United Continental's reputation may still be bruised after a passenger was dragged off an overbooked flight last month.

And the airline is dealing with another PR nightmare -- a giant rabbit died mysteriously in the cargo hold of a United flight a few weeks ago.

But investors couldn't be any happier with the company. United (UAL) reported a strong jump in traffic and capacity for the month of April on Tuesday. That news sent the stock up 5% -- to an all-time high.

Shares are now up more than 10% since the incident with Dr. David Dao on a United flight from Chicago to Louisville on April 9. The stock is also up 15% above the recent low they hit in April when anger about Dao's removal was at its peak.

So much for bad publicity, huh?

Of course, United's nightmare of a month could eventually impact its sales and bottom line. Customers may opt to fly on a different carrier if they feel United is treating passengers poorly.

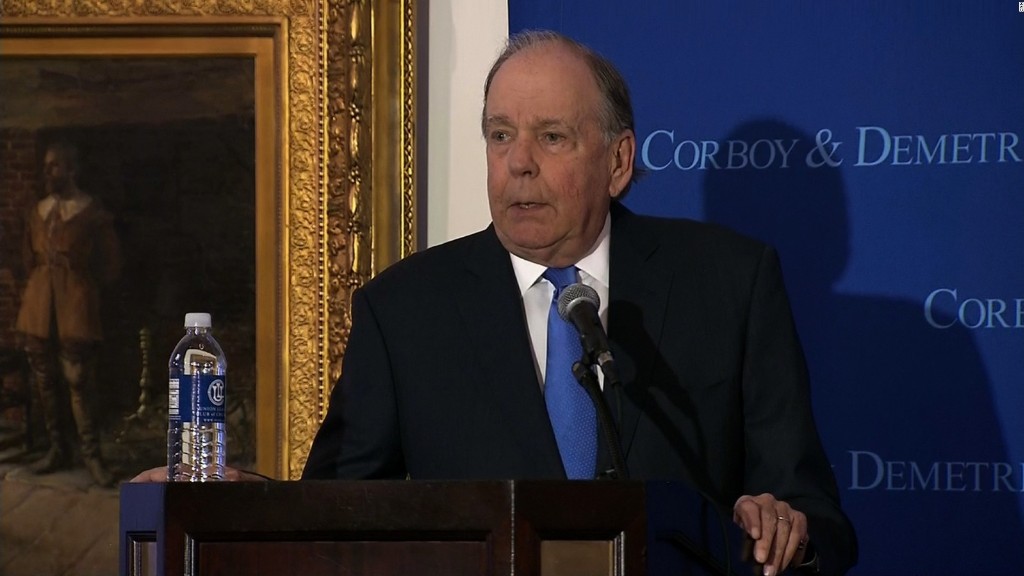

That's probably the main reason why CEO Oscar Munoz has been on a public apology tour lately.

But there's a flaw with that argument. Many of United's competitors are also in the midst of their own customer service fiascoes -- and they are doing well too.

Related: United CEO says 'we had a horrible failure'

Delta has come under fire after a family was kicked off a flight due to a mix-up over seating arrangements because a different child was sitting in a seat than was listed on the ticket -- even though the family had paid for the seat.

The incident went viral after the father posted footage of it online. A flight attendant is heard in the video threatening to put the parents in jail.

Delta also kicked off a passenger who went to the bathroom before takeoff. And the company is still dealing with the headaches from its weather-related cancellations earlier this month.

Delta (DAL) even postponed its international media day that it was planning for this month, citing "the recent focus by Congress on airline customer service issues that have gone viral on social media." It will still host a meeting for analysts on Thursday though.

American has also had to deal with image problems. A video showing a flight attendant forcibly removing a stroller from a mom went viral as well. The video showed the mom sobbing. The flight attendant was ultimately suspended.

The airline was panned by many as well after it recently announced it would be shrinking the amount of legroom for passengers in its economy class.

But American (AAL) recently reported record traffic for April. Delta's traffic was up too. Both stocks have surged in the past month despite their customer service debacles.

In fact, J.D. Power reported Wednesday that fliers are happier these days thanks to lower fares, more flights arriving on time, and fewer lost bags.

Customer satisfaction is actually at an all-time high. J.D. Power acknowledged how surprising that may seem, saying in the headline for its press release that the improvement came "despite inflammatory incidents."

All of this is good news for airline investors, including Oracle of Omaha Warren Buffett. His Berkshire Hathaway (BRKB) firm recently made a big bet on United, American and Delta, as well as Southwest (LUV).

But he acknowledged in an interview with CNBC Monday following the company's shareholder meeting last weekend that United made a "terrible mistake" with how it handled the situation with Dao.

Related: Spirit customers are mad, but its pilots are furious

Still, airlines continue to make headlines for all the wrong reasons.

Spirit's (SAVE) stock plunged earlier this week after angry passengers fought with airline employees in Fort Lauderdale due to frustration about canceled flights. Spirit is in the midst of a battle with its unionized pilots.

Spirit shares rebounded a bit Wednesday though.

So yes, airline rage is real. But Wall Street doesn't think it's enough to stop people from flying or that it's a long-term problem for the industry.