Opel + Vauxhall + Peugeot + Citroen = Major job losses?

That's the equation worrying thousands of workers across Europe following General Motors (GM)' announcement that it is selling its struggling operations in the region to France's PSA Group.

The $2.3 billion deal will create a new European autos giant. But it could also result in significant job losses among the 38,000 workers employed by GM brands Vauxhall and Opel.

"It's too early to have numbers, but we're not talking hundreds," said Christian Stadler, professor of Strategic Management at Warwick University. "I think we are talking real numbers [of job losses]."

Two factors are driving the concerns: PSA needs to cut billions in costs at Opel and Vauxhall, which haven't turned a profit since 1999. And the new company will be forged against the backdrop of severe political and economic uncertainty.

PSA boss Carlos Tavares said on Monday that closing entire factories would be "a simplistic approach." But he made clear that job security would depend on workers and managers producing higher quality cars with less.

"The only thing that really protects [workers] is their ability to be at the right level of performance," he said.

Brexit fears

Prime Minister Theresa May, who is leading the U.K. out of the European Union, raised her concerns with Tavares.

She spoke to the Portuguese executive on Sunday, expressing a desire to "protect and promote" the 4,300 Vauxhall workers at factories in the U.K.

It's Brexit, though, that is most likely to determine the fate of the British car plants.

May is seeking a complete break with the EU -- a strategy that is almost certain to mean new trade barriers between the U.K. and its biggest export market.

These barriers would make it more expensive for British manufacturers to import auto components, and push up the price of cars exported to Europe. If costs go up, PSA could choose to shut its U.K. factories and blame Brexit.

But trade barriers work both ways. Cars made in Britain could appear cheaper to U.K. consumers than imports. And if May can strike trade deals with nations outside Europe, PSA's U.K. factories could tap export markets.

Workers' representatives don't want to leave it to chance. They want the government to do more than talk.

"The uncertainty caused by Brexit is harming the U.K. auto sector," said Len McCluskey, leader of British labor union Unite. "We need every assistance from the government to give this sector a fighting chance. That absolutely includes committing now to securing access to the [EU] single market and customs union."

Andreas Hoepner, associate professor of finance at Henley Business School, said that PSA will likely push the British government to provide support for the Vauxhall jobs.

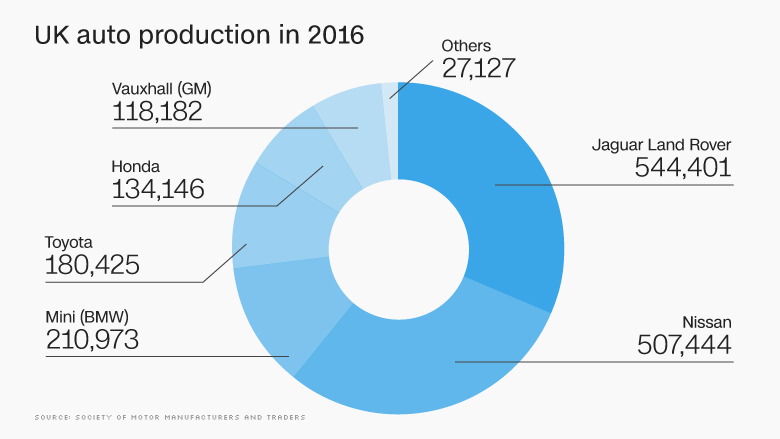

In October, Japan's Nissa (NSANF)said it had been convinced to build two new models at a massive production facility in the U.K. after getting reassurances from the British government about its plans for Brexit.

"PSA might be trying to say: 'You gave that to Nissan, you must give it to Vauxhall,' " Hoepner said.

(Nissan has since said the plant's future is not safe because of May's plan for a complete exit from Europe's unified market.)

Meanwhile, in Europe ...

The logic for PSA's purchase is based on scale. With four major brands operating under one roof, supply chains can be simplified and costs reduced.

Tavares has a earned a reputation as an effective cost cutter, but he would face stiff opposition to any job reductions in France and Germany. And with the French government as a major shareholder, PSA may come under pressure to put EU workers before their British counterparts.

Still, it might find working with Europe's famously strong labor unions easier than GM.

"Being a European company, having a lot of experience dealing with the unions, [PSA] might be better with striking deals with them," Stadler said. "American companies tend to see unions as opponents, where in Europe they are more typically seen as being in partnership."

There are other big political risks on the horizon. Far-right politician Marine Le Pen could win the French presidency on a promise to ditch the euro.

With Paris and Berlin preparing for key elections, Hoepner said it might have been more prudent for PSA to wait a few months before pulling the trigger.

"If Le Pen wins, they're going to have all kinds of problems at home," said Hoepner.