The pound had a terrible 2016. Could this year bring even more pain?

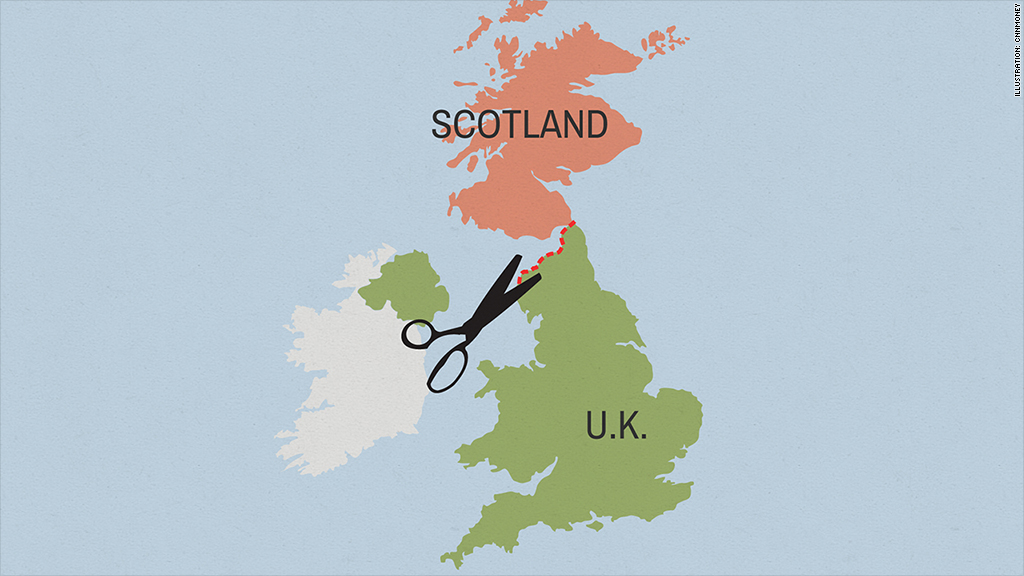

The currency slumped by 0.4% against the dollar on Monday to $1.24 on fears that Britain could soon face a new crisis: A referendum on Scottish independence.

The Times reported Monday that the government of Prime Minister Theresa May is preparing for the possibility that a second independence vote could be called for next month when Britain is expected to formally trigger its departure from the European Union.

May could refuse such a demand from first minister of Scotland Nicola Sturgeon, but doing so would risk a constitutional crisis.

Scotland held an independence referendum in 2014, with 55% of Scots voting to remain a part of the U.K.

But Sturgeon argues that Britain's planned departure from the EU -- which a majority of Scots voted against -- has significantly altered the terms of the national relationship. She has pledged to push for a second vote on Scottish independence if Britain leaves Europe's single trading market -- now a near certainty.

May's government responded Monday by saying the 2014 vote should stand.

"The question isn't whether there could be a second referendum, but: Should there be a second referendum?" a government spokesman said. "Our clear answer to that is no ... there was a fair, legal and decisive result."

The chatter about a second referendum is already unnerving investors.

"All this negative development, which has mostly been self-inflicted by Theresa May, is going to make the [pound] the least desirable currency against a basket of currencies," said Naeem Aslam, chief market analyst at Think Markets UK.

The currency is now trading 17% below its levels on the day of the Brexit referendum.

Brexit Britain: UK shoppers feel the sting of rising prices

Leaving the EU's free trading area is likely to bring bureaucratic pain to businesses trading across the EU. Banks and other financial institutions said they will have to move jobs abroad in order to safeguard their operations across the union.

The cheap pound is also hurting British shoppers as the price of imported goods rise. Retail sales dropped for a third consecutive month in January and economists expect inflation to creep above 2% in March.

-- David Wilkinson contributed reporting.