The black cloud hanging over Wells Fargo is unlikely to clear up any time soon.

Wells Fargo (WFC) continues to be under investigation from its own board of directors.

That investigation, launched in late September by independent directors, could result in additional disciplinary action against former and current executives, including more potential "clawbacks" of compensation.

A person familiar with the independent investigation told CNNMoney that the review likely will not conclude until the spring, and the results will be made public after that.

The timeframe reflects the obvious challenges with probing the operations of a massive bank the size of Wells Fargo. As one of the biggest lenders in America, Wells Fargo has $1.3 trillion in deposits and more than 6,000 branches across the country.

The person familiar with the Wells Fargo investigation said it's a "massive effort" that now includes "many dozens" of lawyers from Shearman & Sterling, the firm hired to assist the review.

The investigation is a "wide-ranging review" into all aspects of the sales issues, focusing on "what went wrong and who was responsible" as well as what policies and procedures need to be installed going forward, the person said.

Related: Feds 'tightening the straitjacket' around Wells Fargo

When the investigation was launched, Wells Fargo lead independent director Stephen Sanger promised it would be "thorough" and "follow the facts wherever they lead."

One development the board said it will review is a 2007 letter uncovered by CNNMoney that was addressed to former CEO John Stumpf warning of "widespread" fraud inside Wells Fargo. The letter seemed to predict the scandal that Wells Fargo is dealing with today.

Other former employees have blamed Wells Fargo's culture for encouraging the opening of as many as 2 million unauthorized accounts. Alarmingly, some former workers told CNNMoney they were fired after calling the ethics hotline warning about illegal activity.

Wells Fargo may struggle to turn the page on the fake account scandal until the investigation's findings are made public.

Kevin Barker, a Piper Jaffray analyst who covers Wells Fargo, said the six-month timeframe for the investigation is "not unreasonable" given the size of the bank.

However, Barker, who has a "sell" rating on the stock, said the investigation is a "concern and a temporary overhang for the company."

Not only will the results likely create more negative headlines and scrutiny from angry lawmakers (see: Elizabeth Warren), but analysts have said Wells Fargo's senior management may not be able to decide on key strategic moves like branch closures until after the investigation concludes.

Related: Warren Buffett says Wells Fargo made 'terrible mistake'

Wells Fargo may also continue to infuriate lawmakers who have questions about the bank's handling of the crisis. Last week, U.S. Senator Sherrod Brown blasted Wells Fargo for "stonewalling" by failing to adequately respond to key questions from lawmakers.

Instead of answering several questions from Senate Democrats, Wells Fargo repeatedly cited the ongoing independent investigation. For instance, the bank did not give lawmakers a specific date for when Stumpf first learned about the opening of fake accounts, noting that the investigation "remains ongoing."

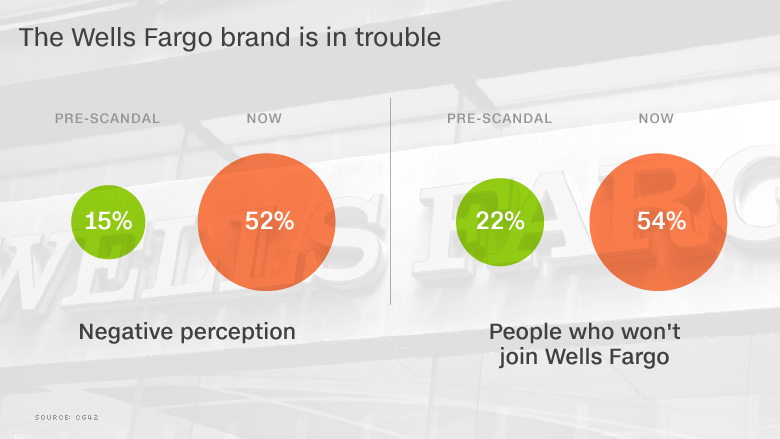

Tim Sloan, Wells Fargo's new CEO, has acknowledged in a recent speech that it will take time to repair the bank's damaged reputation.

"The job of rebuilding trust in Wells Fargo will be a long-term effort," Sloan said in a recent speech in Iowa, "one requiring our commitment, patience and perseverance."