American middle class optimism has gone missing.

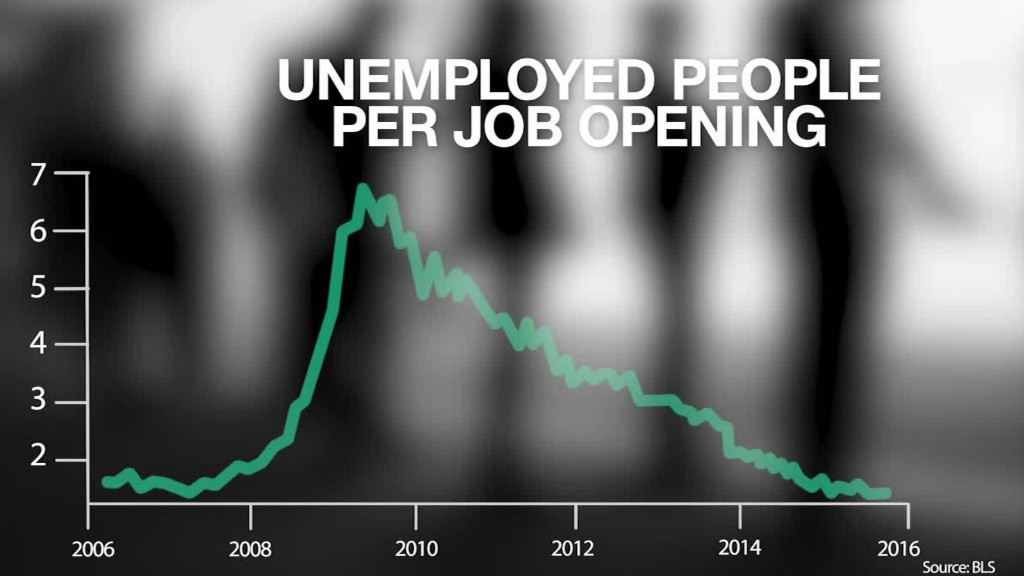

The U.S. stock market is at record high, unemployment is very low, there's been a surge in hiring and gas is really cheap. Yet, Americans remain on edge.

Call it the "low-esteem economy." Poll after poll shows that most voters acknowledge they are better off today than during the Great Recession. But they still worry about their jobs, their finances and their future.

The question is: Are people too pessimistic?

There's a case to be made that America's middle class is suffering from a recession hangover. They lost a lot of money in the 2008 crisis (almost a quarter of their wealth, according to Stanford researchers), and they are extremely fearful it could happen again.

America is overdue for another downturn. The next president will almost certainly face one. But for the middle class (and below), there are legitimate reasons to worry about the future that go beyond the next recession.

Related: Workers over 45 struggle to get back to work

Show me the money

Jobs may be plentiful in the U.S., but are they good paying jobs? Five of the 10 fastest growing jobs pay less than $25,000 a year, according to the Bureau of Labor Statistics. A single parent, with two kids, who earns that amount would qualify for food stamps.

Then there's all the Silicon Valley talk of a robot revolution where machines replace humans. This has already happened in the manufacturing sector, and as "bots" get more sophisticated, more and more jobs are potentially at risk.

Americans in the middle and the bottom have the most to fear, according to the President Obama's Council of Economic Advisors. The economists estimated the probability of a worker's job being replaced by a robot.

If you earn less than $20 an hour, there's an 83% chance your job will be replaced.

If you earn $20 to $40 an hour, there's a 31% chance your job will be replaced.

If you earn over $40 an hour, there's a 4% chance your job will be replaced.

Right now, the median hourly wage in the U.S. is about $25, according to the Labor Department.

Related: 71% of Americans believe economy is 'rigged'

It's not a happy scenario for many Americans, who are still worried about the economy because they have just come through a period where their pocketbooks were gut-punched. The middle class was hurt the most in the aftermath of the crisis. The middle lost 23% of its wealth versus just a 13% loss for those in the top 10%, according to the Stanford Center on Poverty and Inequality.

The biggest asset for most middle class families is their homes, and property values plummeted after the crisis. Home values have finally climbed back, but barely to pre-crisis levels, which means a decade of growth was lost for many people living outside the sky-high property markets in New York and San Francisco.

"The bust, in particular, had a disproportionate effect on families in the middle," the Federal Reserve says in its latest look at family finances.

Related: Trump supporters feel worse off than Clinton fans

Job losses in the crisis also showed a similar pattern: people at the top suffered less and bounced back faster. The unemployment rate for workers with no high school education shot to almost 16% during the downturn. Unemployment for those with a high school degree but no college coursework hit 11%. In contrast, workers with a college degree faced only a 5% unemployment rate at the ugliest point.

Middle and lower class workers understand who got hurt in the past and who will likely be the first to be hurt as technology advances and the next recession (or two) arrives.

Election 2016 will likely be determined by the candidate who offers the better -- and more optimistic -- plan for the middle class.