One tech firm wants to capitalize on President Trump's Twitter trolling -- and save puppies in the process.

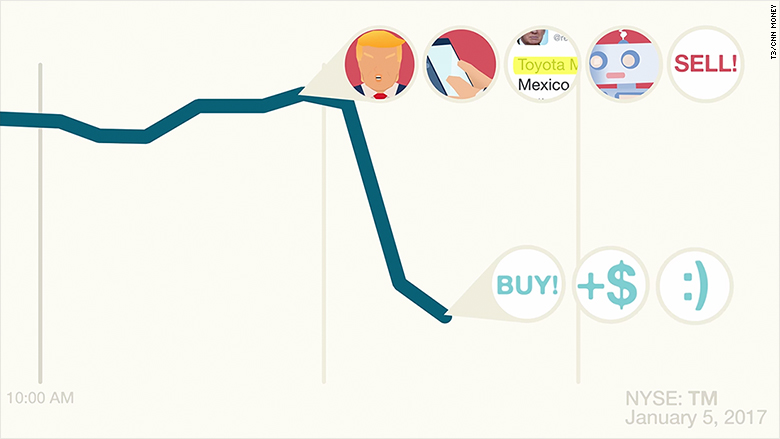

Austin-based marketing company T3 has created a robot -- dubbed the "Trump and Dump" -- that analyzes Trump's Twitter feed. Every time the president sends a negative tweet about a publicly traded company, the bot automatically short sells that company's stock, which means the bot essentially places a bet that the company's stock price will go down.

And they've been making money doing it, says T3 President Ben Gaddis. The proceeds are then donated to the American Society for the Prevention of Cruelty to Animals.

"When a negative tweet goes out and has a negative impact on that company's stock, something positive comes out of it. And who doesn't love puppies and kittens?" Gaddis told CNNMoney.

Related: Becoming President more than doubled Trump's reach on Twitter

Gaddis said his company isn't yet revealing how much money they've made, but he said so far four tweets have triggered the bot to short sell since it was launched in early January. They've made "excellent" returns on three of them.

For example, when Trump tweeted about Delta's computer outage on Monday, the Trump and Dump bot was "all over it," Gaddis said, adding they saw a 4.47% return on investment.

It might seem odd for a marketing firm to take on robotic short selling based on Trump's tweets, but Gaddis said T3 was perfectly poised to get the Trump and Dump bot up and running.

Related: The Twitter resistance: Fighting Trump one tweet at a time

T3 says it develops social strategy for some major companies, such as Capital One and UPS. Part of what T3 does is build algorithms that can determine whether a tweet is saying something positive or negative about a company.

"All we had to do is take that knowledge and translate it into a trading platform," Gaddis said. He said after the idea was born, it took a T3 engineer two and a half days to get the bot up and running.