Sergi Cutillas was thrilled when Spain joined the euro. Now he wants out.

"The eurozone has failed. It was a bad experiment," he said. "It was wishful thinking."

The 34-year-old economist wants Spain to abandon the euro. He's far from alone: 25% of the people who use the common currency want to ditch it, according to the latest European Union poll.

The threat to the euro is most acute in France, where people will vote Sunday in the final round of a presidential election that features Marine Le Pen. The far right politician wants France to abandon the currency union.

The euro, the currency of 19 EU countries, is the most visible symbol of the region's long experiment with economic integration since the end of World War II.

But it's now under threat from politicians on both the left and right who want to bring the lira, drachma, peseta and French franc out of retirement.

Here's why some Europeans want to kill the euro:

'Europe is not a nation'

For Alberto Bagnai, the case against the currency boils down to this: European countries are not the same, and so they shouldn't use the same currency.

"The basic point is that you cannot have a federal state among citizens from countries with such a different cultural past," said the Italian academic. "Without a European state, you cannot have European money."

Some European countries are richer, some are poorer, like American states. But unlike the U.S., the eurozone does not have a central government to decide on spending, tax and budget policies.

"The U.S. is a nation, there is a sense of common identity," he said.

That's not true in Europe, where there's little prospect of political unity because wealthier nations such as Germany would end up transferring money permanently to the less fortunate.

"Germany does not want this," said Bagnai. "We should stop telling fairy tales."

'Optical illusion'

Such deep divisions were not always so apparent.

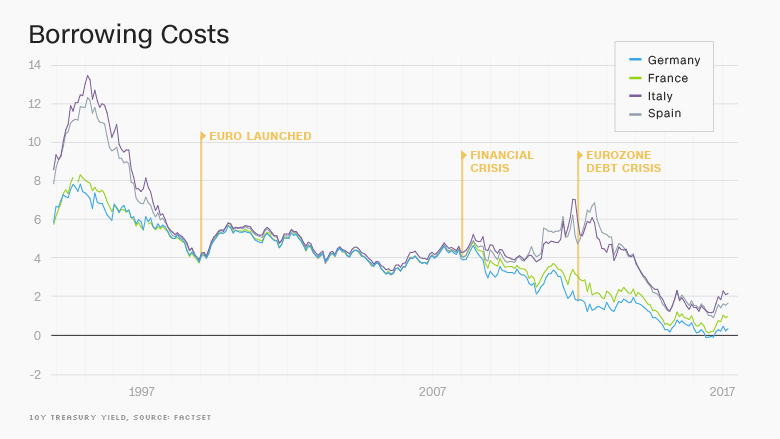

The interest rates that Spain, Greece and Italy needed to pay creditors plummeted after they joined the euro -- putting them on a par with Germany.

"Investors looked at nominal interest rates and thought the Greeks have become German," said Bagnai. "It was kind of an optical illusion."

Then the financial crisis hit, and cracks in the monetary union began to show.

In Spain, policymakers weren't able to make the euro cheaper to counter the collapse of a property bubble and debt crisis.

Instead, Madrid was forced to reduce spending and implement an austerity program -- and that hit living standards.

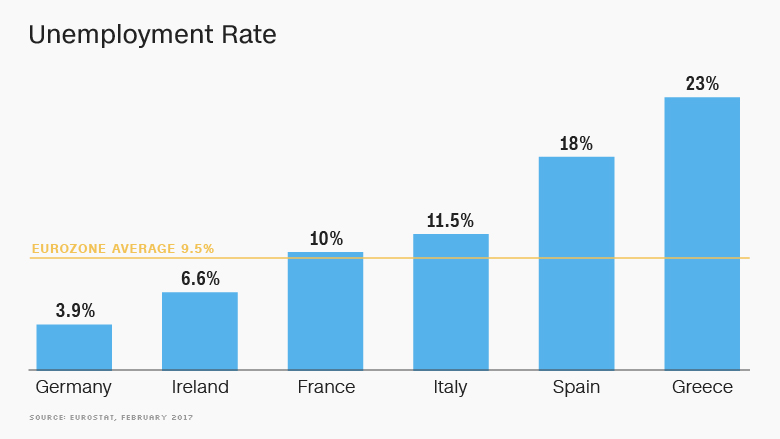

"The 20% unemployment we now have in Spain is a direct result of the euro," said the economist Cutillas.

Related: Europe's lost generation: Young, educated and unemployed

Cutillas said that many people in Spain, which endured decades of violent dictatorship under Francisco Franco, support the euro because it's associated with progress, modernity and peace. That isn't enough for the economist.

"It's nice to be able to travel around easily and have easy means of payment, but these advantages shouldn't cover what's happening with the euro," he said.

A Greek tragedy

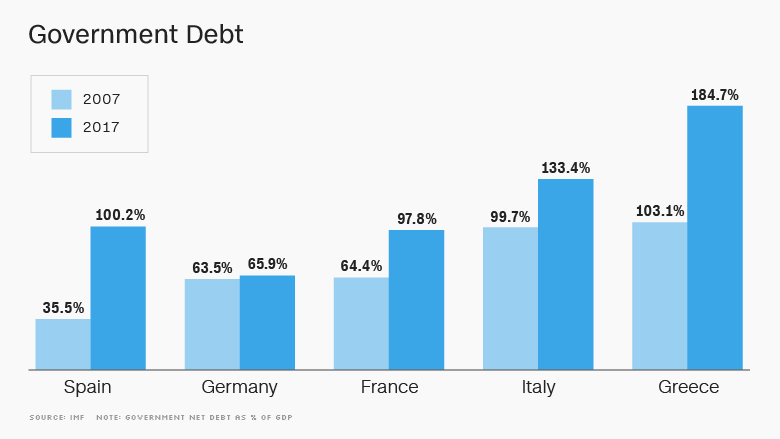

Greece is a prime example of the division between wealthy northern European countries and weaker economies on the continent's periphery.

Facing a debt crisis of its own, Athens agreed to drastic austerity programs in exchange for repeated bailouts. Salaries, pensions and government spending have all been cut dramatically.

Fotis Panagiotopoulos, a dock worker at the Athens Port Authority, experienced the consequences first hand.

His salary has dropped 50% since the beginning of the Greek crisis in 2010. His wife can't find a stable job.

"What we are experiencing in Greece is slow death," he said. "There is no way out unless we break free from this debt cycle."

Panagiotopoulos wants Greece to ditch the euro and start over.

"We just want to make sure that we, and our children, can have a decent future," he said. "With the euro, I don't see how this is possible."

Ireland's 'euro-bubble'

Remember the Celtic Tiger? Ireland boomed in the euro's early years, growing on average 6.5% a year between 1999 and 2007.

Keith Redmond, a dentist and local politician in Dublin, looks back on those days with fear.

"It wasn't a boom. It was a bubble ... a euro-currency bubble," he said.

Redmond argues that without control over its interest rates, Ireland wasn't able to cool the bubble.

When it burst, it brought the Irish banking system to the brink of collapse. Ireland was forced to slash spending.

Ireland has turned the corner and its economy is growing again. But for Redmond, the euro remains a problem.

"The fundamental flaw is still there ... this can all happen again. We have no flexibility in our monetary system to deal with a shock," he said.

French nationalism

Vincent Brousseau is a French economist. But for him, the trouble with the euro is not about the economics.

Instead, he sees the common currency as a threat to France's national sovereignty.

"It's not French," he said of the currency. "It doesn't matter whether it's overvalued or undervalued... this is about making our own decisions."

He's had a major change of heart. Brousseau worked for the European Central Bank until a few years ago.

"When I started at the ECB, I believed there could be one Europe, I was a convinced European," he said.

But he gradually changed his opinion over the 15 years he spent at the central bank that sets a common interest rate for all 19 eurozone countries.

"I realized that transferring sovereignty from France to the European superstate is not good for the country," said Brousseau, who now oversees economic and monetary policy at French political party UPR.

Related: The euro cannot survive unless Europe changes

What's next

Opponents of the euro disagree on what should happen next.

Redmond would like to see the currency split into two. The current euro would be used by Germany, Netherlands and other economically stronger countries. A second, weaker euro, would be introduced for Portugal, Italy, Ireland, Greece and Spain.

Brousseau wants France to completely drop the euro and bring back the franc. He's not a fan of the the compromises proposed by Le Pen, who has suggested that a new pan-European currency could be used in parallel to the franc.

In Italy, Bagnai thinks the end of the euro is an inevitability.

"We know that the project could last for a decade, perhaps, but it's going to end. And the sooner it ends the better."

-- Elinda Labropoulou and Maud Le Rest contributed reporting.