The Dow managed to avoid suffering its longest slump since Jimmy Carter was in the White House.

After eight days in a row of selling, the Dow jumped 151 points Tuesday. It put an end to the index's longest losing streak since 2011.

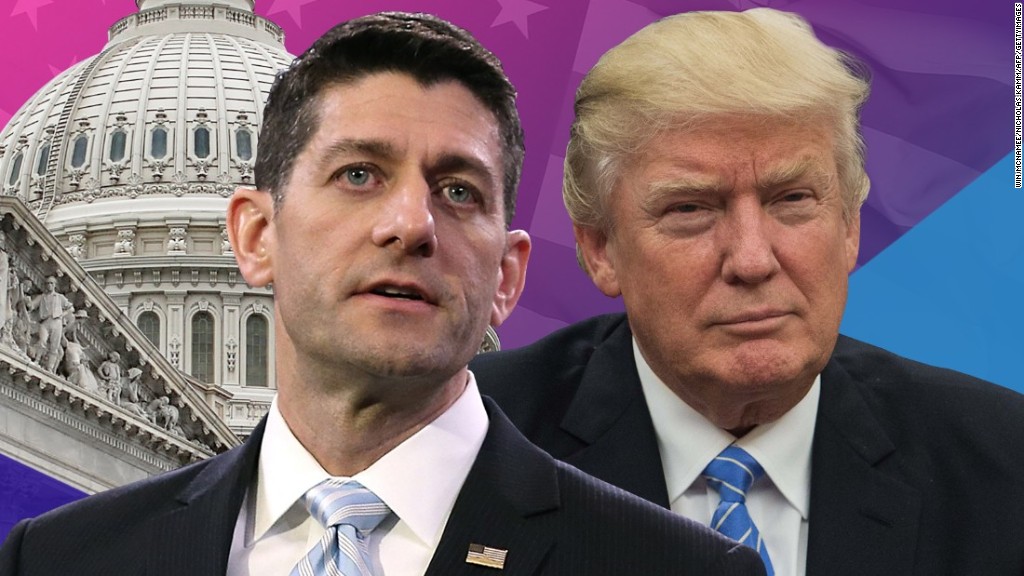

The Trump rally came under siege in recent days as investors worried that the president's stunning failure to repeal and replace Obamacare will make it harder for him to push through tax reform and the rest of his pro-business agenda.

But those concerns eased on Tuesday as traders focused on statements from the White House signaling a focus on tax reform.

"There was concern this was going to be a black eye preventing them from getting anything accomplished. Now, there's hope this moves forward tax reform," said Art Hogan, chief market strategist at Wunderlich Securities.

U.S. stocks received a boost after a new report from the Conference Board showed that consumer confidence surged in March to the highest level since December 2000.

While the survey took place before the health care vote was scrapped, it mirrors a string of other metrics that have turned more optimistic since the end of the election.

Bank stocks like Bank of America (BAC) and Morgan Stanley (MS) also rebounded on Tuesday. The group received a lift from the fact that the 10-year Treasury yield stopped sinking. Falling interest rates make it harder for banks to make money.

Before Tuesday, Wall Street displayed nerves about the fate of Trump's promise for a sweeping reform of the corporate tax code and "massive" tax cuts. Republican infighting exposed by the health care debacle could delay or water down the complex efforts to rewrite tax laws.

"The perception, right or wrong, is that the new administration has been greatly weakened by the implosion," Ed Yardeni, president of investment advisory Yardeni Research, wrote in a report to clients.

Related: Trump rally in jeopardy after health care debacle

Still, it's important to note that the Dow remains up 12% since the election and the eight-day losing streak only knocked it down by about 1.6%. By comparison, the August 2011 stumble wiped 7% of value from the Dow.

"It was long, but it was shallow," Hogan said of the recent slide.

CNNMoney's Fear & Greed Index briefly flipped to "extreme fear" on Monday but it has since improved to "fear" amid the market rebound.