Hampton Creek is getting used to wiping the egg off its face.

The food tech startup is challenging staples of the American diet with its vegan renditions on everything from mayonnaise and eggs to cookie dough and salad dressings. Some of its more well-known products are plant-based offerings like Just Mayo and Beyond Eggs.

But it hasn't been easy to innovate in a highly regulated industry with major stakeholders who want to preserve the status quo.

Hampton Creek, which sells its products in stores like Whole Foods (WFM), has had a turbulent few years. Since launching in 2011, the company has faced lawsuits over its products and scrutiny from the FDA.

And then on August 4, Bloomberg News reported that Hampton Creek had orchestrated a sort of "mayo buyback scheme."

Some Hampton Creek contractors were apparently tasked with purchasing jars of Just Mayo from stores to make the product appear more in-demand than it actually was -- and to help raise more money from venture capitalists, according to Bloomberg.

According to Hampton Creek, the mayo purchases made up approximately 1% of its sales in 2014, the year that Bloomberg honed in on. Cofounder Josh Tetrick defended the practice as one of quality assurance and control.

But the article did alert the SEC, which Bloomberg reported is now looking into whether Hampton Creek broke the law with its undisclosed buybacks. "[It's] a preliminary step and doesn't mean the company will face an enforcement action," Bloomberg wrote.

Related: Tech CEO organizes anti-Trump stunt outside RNC

"We're aware of the informal inquiry and we'll be sharing the facts, as opposed to the inaccuracies reported by Bloomberg," Tetrick told Bloomberg in an emailed statement.

The SEC declined to comment. Tetrick, 36, doesn't seem fazed -- but this isn't the first time his company has been in the hot seat.

"We've learned over the last two years that building something meaningful is very hard," he wrote in an email statement to CNNMoney. "And also very worth it."

In October 2014, Hampton Creek was sued by Unilever (UL), the parent company of Hellman's mayonnaise. Unilever alleged that Hampton Creek was falsely advertising itself with its "Just Mayo" claim when it wasn't technically mayo at all. It dropped the suit in December 2014. (It's also worth noting that Bloomberg's report on the mayo buybacks quotes analyst Kurt Jetta, the founder of Tabs Analytics, about Hampton Creek's "shady" practices. But it doesn't disclose that Tab Analytics has worked with Unilever in the past.)

Then, in August 2015, the FDA sent Hampton Creek a warning, accusing the company of unauthorized health claims and misbranding its products. In December 2015, Hampton Creek said it had reached an agreement with the FDA, and the FDA closed the case. Hampton Creek now indicates on labels that the "Just" in Just Mayo means "guided by reason, justice, and fairness" -- not as in "only" mayonnaise.

The American Egg Board, which is overseen by the U.S. Department of Agriculture, was also allegedly gunning for Hampton Creek. Internal emails came out showing that the American Egg Board wanted to block distribution of Hampton Creek to protect its own interests. It viewed Hampton Creek -- and its "Beyond Eggs" product in particular -- as a threat.

The U.S. Department of Agriculture opened an investigation into the American Egg Board for campaigning against Hampton Creek. USDA did not immediately respond to request for comment.

Tetrick isn't one to stand down or stay quiet, though.

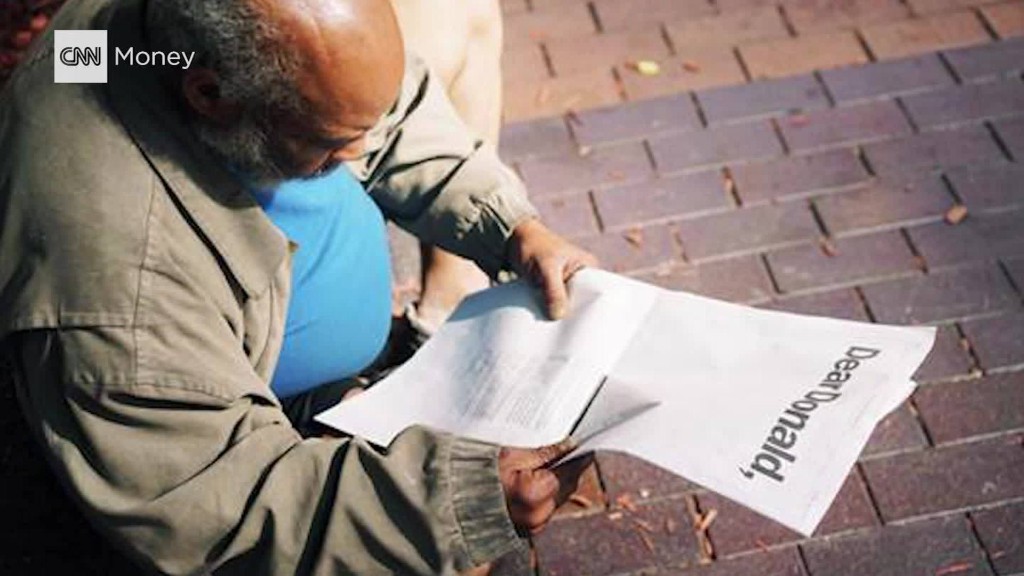

He's taken out numerous full page ads in The New York Times, listing his name and number for the world to see. The most recent one targeted Republican presidential nominee Donald Trump. Previous ads generally target the food industry. "Our food system isn't resilient or safe or aligned with our values. So we decided to start over," read one.

Since launching in 2011, Hampton Creek has raised about $120 million from high-profile investors including Salesforce (CRM) CEO Marc Benioff, Facebook (FB) cofounder Eduardo Saverin and Hong Kong billionaire Lin Ka-shing. According to Bloomberg, it is in the process of raising another round that could thrust the company into "unicorn" status, the term for privately-held companies valued at $1 billion or more.