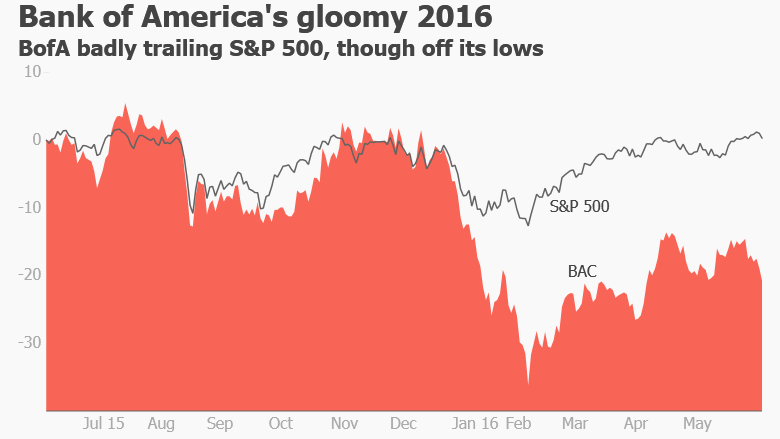

It's been a nightmarish year for big banks. And the beating might not be over yet.

Stocks of Bank of America, Citigroup and Goldman Sachs all took another hit on Friday, deepening their 2016 slumps further into double-digit territory. Banks have been among the worst performers on the day, dragging the Dow down over 100 points.

Up until last Friday's ugly jobs report, bank stocks had been on the rebound, buoyed by hope that the Federal Reserve would raise interest rates soon. That would have been huge because banks struggle to make profits when rates are ridiculously low, like now. But the jobs report was a big dud that dramatically lowered the chances of a June rate hike and sent U.S. Treasury bond rates tumbling to insanely low levels.

"The hope of higher interest rates has been at best delayed and at worst derailed," David Joy, chief market strategist at Ameriprise Financial, wrote in a note.

Things are so bad for banks that the KBW Bank Index (BKX) that tracks 24 banks is on track for its worst performance in the first half of the year, since 2011. That's the year the European sovereign debt crisis freaked investors out, raising the specter of a new financial meltdown.

Related: Bond bubble bursting? Don't hold your breath

Individual big banks are down even more. Bank of America (BAC) slid another 2% on Friday, leaving it off 17.6% this year. That would be the worst first-half performance for BofA since 2011 when it plunged 18%.

Shares of Citigroup (C) are now down 15%, on track for their worst start to a year since 2009 when they plummeted 56%. Morgan Stanley (MS), down 19% this year, is actually on pace for its darkest first half since 2008.

Even Goldman Sachs (GS) is caught up in the storm. Shares of the elite investment bank have tumbled 16% this year, its ugliest start to a year since 2011 when it dropped 21%.

The latest slump has been triggered by incredibly shrinking bond rates around the world. The yield on the benchmark 10-year Treasury fell to a four-month low of 1.64% on Friday. That's bad news because banks make money off the difference between what they charge in interest on loans and what they owe depositors.

While U.S. rates are ridiculously low, they're better than many other countries -- you almost need a microscope to see rates elsewhere. The yield on 10-year German bonds plunged to a record low of 0.02% and Japan bonds have a negative yield -- the 10-year sunk to -0.15% overnight.

Related: The Janet Yellen Fed: Too cautious?

No wonder influential money manager David Kotok is now "max underweight" banks. He also cited other risks such as the upcoming Brexit referendum in the U.K. and the political environment in the U.S.

"Both political presumptive nominees are unfriendly to banks. Congress is unfriendly to banks. Regulators are unfriendly to banks. The climate for bankers is difficult," Kotok, chairman of Cumberland Advisors, wrote in a note.

Investors may also be steering clear of banks until it becomes clear which ones pass the stress tests conducted by the Fed, which measure how they would hold up under in a new crisis. Results are due later this month.

Related: Brexit could trigger European stock market crash

Of course, tough regulation and low rates are nothing new for banks post-2008. Nor is slumping stock prices.

Shares of traditional banks/brokers/insurers are down by about a third over the past decade, making them the only industry group with a 10-year capital loss, according to brokerage firm ConvergEx.

"Financials will likely remain a tough place to make outsized returns," said Nicholas Colas, chief market strategist at ConvergEx.

But banks could be due for at least a short-term rebound if the market is wrong and the Fed is able to raise rates soon. For that to happen though, the next jobs report would need to signal that May was just a one-off blip and not the beginning of an alarming new trend of low job growth.