship fund is down around 30% in the past year, according to Moreno.

Related: Hedge funds love these stocks. Regular investors don't

It's possible that Valeant stock will turn around. Ackman himself has joined the company's board, vowing to "identify new leadership."

Ackman still manages about $12 billion. In a letter to his investors in January, he wrote that great money managers need the "humility to recognize when you are wrong."

But what's happening with Valeant stock is a warning to all investors on Wall Street and Main Street of the pitfalls of getting too excited about one company.