For decades, U.S. presidents have observed a couple rules about the dollar:

1) Try to avoid talking about the dollar. 2) If you must comment, say you support a strong dollar and leave it at that.

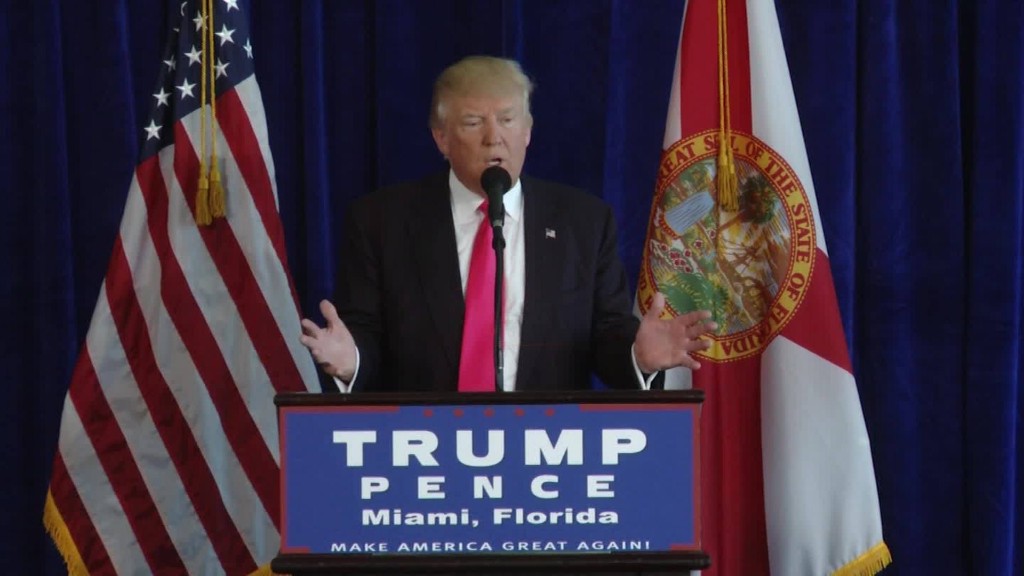

Not President Trump.

Trump sent the dollar sharply lower on Wednesday by saying in an interview with The Wall Street Journal that the currency was "getting too strong." Critics said the new president was trying to "talk down" the dollar.

Barry Bosworth, a senior fellow at the Brookings Institution, said it was common in the 1970s and 1980s for presidents and their aides to try and move markets by commenting on the currency. But recent administrations have been much quieter, sticking to platitudes about their pursuit of a strong and stable dollar.

"I thought we had moved past this foolishness," said Bosworth.

It's not clear whether Trump was deliberately trying to weaken the dollar. But it's not the first time he's claimed the currency is too strong, having repeated the same talking point in an interview with the Wall Street Journal just before taking office.

"I believe Trump in his first almost 100 days has talked about the dollar more than his two predecessors during their eight-year presidencies," said Florian Hense, an economist at Germany's Berenberg Bank.

Why would Trump want a weaker dollar? A drop in the value of the currency would provide a boost to American exporters by making their goods appear cheaper to buyers in foreign markets.

That could, in turn, help alleviate the trade deficit that Trump has repeatedly expressed concern over.

"Trump recognizes that the strong dollar is part of the U.S. trade deficit problem," said Nariman Behravesh, the chief economist at IHS Markit. "He doesn't want the dollar to strengthen even further."

Related: Americans have become lazy and it's hurting the economy

But there are compelling reasons why recent administrations have tried to avoid commenting on the dollar: Other countries can interpret loose talk as an effort to manipulate the vital currency.

And even if the comments do succeed in moving markets, the effect is bound to wear off quickly.

"The Clinton, Bush, and Obama administrations came to understand that such a statement has a life in the market of about two days," said Bosworth. "Talk has no lasting influence in markets."

Market observers have largely interpreted Trump's comments as "jawboning" -- a form of manipulation. If it remains a habit, U.S. efforts to stop other countries from pursuing similar strategies could be undermined.

Trump, for example, repeatedly accused China of manipulating its currency during the campaign. (Trump abruptly reversed course on Wednesday, saying China does not manipulate its currency.)

Trump vs. Trump: Who to believe on the global economy?

Still, without changing economic fundamentals, efforts to talk down the dollar won't have a lasting impact on the currency.

"The dollar is strong today because the U.S. economy is performing better than most advanced economies and offers the promise of a higher rate of return," said Bosworth.

Hense said that Trump's actions will matter far more than his words.

"It doesn't matter what Mr. Trump says, if he follows on his tax reform plan, it will lead to stronger U.S. economy and a stronger dollar," he said.