ARM Holdings, one of Britain's most successful tech companies, is being snapped up by Softbank for £24.3 billion ($32 billion) in the biggest foreign takeover by a Japanese company.

The cash purchase, which has been agreed to by the boards of both companies, represents a major strategic bet by Softbank CEO Masayoshi Son on mobile communications and the "Internet of Things."

ARM shares jumped 43% in early trade on Monday to match the £17 pounds ($22.50) per share offered by Softbank. Markets in Japan were closed for a holiday.

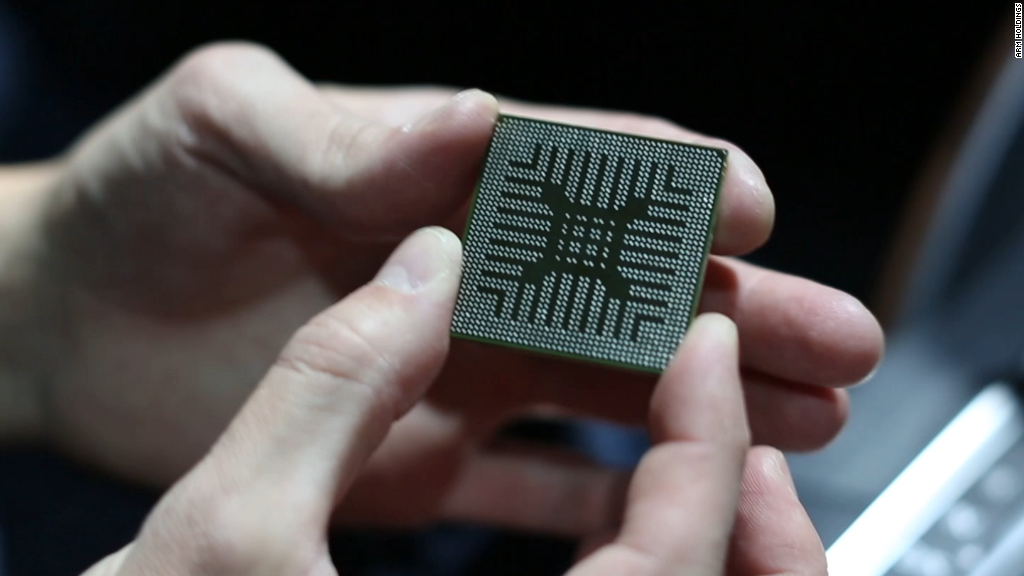

Cambridge-based ARM is a leader in mobile computing, designing technology that can be found in popular smartphones including Apple's (AAPL) iPhone, making it a juicy takeover target for mobile-focused Softbank (SFTBF).

Son told reporters that the acquisition was his "big bet for the future," explaining that ARM was well positioned to capitalize as more and more devices -- household appliances, cars and censors -- are connected to the Internet.

"This is the company I've wanted to [build] for 10 years," he said. "The 'Internet of Things' is growing big time."

The deal is the largest investment ever from Asia into the U.K. It's also the biggest Japanese purchase of a foreign company based on the value of the equity, according to Dealogic.

The ARM takeover comes less than one month after the U.K. voted to leave the European Union, a shock event that rattled investors and caused the pound to plummet.

Son said he had discussed the deal with U.K. officials, and found them to be receptive. Philip Hammond, the U.K.'s new Treasury chief, said the takeover showed that "Britain has lost none of its allure to international investors."

But the deal was also a chance for Softbank to buy a prized asset on the cheap. The pound has fallen by more than 27% against the yen since this time last year, with more than half of those losses coming before the British vote to exit the EU.

ARM does very little business in Europe, which should help shield it from Brexit fallout. The company generated only 1% of its revenue in the U.K. in 2015, 9% in the rest of Europe and 52% in Asia.

Softbank, which also owns a controlling stake in U.S. telecom Sprint (S), has been raising cash in recent months. In June, the company announced a plan to unload roughly $8 billion in Alibaba (BABA) shares, the fruits of an early investment in the Chinese e-commerce giant.

Son said that while he only approached ARM about a potential deal in early July, he wasn't bargain hunting.

"Brexit did not effect my decision," he told reporters. "I was waiting to have the cash on hand."

Related: Check the performance of CNNMoney's 'Tech30'

As part of the deal, Softbank committed to doubling the number of ARM employees in the U.K. over the next five years. Roughly 40% of ARM's (ARMHF) 3,975 workers are currently based in Britain.

There have been major changes to Softbank's leadership recently. Superstar executive Nikesh Arora, who was being groomed as Son's successor, resigned as company president in June.