These are not easy times for relations between the world's two largest economies.

Against the backdrop of a slowing Chinese economy and a fiery U.S. presidential election campaign, economic tensions are rife.

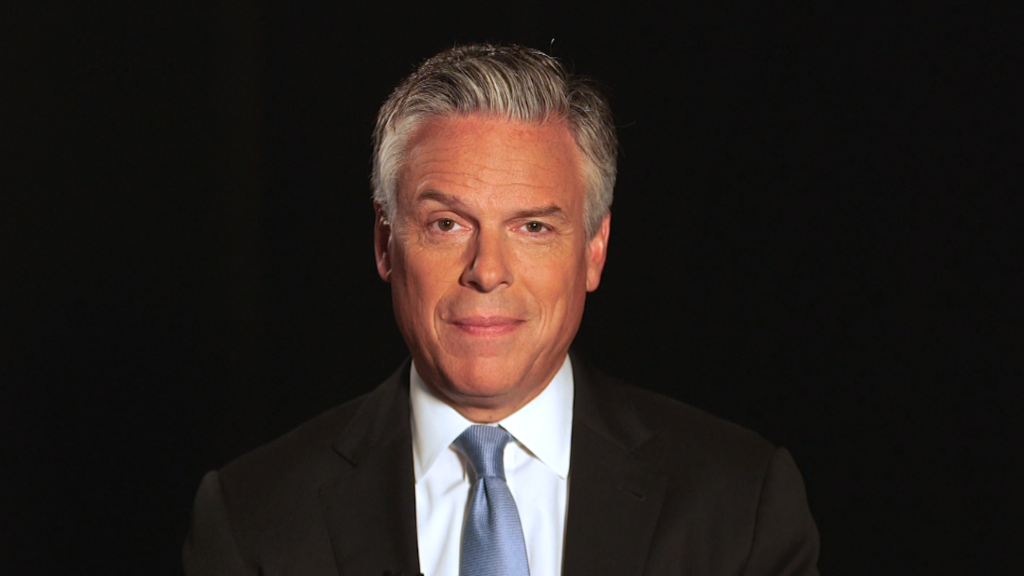

U.S. Treasury Secretary Jack Lew is part of a team visiting Beijing on Monday and Tuesday for annual talks with top Chinese officials.

Here are some of the key points of friction between the two sides:

Too much steel

China produces half of the world's steel. But as the country's vast economy has slowed down, internal demand for steel has dropped. Beijing now stands accused of dumping its unwanted metal on other markets, forcing rivals to close their plants and killing thousands of jobs.

A U.S. move last month to dramatically increase duties on some Chinese steel products drew an angry reaction from Beijing.

China has defended itself, saying overcapacity is a global problem brought on by weaker demand. Beijing says it is willing to work toward a solution and has announced 500,000 job cuts in its own steel mills.

But the international supply glut remains a problem.

"Excess capacity has a distorting and damaging effect on global markets," Lew said in his opening remarks Monday at the Beijing talks, adding that it's "critical" for China to "substantially reduce production" in industries like steel and aluminum.

Chinese Finance Minister Lou Jiwei shot back later in the day that Beijing was letting market forces decide how much capacity to cut. "The government can not dictate to industries on this. More than half of the country's steel makers are privately owned," he said, according to state media.

Related: China plans to cut 1.8 million coal and steel jobs

Currency concerns

China's currency, the yuan, has been on a rocky ride over the past year, coming under pressure from massive outflows of money from the country. A big devaluation in August set off chaos in global markets.

Beijing recently set the yuan's daily trading range at its lowest level in more than five years. That could produce fresh allegations of currency manipulation designed to aid its huge export sector, a favorite theme of presidential candidate Donald Trump.

China has vowed to let the yuan trade more freely, but there are doubts about how closely it's sticking to its promise. The U.S. Treasury in April put China on a new watch list of countries whose foreign exchange policies it said it would closely monitor.

Beijing has taken its own jabs at the U.S. Federal Reserve, meanwhile.

"The Fed has the right to decide its monetary policy stance," Chinese Vice Finance Zhu Guangyao said Thursday, according to state media. "But we would welcome the Fed strengthening its policy communications with China and the international financial markets."

Related: China sets currency at 5-year low

Feeling less welcome

Many U.S. companies complain of tough operating conditions in China.

In the latest survey by the American Chamber of Commerce in China, 77% of firms who responded said they felt less welcome in the country than before.

"Our members are concerned about measures they see as being used against them," James Zimmerman, the chamber's chairman, said last week. "Unclear laws and inconsistent interpretation was named the top challenge for members for the first time this year."

Recent issues have included an intensified clampdown on foreign online content, with Apple's digital books and movies services and a Disney streaming platform taken offline.

Chinese companies have also come up against challenges with access to the U.S. market. Tech giant Huawei has faced restrictions on building up its telecom equipment business in the U.S. because of security concerns.

Correction: An earlier version of this story used an incorrect name for the American Chamber of Commerce in China.