Warren Buffett really likes Apple.

Buffett told CNBC Monday morning that Berkshire Hathaway (BRKB), the conglomerate that he runs, now owns about 133 million shares of Apple -- worth more than $17 billion at current prices.

That makes Apple (AAPL) Berkshire's third largest holding, trailing only Kraft Heinz (KHC) -- which recently pulled the plug on a more than $140 billion offer to buy European food conglomerate Unilever (UL) -- and scandal-ridden bank Wells Fargo (WFC).

The most recent quarterly filings with the Securities and Exchange Commission show Berkshire Hathaway owned about 57.4 million shares at the end of the fourth quarter, an increase of more than 42 million shares from the third quarter.

That means Berkshire has purchased more than 75 million shares in Apple in 2017.

"We bought a lot more Apple after year-end," Buffett said. He added Berkshire has not bought any additional shares since the company reported earnings on January 31 because the stock has shot up significantly since then.

Related: Apple's stock is at an all-time high

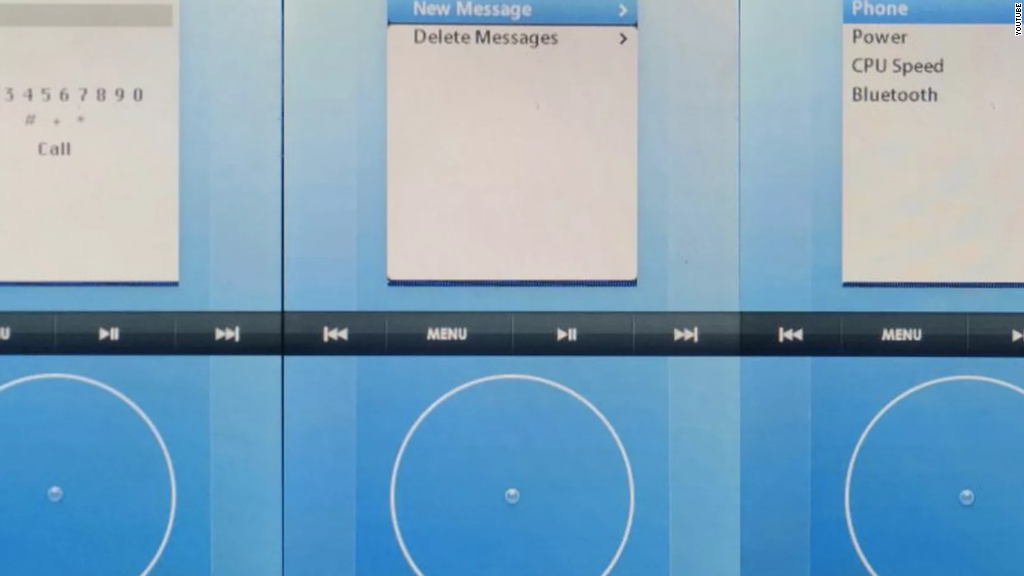

He joked during the CNBC appearance that there is still a vast, untapped market of 86-year-old guys who don't have Apple products yet, showing his old flip phone to the camera as proof. He does have an iPad -- but someone else gave it to him.

Joking aside, Buffett has warmed up to investing in big technology companies lately, even though he is famous for having shunned them in the past.

IBM (IBM), for example, is another large Berkshire holding. And Berkshire bought a new stake in satellite radio firm Sirius XM (SIRI) during the fourth quarter. Berkshire also owns a sizable position in cable giant Charter Communications (CHTR).

Related: Buffett: Red-hot market not in a bubble, still looks 'cheap'

As for Apple, Buffett said there is an "incredible stickiness" to the company's products and that it's a pretty nice franchise to have.

"When I take a dozen kids -- as I do on Sundays -- out to Dairy Queen, they are all holding Apple [products] and they can barely talk to me," he added. (Berkshire Hathaway owns Dairy Queen, by the way.)

He also said Apple will probably get to a $1 trillion market value before Berkshire Hathaway does. That's not a huge shock, though: Apple, currently worth about $720 billion, has a pretty big lead over Berkshire Hathaway, which is worth $420 billion.

Shares of Apple are now up 18% this year, making it the best performer in the Dow.