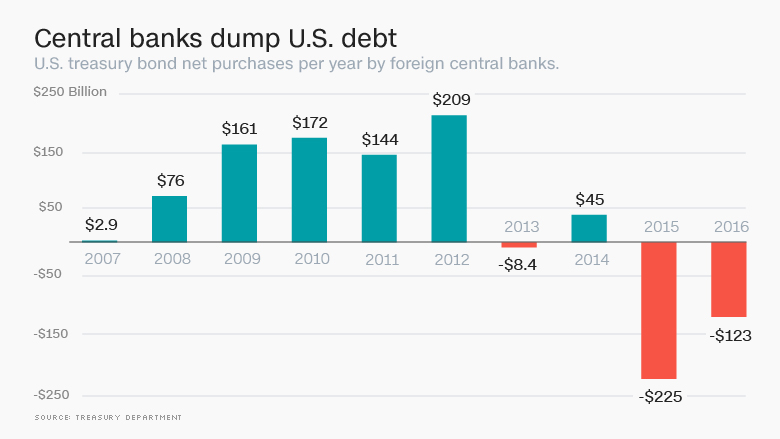

Central banks are dumping America's debt at a record pace.

China, Russia and Brazil sold off U.S. Treasury bonds as they tried to soften the blow of the global economic slowdown. They each sold off at least $1 billion in U.S. Treasury bonds in March.

In all, central banks sold a net $17 billion. Sales had hit a record $57 billion in January.

So far this year, the global bank debt dump has reached $123 billion.

It's the fastest pace for a U.S. debt selloff by global central banks since at least 1978, according to Treasury Department data published Monday afternoon.

Related: Saudi Arabia owns $117 billion in U.S. debt

Treasuries are considered one of the safest assets in the world, but some experts say a sense of panic about the global economy drove the selloff.

"It's more of global fear than anything," says Ihab Salib, head of international fixed income at Federated Investors. "There's still this fear of 'everything is going to fall apart.'"

Judging by the selloff, policymakers across the globe were hitting the panic button often and early in the year as oil prices fell, concerns about China's economy rose and stock markets were very volatile.

In response, countries may be selling Treasuries to prop up their currencies, some of which lost lots of value against the dollar last year. By selling U.S. debt, central banks can get hard cash to buy up their local currency and prevent it from losing too much value.

Also, as investors have pulled money out of developing countries, central bankers seek to replenish those lost funds by selling their foreign reserves.

Related: China posts worst economic growth in 7 years

The leader in the selloff: China.

"We've seen Chinese central bank foreign reserves fall dramatically," says Gus Faucher, senior economist at PNC Financial. "Their currency is under pressure."

Between December and February, China's central bank sold off an alarming $236 billion to help support its currency, which China is slowly letting become more controlled by markets and less by the government. In March, China sold $3.5 billion in U.S. Treasury bonds, Treasury data shows.

Experts say the sell off may be slowing down now that global concerns have eased.

If anything, demand is still high for U.S. Treasury bonds -- it's just coming from private investors. The yield on a typical 10-year bond is just 1.76%, which is very low.

"While central banks may be selling Treasuries to support their currencies, investors seek the safety of Treasuries at the same time," says Jeff Kleintop, chief global investment strategist at Charles Schwab.

--Sophia Yan contributed to this article