America really wants the United Kingdom to stay in the European Union.

During a visit to London on Friday, President Obama joined eight former U.S. Treasury secretaries in urging the U.K. to remain a member of the 28-country group. The country's first national vote on EU membership in 40 years is just two months away.

Obama said the U.K. is "best when it's helping to lead a strong Europe."

"Speaking honestly, the outcome of that decision is a matter of deep interest to the United States because it affects our prospects as well," he said.

He said a decision to leave the EU -- the Brexit scenario -- would put the U.K. "at the back of the queue" for a free trade deal with the U.S.

Most independent forecasters say Brexit would deliver a shock to the U.K. economy, the fifth biggest in the world. Investors are already nervous, and the pound has fallen sharply this year.

More uncertainty is the last thing that America needs. Here's why the outcome of the June 23 vote matters to the U.S. economy.

Business loves London

American companies can operate anywhere in the EU as long as they establish a branch or subsidiary in one of its 28 member states.

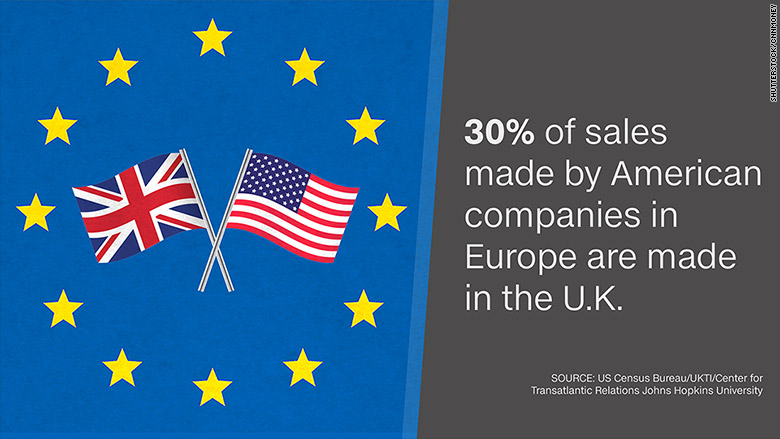

London is the most convenient option for many firms, because of the language, huge talent pool, and easy access to the rest of Europe. The market is crucial for U.S. companies -- 30% of sales made by American companies and their affiliates in Europe are made in the U.K.

Related: Why the big banks really hate 'Brexit'

London is home to 40% of the European headquarters of the world's 250 top companies, according to a research by Deloitte. Paris hosts just 8%.

Wall Street's gateway to Europe

Big Wall Street banks have a lot to lose if the U.K. drops out of the EU.

Many American banks use London as a springboard for their business throughout Europe. That's because as an EU member, the U.K. has a "passport" that allows financial firms to offer services across the other 27 countries.

Leaving the EU could disrupt this link. Banks may have to establish bases elsewhere in the EU, in addition to the U.K., to continue operating across Europe.

Related: Why Brexit could hurt the U.S., too

"EU membership allows banks based in London to sell their services across Europe without needing multiple regulatory approvals in each country. While Britain will remain an attractive center for finance even if Britain exits, it should not take for granted its global primacy when it is no longer the gateway to Europe," the former Treasury officials said.

Risk to trade

The U.S. is the second biggest trading partner for the U.K., after the EU. The U.K. is the seventh largest trading partner for the U.S., after Canada, China, Mexico, Japan, Germany and South Korea.

More than 10% of British exports go to the U.S., worth $58 billion last year. And the U.S. is a key supplier to the U.K., exporting $56 billion worth of goods in 2015.

The relationship is even more important when it comes to service industries -- the U.K. is the biggest foreign provider of services in the U.S., and vice versa. Telecoms, technology services and finance are the top areas for both.

Related: U.S. officials think Brexit is a terrible idea

Brexit could change this. The EU and the U.S. are negotiating a free trade agreement covering their combined population of 800 million people.

Those in favor of Brexit say the U.K. would be able to secure its own trade deals with the U.S., China, and other heavyweights. Obama made clear that wouldn't happen quickly with the U.S.

"Our focus is in negotiating with a big block of the European Union to get a trade agreement done," Obama said at a press conference in London.

There is currently no free trade deal between the U.K. and U.S.

Mutual investments

British companies are the biggest foreign investors in the U.S., having accumulated assets worth about $519 billion by the end of 2014. In that year alone, British investment accounted for more than 18% of all foreign direct investment into the U.S. And U.K. companies employ roughly 1 million people in the U.S.

Brexit scenarios: The good, the bad and the ugly

The flow is two-way. American companies are by far the biggest source of foreign investment in the U.K., where they and their affiliates employ 1.2 million workers.

The U.K. receives about 30% of all U.S. investment in the EU -- a far bigger chunk than any other country.

Researchers at John Hopkins University estimate that U.S. companies held $5 trillion in assets in the U.K. in 2014, more than 20% of all foreign assets held by U.S. corporations globally.