President Trump and his top advisers appear to have a new message for America: Lower your expectations.

Trump played up his image as a businessman and dealmaker who could rescue the U.S. economy. The day he was sworn in, he vowed to create 25 million new jobs -- the most of any president in history -- and double the growth of the Obama era (among other promises).

Wall Street has roared in anticipation, with the stock market hitting new heights. Over on Main Street, small business and consumer confidence hit multi-decade highs.

Now, reality is setting in for how much Trump can really get done (and how fast) on the economy.

The big tax reform that was supposed to be done by August? Don't bet on it. White House Press Secretary Sean Spicer put it this way: "It still would be a great opportunity before they leave for August recess, but we're going to make sure we do this right."

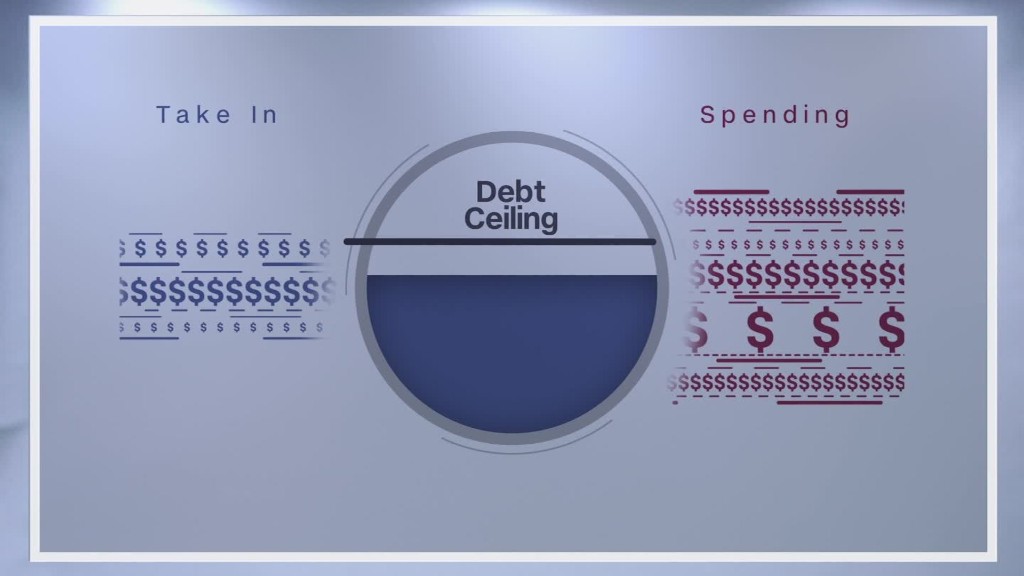

Trump's campaign promise to greatly reduce -- or even eliminate -- America's federal debt? "That was hyperbole," White House budget director Mick Mulvaney told CNBC Wednesday. "I'm not going to be able to pay off $20 trillion worth of debt in four years."

Labeling China a currency manipulator on Day One? That's not happening (not even on Day 100). "They're not currency manipulators," Trump told the Wall Street Journal Wednesday in a major U-turn. During the campaign, Trump had said China has the upper hand against American manufacturers because it keep its currency artificially low.

Related: Americans have become lazy and it's hurting the economy

Repealing Obamacare and replacing it with something "something terrific"? That's up in the air. His first attempt failed in March when he couldn't gin up enough votes in Congress. Many business leaders hoped Trump would move on to tax cuts, but Trump surprised many by telling Fox Business on Tuesday, "I have to do healthcare first." Now, confusion abounds on what the next priority is.

Fixing America's "disastrous trade policies"? The White House has decided to study the issue. Commerce Secretary Wilbur Ross announced a 90-day comprehensive trade review at the end of March. Much of the "trade war" talk has been dialed back after Trump's recent meeting with Chinese President Xi.

Spending $1 trillion on infrastructure? That's unlikely. Mulvaney said he and top economic adviser Gary Cohn are "assuming a $200 billion number."

"The Trump train appears to be coming off the tracks as the president backpedals on a number of issues," says Mike O'Rourke, chief market strategist at Jones Trading.

Related: U.S. dollar drops sharply after Trump calls it 'too strong'

Investors run to 'safe haven' assets again

There are also his flip flops on NATO (now he's really for it), China's trade surplus (he says he'll give China more favorable trade terms if they help out on North Korea), Syria (now the White House wants regime change there) and Janet Yellen (he bashed her on the campaign trail for propping up the Obama economy. Now he says he "likes her" and that low interest rates are good).

All this dialing back of expectations is causing a reality check in the markets.

U.S. stocks have stalled -- and even dipped -- since the S&P 500 closed at an all-time high on March 1. Even more telling is how investors are stocking up on "safe haven" assets like gold and government bonds.

Gold has jumped 7% in the past month, and the 10-year U.S. Treasury bonds are now yielding a mere 2.26%, a significant decline from 2.58% a month ago. The yield goes down when more people are buying bonds.

The key might still be tax reform

Since the election, the consensus view has been that Trump would do a major tax cut/overhaul (the biggest since the 1986 reform under President Reagan), scale back regulations and spend more money on the military and infrastructure. All of this was supposed to juice the economy -- and stocks.

Related: Trump's mixed messages on Obamacare subsidies could prompt insurers to flee

But now that thesis is breaking down. Any action on taxes probably won't happen until later this year -- or even 2018. Infrastructure and the massive budget cuts Trump wants are in doubt, and Trump's "get tough" foreign policy is causing some alarm that the U.S. could be headed for more war.

"The 30 Freedom Caucus members in the House have sent a chill through the Trump inner circle. It's clear they can block much of the Trump agenda, and Democrats seem lukewarm, at best, about cooperating," says Greg Valliere, chief strategist at Horizon Investments. "So Trump has to lower expectations."

Valliere still believes the "pro-business" faction of the White House, led by Goldman Sachs alum Gary Cohn, will prevail.

Business owners from Wall Street to Main Street would probably forget (and forgive) a lot of Trump's flip flopping and uncertainty if tax reform gets done. But all the indications are the White House and Congress are a long way from making that happen.

"We're talking about revamping one of the most complicated tax systems in the developed world, which would understandably take time to draft and negotiate across party lines," says Lindsey Piegza, chief economist at Stifel Fixed Income.