President-elect Donald Trump's vow to deport two to three million undocumented immigrants could spur an increase in foreclosures among Latinos and hurt the nation's overall housing market, a new report finds.

Researchers at Cornell University published a study this week that links an increase in deportations to a higher rate of foreclosure within Latino communities. They found that nearly one-third of undocumented Latinos live in homes owned by Latinos residing in the U.S. legally. A sizable share of these undocumented residents are wage earners that contribute to their household's income. Once an undocumented household member is deported, that income is no longer available to help pay the mortgage or any other bills.

Related: The steep cost of underemploying skilled immigrants

"Foreclosure and immigration enforcement affect [Latino] households in significantly negative ways, so there's a question of whether we are derailing our own future by handicapping these families," said Matthew Hall, a professor of policy analysis at Cornell University, who helped conduct the research.

Latino households have the highest rate of foreclosure among any ethnic group in the U.S. It has long been believed this was the case because Latinos were one of the primary targets for subprime mortgage loans, the researchers said. But they contend that was only part of the problem.

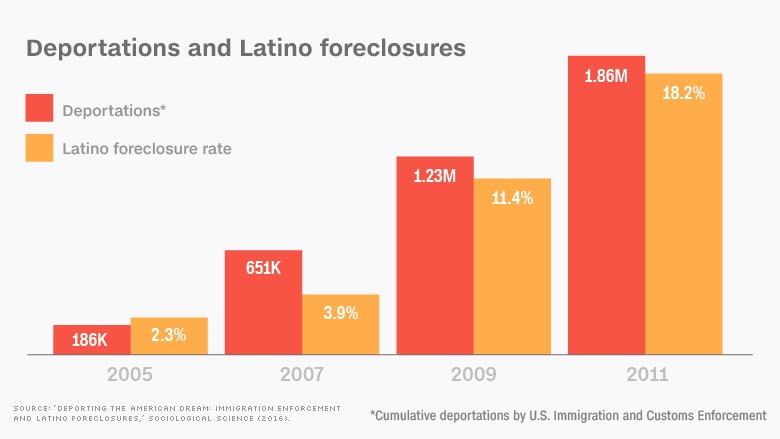

Post September 11th, immigration enforcement heated up. And from 2005 to 2011, Latinos were hit with a double whammy: As the housing bubble began to pop, the federal government and communities across the U.S. began cracking down on undocumented immigrants.

Related: By the numbers -- Immigrants removed from the U.S.

Many communities started turning to a 1996 law called 287(g), which gave state and local law enforcement officers broad latitude to detain undocumented immigrants and have them deported. Initially implemented in towns and cities along the border, the law was increasingly adopted by law enforcement agencies in the interior of the U.S. as a growing number of immigrants moved to less traditional gateway cities.

In counties that implemented the law and had high detention rates, foreclosures among Latinos spiked, the researchers found.

To prove this trend, the researchers compared foreclosure rates in 40 counties that implemented the law to rates in the 67 counties that had requested to implement the law but were not granted federal approval.

The researchers also compared the foreclosure rates among Latinos with that of blacks and whites. They found that foreclosures for blacks and Latinos rose at about the same rate before 287(g) became widely adopted. But after the law was broadly implemented, foreclosures for Latinos grew at a much faster rate.

Related: Sanctuary cities risk billions in defiance of Trump

In 2005, the U.S. foreclosure rate for blacks and Latinos was 2.3%, while it was just 1% for whites, according to Hall. By 2011, the foreclosure rate for Latinos had ballooned to 18%, while the rate among blacks had climbed to 13%. Meanwhile, the foreclosure rate among whites was 7%.

In that same time period, deportations had gone from 186,000 in 2005 to almost two million by 2011. A record three million undocumented immigrants have been deported since 2008 according to the Department of Homeland Security. The vast majority of those immigrants are from Mexico and Central America.

For the most part, the researchers said foreclosure rates are back to pre-recession levels, except in states with a judicial foreclosure backlog like New Jersey, New York and Florida. However, they fear another wave of foreclosures should President Trump stick to his campaign promises.

"If we take Trump at his word we should assume that deportations are most likely going to increase -- and perhaps dramatically so," Hall said. "Deportations not only destroy families -- many of whom are U.S. citizens -- but also harm communities and local economies," he said.