Oil prices are down so far this year -- and so are energy stocks. But some experts think that won't last for long.

President Trump is clearly a fan of the traditional oil and gas sector.

His secretary of state, Rex Tillerson, used to be the CEO of ExxonMobil. Trump also just rolled back some of President Obama's climate control rules, which should be a gift to Big Oil.

And Trump has also declared an end to Obama's "war on coal."

Still, the S&P Energy Sector ETF (XLE) is down more than 6% in 2017, while the S&P 500 is up 5%.

That's despite the fact that earnings for oil companies are expected to be solid in the first quarter. Analysts are predicting that sales at Exxon (XOM), for example, will be up 40% from a year ago and that profits will nearly double.

Why? Even though crude prices are down year-to-date, a barrel of oil is around $50 -- and that's nearly double the price from a year ago.

Oil hit a 13-year low of just above $26 a barrel in February 2016. So it's a lot more profitable to pump now than this time last year.

Despite this, Exxon shares are down 9% in 2017, making it the worst performer in the Dow. Rival Chevron, also a Dow component, is down more than 8%.

These price drops are attracting some bargain hunters.

Rob Bartenstein, CEO of Kestra Private Wealth Services, said Exxon is too attractive to ignore.

"If you are a conservative long-term investor, the opportunity to pick up a blue chip stock with 34 years of dividend increases and $9 billion in free cash flow at these levels is hard to pass up," Bartenstein said.

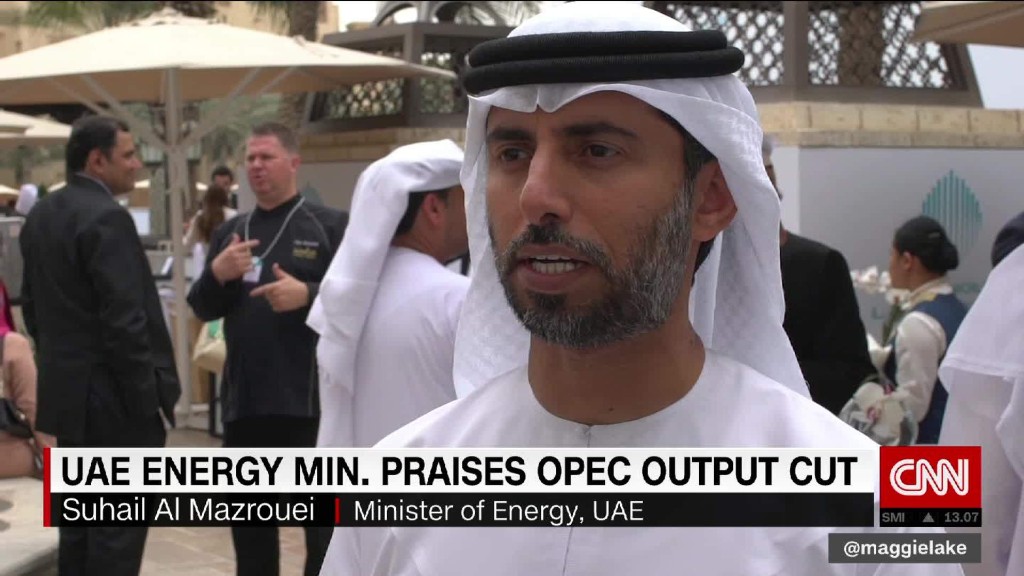

He added that he doesn't think oil prices will fall much further from here either. For one, production cuts by OPEC during the past year have put a floor on oil prices. He also thinks demand for oil will increase as the U.S. economy improves.

Related: This Texas oilfield is messing with OPEC

Jim Brilliant, manager of the CM Advisors Fixed Income Fund, agrees. He said that the combination of higher demand and concerns about supplies in the wake of lower production from OPEC could drive oil prices back to about $75 to $80 a barrel.

That would be great news for oil and gas companies, and it's a key reason why Brilliant said that his fund likes corporate bonds of oil, coal and other energy firms. Bonds for Wyoming coal company Cloud Peak Energy (CLD) is one of his fund's top holdings.

Money manager Louis Navellier of Navellier & Associates also thinks the time is right to make more bets in the oil patch. He said he's been scooping up shares of oil and gas exploration companies Devon (DVN) and Pioneer Natural Resources (PXD).

Navellier said it's a "lock and load" year for these and other energy companies because of expectations for much better earnings. Devon and Pioneer both lost money last year and are expected to return to profitability in 2017 thanks to higher crude prices.

Finally, it's worth noting that several oil companies are also in the process of selling some assets to shore up their balance sheets and boost profits.

ConocoPhillips agreed Wednesday to sell a big chunk of its oil sands assets in western Canada to Canadian energy company Cenovus for about $13 billion. Shares of ConocoPhillips (COP) surged 7% on the news while Cenovus (CVE) plunged more than 10%.

This is the third deal involving big oil companies selling Canadian assets in just the past few weeks. Both Royal Dutch Shell (RDSA) and Marathon Oil (MRO) announced sales of some of their oil sands assets to Canadian Natural Resources (CNQ) earlier this month.

If this keeps up, oil stocks may not stay in the doldrums for that much longer.