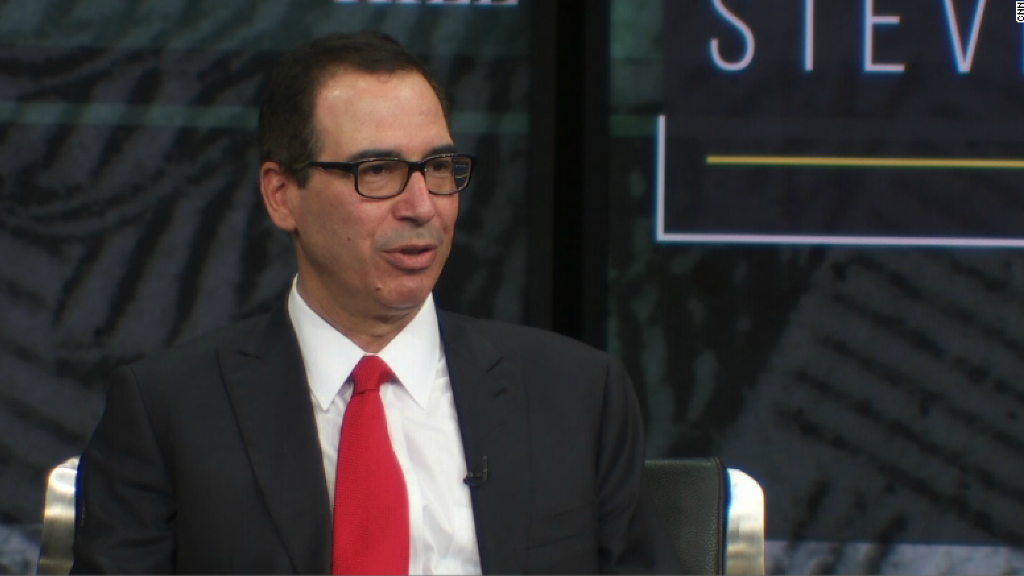

Treasury Secretary Steven Mnuchin said Thursday housing finance reform will be a top "priority" for the Trump administration.

"This has been an unresolved issue for far too long and one we are committed to fixing," said Mnuchin before the Senate Banking Committee. "We will ensure that there is both ample credit for housing and that we do not put taxpayers at risk."

The Trump administration wants to jump start an overhaul of the housing mortgage giants, Fannie Mae and Freddie Mac, nearly a decade after they were seized by the government in 2008. Their endorsement has given a boost to Senate lawmakers, who want to advance a bipartisan plan to revamp the companies later this year.

"Housing finance reform remains the most significant piece of unfinished business following the crisis, and it is important to build bipartisan support for a path forward," said Mike Crapo, the ranking member of the panel.

Related: Trump aides try to steer tax reform on Capitol Hill

Mnuchin said if policymakers end up with a proposal that includes an explicit guarantee by the government to backstop the U.S. housing market, it would have to be paid for in a similar way like deposit insurance at the Federal Deposit Insurance Corp. while also keeping taxpayers off the hook.

"If we end up with a scenario where we need some type of explicit guarantee, I would expect that it would be paid for and I would expect it would hopefully never be hit," said Mnuchin.

While the White House hasn't advanced a proposal yet, Mnuchin has signaled he wants to privatize the firms. He has set a revamp as a priority for the second half of this year.

The former Goldman Sachs banker said his "strong preference" would be for Congress to take the lead on the direction of housing finance reform.

The Treasury secretary also threw his support behind keeping a cornerstone of American mortgage market: the 30-year fixed-rate mortgage.

"I think the 30-year mortgage has been a fundamental part of our mortgage finance for as long as people can possibly remember," he said.

Related: Mnuchin pressed terror financing crackdown at G7 talks

Despite the financial conditions of Fannie Mae and Freddie Mac, the secretary said he expects the two companies to continue to pay dividends to the government.

The terms of the government's bailout of the mortgage giants require them to make a quarterly dividend payment to Treasury. Mnuchin said he has discussed the issue on the several occasions with Mel Watt, director of the Federal Housing Finance Agency, which oversees the two firms.

"I did tell him that it was our expectation at Treasury that they would pay us the dividend and we hope they continue to do so per the agreement," he said.

Last week, Watt told lawmakers that it would suspend quarterly dividend payments, if it would prevent Fannie and Freddie from running out of money. The two firms are close to running out of capital, which is expected to fall to zero next year.

During the hearing, the Treasury secretary also focused on the Trump administration's goals of loosening regulations on Wall Street, moving ahead with a historic tax overhaul plan and revisiting trade deals. according to his testimony.

He said Treasury's first regulatory review will be focused on providing relief for community banks.