The return of $50 a barrel oil means the 13 members of OPEC meeting in Vienna this week are in a much better place than they were in December, when prices were plummeting fast due to massive oversupply.

And that's about all they'll be able to agree on.

Talk of freezing output has quickly melted away after Saudi Arabia blocked just such an initiative by 18 countries, including some non-OPEC countries, in Doha in April.

And with world oil prices nearly doubling from multi-year lows posted in February, the Saudi-led core of OPEC Gulf countries will argue that their strategy of maintaining production to drive out higher cost rivals is working.

The chief executive of one Gulf-based state energy company told me it would be a mistake to trim back production to boost prices because a rise above $50 could entice U.S. shale producers and deep water projects in Latin America and Africa back into the market.

If that view prevails, as seems highly likely, it will be despite resistance from what analysts at RBC Capital Markets have dubbed "OPEC's fragile five."

Algeria, Angola, Ecuador, Nigeria and Venezuela are all suffering from a severe drop in revenues -- their government budgets are based on an oil price of $80 a barrel or higher.

Related: Saudi Arabia plans $15 billion bond sale

OPEC is now producing at near record levels of 32.7 million barrels a day, according to the International Energy Agency, with the four Gulf producers -- Saudi Arabia, Kuwait, UAE and Qatar -- making up just over half of the output.

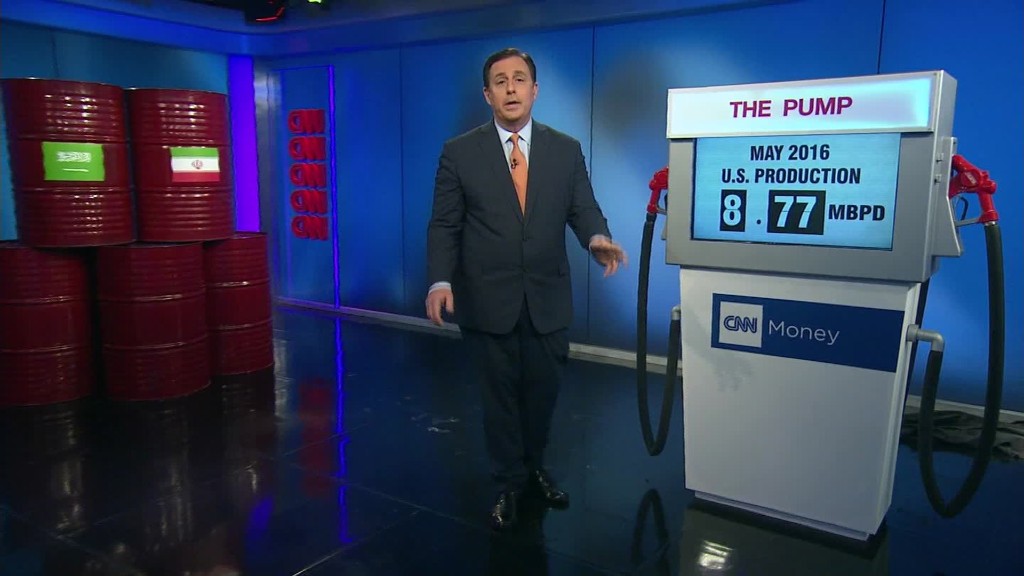

Compare that with U.S. production, which has fallen steadily this year to around 8.8 million barrels per day, nearly one million barrels below its peak, according to the most recent weekly data from the Washington-based Energy Information Administration. [Less volatile EIA monthly production data from March show the decline may be nearer half a million barrels per day.]

With the fall in U.S. production and surprisingly strong global demand, OPEC's big powers will want to leave well alone.

Related: How much oil can Saudi Arabia pump?

Particularly because they may be keen to avoid another damaging public rift between two of the cartel's largest players, Saudi Arabia and Iran.

This will be the first OPEC meeting as Saudi Arabia's minister of energy for Khalid Al Falih, who remains chairman of Saudi Aramco. A close ally of the kingdom's Deputy Crown Prince Mohammad bin Salman, many are eager to see if the man known for his no-nonsense approach will try to restore a sense of unity to the fractious group.

Related: The most powerful man in oil is out -- here's what comes next

Al Falih arrived in Vienna four days ahead of the official gathering for bilateral meetings, Saudi officials said.

Meanwhile, his Iranian counterpart -- Bijan Namdar Zangeneh -- remains steadfast with his plan to restore his country's output to its pre-sanctions level of 4 million barrels a day by the end of the year, despite earlier pressure from Saudi Arabia to curb its aspirations.

Related: Texas congressman: OPEC is dead

As of late, dissension at OPEC's formal gatherings has led to price falls, a cycle many of the higher cost producers will be hoping they can break.