President-elect Donald Trump's selection for Treasury secretary says tax reform will be his top priority and promises the largest tax overhaul since the Reagan administration.

Steven Mnuchin made the pledge in an interview with CNBC on Tuesday.

Mnuchin, a former Wall Street insider who ran an eclectic series of businesses before becoming a Hollywood producer, confirmed that he was Trump's pick for the Treasury job, which has vast responsibility for regulating the financial industry and oversees the IRS.

Mnuchin told CNBC he expects interest rates to stay relatively low for the next two years. He also said Janet Yellen has done a "good job" as Federal Reserve chair.

"I think the United States is the greatest country in the world to invest in," he said.

He also promised corporate tax cuts to "bring huge amounts of jobs back to the United States."

For individuals, he said any reductions in upper-income taxes would be "offset by less deductions that pay for it." He also said that a "big middle income tax cut" would be another part of the reform plan, adding that "taxes are way too complicated" and that people spend "way too much time worrying about ways to get them lower."

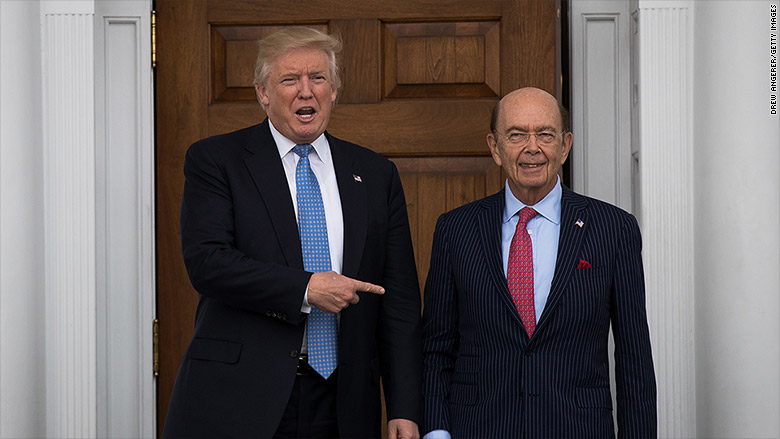

Wilbur Ross, a billionaire who has made a career of resurrecting dying companies, confirmed in the same interview that he is Trump's choice for commerce secretary, the face of American business around the world.

Related: Carrier says it has struck a deal with Trump to keep jobs in Indiana

Ross praised a deal with Trump announced Monday by Carrier, the air conditioner manufacturer, to keep nearly 1,000 jobs in Indiana rather than shipping them to Mexico.

"Here we have a trade victory before we've even come into office," he said.

Both Mnuchin and Ross would need to be confirmed by the Senate.

As Treasury secretary, Mnuchin would be the face of the American economy around the world. The job carries expansive responsibility, including managing the federal debt and overseeing Wall Street and the financial markets.

Related: Steven Mnuchin: Wall Street banker turned Hollywood producer

Mnuchin, like his father before him, was a partner at Goldman Sachs (GS). He worked for the firm for 17 years, joining at age 22 and leaving just before his 40th birthday, in 2002.

He briefly joined the hedge fund of his former college roommate Eddie Lampert. Mnuchin still serves as a director of Sears Holding, (SHLD) of which Lampert is chairman and CEO.

After less than a year, he left Lampert to work as a portfolio manager for the hedge fund of George Soros, the billionaire financier who has bankrolled liberal candidates and causes -- and who was depicted as a villain in Trump's last campaign ad.

He only stayed a year, leaving in September 2004 to start his own hedge fund, Dune Capital Management.

As a producer, he has put out films including "American Sniper," "The Lego Movie" and this summer's "Suicide Squad." His latest film, which opened right before Thanksgiving, is called "Rules Don't Apply."

Mnuchin led the group that bought failed subprime lender IndyMac for pennies on the dollar in 2009, about a year after the FDIC took over the California bank following a run on deposits by customers.

IndyMac had become a poster child for the risky home loans that brought on the housing crisis and the meltdown in financial markets. The FDIC agreed to assume much of the losses as part of its sale to Mnuchin, who renamed it OneWest.

But regulators soon questioned OneWest's foreclosure practices, which included so-called robo-signings that pushed homeowners into foreclosure without proper review or due process.

The bank was one of many that agreed to pay millions in fines to compensate customers. Occupy Los Angeles protesters showed up at Mnuchin's Bel Air mansion. And this month, two fair housing groups in California filed a complaint with the Department of Housing and Urban Development, accusing the bank of discriminating against minority borrowers during his tenure there.

As commerce secretary, Ross would serve as the government's chief business advocate. The Commerce secretary is a liaison between companies and the White House. Ross could play a key role in what are expected to be Trump's signature economic policy issues like trade and jobs.

Related: Wilbur Ross has made a career of resurrecting dying companies

As a vocal Trump supporter before the election, Ross cited the need for a "more radical, new approach to government" that would help middle class and lower middle class Americans.

Ross is chairman of WL Ross & Co., which has specialized in reassembling dying companies. Fittingly, some of Ross's biggest hits have been in the same demoralized industries that Trump wants to revive: steel and coal.

For instance, Ross's firm scored huge returns last decade by cobbling together bankrupt steel makers including Bethlehem Steel to form International Steel Group. Ross then flipped the conglomerate in a $4.5 billion sale two years later.

Ross's foray into the coal industry, however, ran into trouble in January 2006 when 12 miners were killed after an explosion at the Sago Mine in West Virginia. His company, the International Coal Group, had taken over the mine a couple months earlier.

According to federal reports, the mine had recorded 96 safety violations in 2005 that were deemed "serious and substantial." The mine was fined nearly $134,000, an amount later reduced in court.

Ross, a New Jersey native, has amassed a fortune that Forbes estimates is worth nearly $3 billion. He's used some of that money to build an impressive art collection worth a reported $150 million.

Trump named Todd Ricketts, a member of the billionaire family that owns the Chicago Cubs, as his deputy commerce secretary.