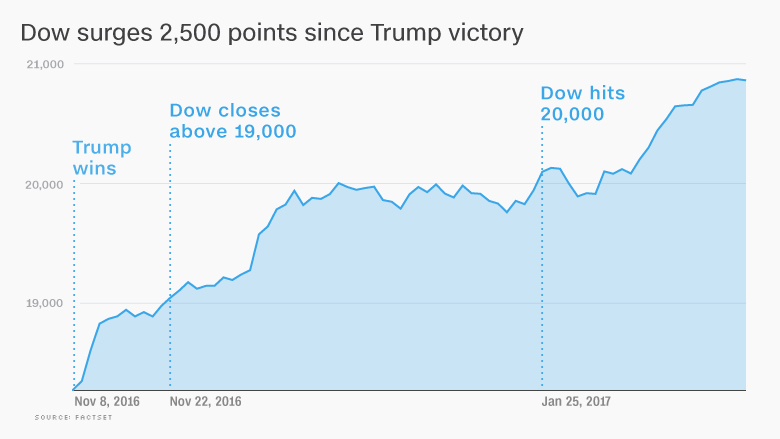

President Trump's pro-business promises have helped lift the Dow an incredible 2,500 points since the election.

Now Wall Street wants him to deliver.

Investors will be watching very closely when Trump addresses Congress on Tuesday night. They crave details about the timing and specifics of Trump's plans to slash taxes, rip up regulations and unleash infrastructure spending.

On the other hand, signs that the Trump platform is being delayed or scaled back could leave Wall Street bummed.

The stock market has made the stakes clear: The Dow has closed at a record high 12 days in a row and is going for a 13th on Tuesday, a feat that has never happened before.

"Expectations are phenomenally high," Peter Boockvar, chief market analyst at The Lindsey Group, wrote in a note to investors.

Here's a guide to what investors want to hear from Trump.

Taxes, taxes, taxes, taxes...

A CNNMoney survey of economists on Monday found that what they want most is details on Trump's tax plan: When will it happen? How big will it be?

Hopes for big tax cuts have been at the heart of the post-election rally. Wall Street is betting that enormous tax savings will translate to juicier profits.

"Unfortunately I'm going to have to torture myself and watch Tuesday night in search of some comments on tax reform," Boockvar said, adding that he normally skips these types of speeches.

Related: Buffett: Market not in a bubble, still looks 'cheap'

Border adjustment tax?

A big key will be whether Trump throws his weight behind an idea from House Republicans called the border adjustment tax as a way to bring jobs back to the United States.

The complex proposal would give tax breaks to American companies that ship products to other countries and strip tax breaks from American companies that import goods.

"What I hope to hear from Trump is some well-reasoned policy proposals, and not just more ... babble about 'winning' or making 'better deals,'" said Bernard Baumohl, chief global economist at The Economic Outlook Group.

Obamacare timing

The overhaul of the health care system is extremely important to many Americans, but investors are paying particular attention because of its implications for the rest of the Trump agenda.

Trump has said repealing and replacing the Affordable Care Act must come before taxes.

"This is a giant obstacle blocking the path to the rest of the president's agenda," Jaret Seiberg, analyst at Cowen & Co., wrote in a research report.

Related: The market rally: Too far, too fast

Fair trade, not trade wars

Economists and market strategists surveyed by CNNMoney say their biggest fear is that Trump will erect barriers to trade.

The new president has already withdrawn the United States from the Trans-Pacific Partnership and started renegotiating the NAFTA trade deal with Mexico and Canada. Economists' concern is that Trumps will impose high tariffs that slow the economy and provoke a tit-for-tat response from trading partners.

"Wall Street is not opposed to reviewing trade deals, but Wall Street doesn't want to see that turn into a trade war," said David Joy, chief market strategist at Ameriprise Financial.

What happened to infrastructure spending?

Since he took office, Trump hasn't focused much on his promise to spend $1 trillion on infrastructure. Investors hope Trump will follow through by releasing a plan to build or rebuild roads, bridges and airports. Infrastructure stocks like U.S. Steel (X) and U.S. Concrete (USCR) have soared since the election.

Will Trump give clues about the timing and structure of an infrastructure plan and how it can be paid for without blowing up the U.S. deficit?

Ripping up bank regulation

Big bank stocks like Goldman Sachs (GS) have skyrocketed, partly because of Trump's promise to "do a big number" on the Wall Street reforms known as Dodd-Frank. But few specifics are known here, either.

Seiberg, the Cowen analyst, said one risk is that Trump will repeat a call for a 21st century version of the Glass-Steagall Act, which would force a separation between commercial banking and trading. That could be a signal that Trump wants to break up big banks.

Investors would probably react better if Trump said his focus is on allowing banks to lend more -- even though they are already lending a ton.

What Wall Street doesn't want to hear

Markets took a brief tumble in late January as investors grew concerned that controversy over Trump's immigration order could derail the rest of his agenda.

Look for a similar reaction if Trump's speech veers off course.

"If he focuses on the evil press or some other nonsense, markets may get impatient," Michael Block, chief market strategist at Rhino Trading, wrote in a research note.

--CNNMoney's Heather Long contributed to this report.