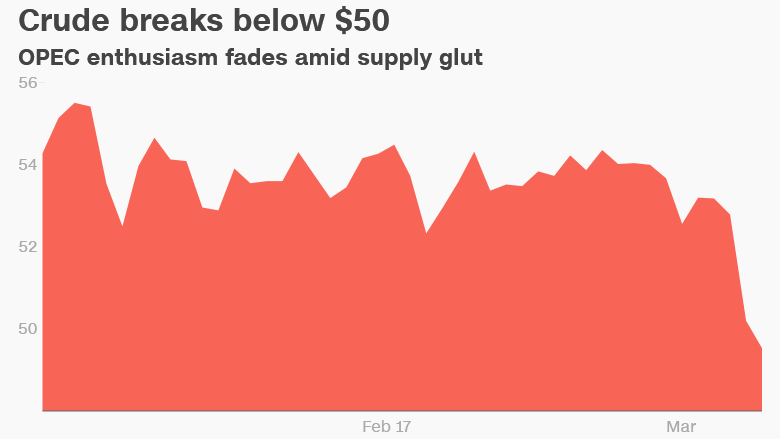

Here we go again: Crude oil is once again in selloff mode with prices sinking below the closely-watched $50 threshold.

Oil has plunged 7% in the last two days, taking its first sub-$50 trip since mid-December. This breaks a period of relative stability in the oil patch since November, when OPEC reached a deal to cut production.

But the enthusiasm for the OPEC deal is fading due to rising concerns about the picture at home. Not only have U.S. crude stockpiles risen to record highs, but American shale producers could deepen the glut as they're in the midst of a stronger revival than previously thought.

"We've got a surplus situation. We just have too much crude oil," said Darin Newsom, senior commodities analyst at DTN.

Crude closed at $49.28 a barrel on Thursday, the fourth decline in a row and the lowest settle since November 29. Oil prices are now down 9% in March alone.

The oil weakness is rattling Wall Street a bit, just as the bull market in stocks celebrates its eighth anniversary. Energy stocks such as Halliburton (HAL) and Transocean (RIG) slid more than 2% apiece on Thursday after both slumped 3% the day before. The Energy Select Sector SPDR ETF (XLE) that tracks the energy industry is now down 8% this year.

"The word on everyone's lips is oil," Michael Block, chief market strategist at Rhino Trading, wrote in a note. He called the $50 level that crude slipped below a "crucial point."

Related: America poised for record oil output

The oil selloff was sparked by further evidence that the U.S. continues to face a supply glut. Crude stockpiles soared by 8.2 million barrels last week, according to government statistics. It was four times as large as the inventory increase anticipated, and left stockpiles further in record territory.

More concerning to oil bulls, the supply glut is being driven lately by OPEC, the cartel that reversed strategies last year by supporting the market with an agreement to pump less crude.

U.S. imports of Saudi Arabian oil surged by 145,000 barrels per day last week to the highest level since last August, according to S&P Global Platts.

The rush of Saudi oil "may have folks questioning the efficacy of their production cuts," Anthony Starkey, manager of energy analysis at Platts Analytics, wrote in a report.

Three other OPEC nations -- Iraq, Kuwait and Ecuador -- ramped up their shipments to the U.S. by 730,000 barrels per day last week.

Related: Rex Tillerson may have left Exxon at the right time

Oil bulls won't get any help from the resurgent U.S. shale oil boom either. The situation is looking much brighter for the American oil industry, especially frackers in the Permian basin of Texas and New Mexico. Activity in this shale hotbed has come back to life in recent months and it's expected to lead a rebound in U.S. output this year, whether the market needs more oil, or not.

"The markets are getting impatient waiting to see any impact on U.S. crude inventories," Michael Wittner, global head of oil research at Societe Generale, wrote in a report.

Some have been taken aback by a new forecast from the U.S. Energy Information Administration this week predicting the domestic oil production could rise to an all-time high of 9.7 million barrels per day next year.

Related: Here comes the next wave of oil

That's great news for laid-off oil workers and American drivers worried about gasoline prices. But it won't do much to solve the oil glut.

U.S. production "could go pretty high," shale billionaire Harold Hamm said at the CERAWeek conference in Houston this week, according to Bloomberg.

"But it's going to have to be done in a measured way, or else we kill the market," Hamm said.