You're not imagining things. The stock market really is hitting new records every day lately.

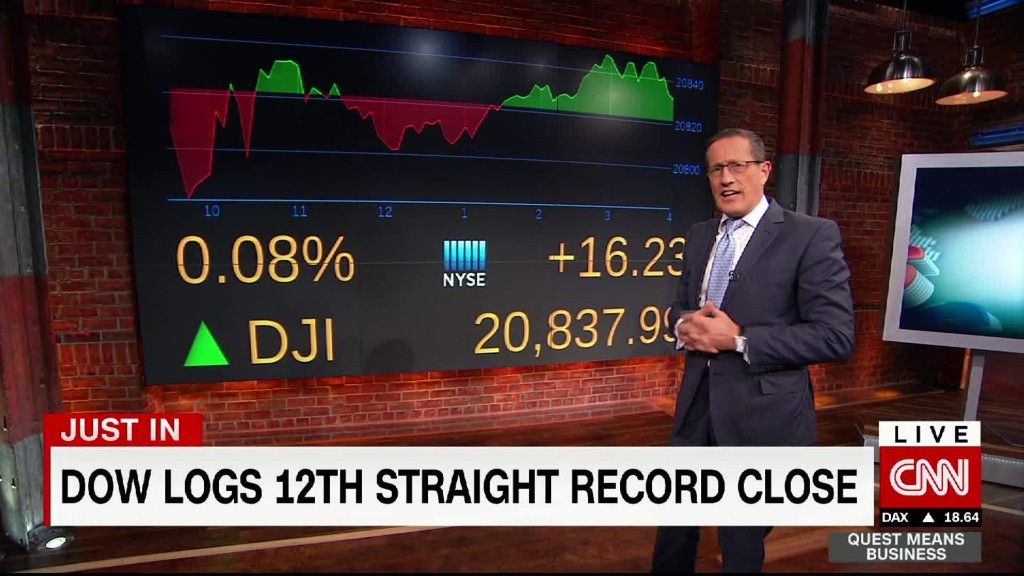

The red-hot Dow closed at an all-time high yet again on Monday, its 12th consecutive record day.

That's only happened two other times in the 120-year history of the Dow. There has never been a 13-day streak of records, though that could change on Tuesday.

The Dow is also closing in on its longest streak of up days (not record highs). That feat was set in 1897 when the market rose 14 trading days in a row, according to Bespoke Investment Group.

So why is the stock market on fire? Clearly, investors remain extremely optimistic about President Trump's promises to grow the American economy faster. The Dow has skyrocketed an incredible 2,400 points since Trump's victory.

The markets have barely blinked in the face of signs that Trump's plans to slash taxes and ramp up infrastructure spending may take longer than anticipated. Wall Street is hoping for more policy details when Trump addresses a joint session of Congress on Tuesday night.

Related: Buffett says red-hot market not in a bubble

Investors have shown an "almost childlike faith in what the unopened box of policy change might mean for the stock market," David Kelly, chief global strategist at JPMorgan Funds, wrote in a note.

"In the week ahead, some of the wrapping paper will be torn off, potentially setting the stage for disappointment," Kelly wrote.

For now, Wall Street continues to like what it hears. The White House released new budget details on Monday, pledging to boost defense spending by $54 billion. Trump called it a "public safety and national security budget."

That was music to the ears of defense contractors. Shares of Lockheed Martin (LMT) and Northrop Grumman (NOC) continued their post-election rally to climb another 2% on Monday.

Likewise, infrastructure stocks were buoyed when Trump reiterated plans to ramp up spending on roads, bridges and airports. Infrastructure-focused companies like U.S. Steel (X), US Concrete (USCR) and Caterpillar (CAT) each closed up by 2% or more.

Related: The market rally: Too far, too fast

So has the market optimism gotten out of control? It's easy to see why stocks are overdue to take a breather after the recent surge.

But it's worth noting that the Dow barely closed higher the past two sessions. Overall, the index is "only" up 4% during this winning streak, which LPL Financial notes is one of the "weakest" gains during a long win streak.

And CNNMoney's Fear & Greed Index isn't signaling complete euphoria. The gauge of market sentiment is currently flashing "greed," down from "extreme greed" last week.

"It isn't like the Dow is soaring higher here," said Ryan Detrick, senior market strategist at LPL. "We don't have a problem with it. Slow and steady tends to win the race."

Famed investor Warren Buffett doesn't sound worried either.

He told CNBC on Monday that the market is "not in bubble territory or anything of the sort." If anything, the billionaire said stocks are "actually on the cheap side" when compared with extremely low interest rates.