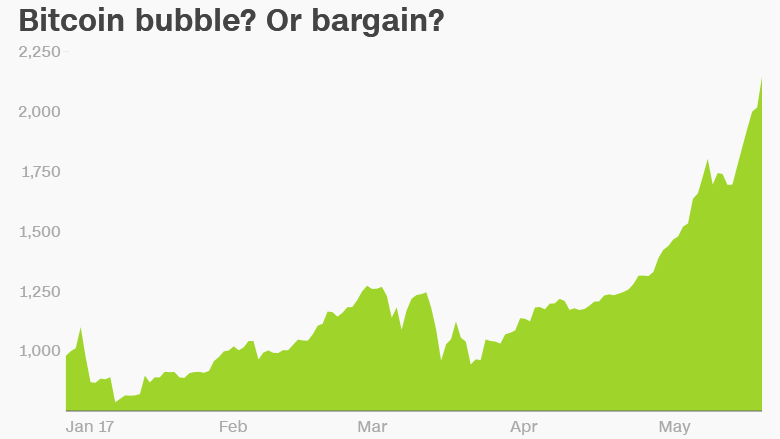

Digital currency bitcoin is more popular than ever. Prices surged to a record high above $2,000 over the weekend and were trading above $2,100 on Monday.

Just in 2017, bitcoin prices have soared 125%.

And traders can probably thank President Trump for at least part of the big spike.

Last week, markets were rocked after reports about former FBI director James Comey's memo about being asked by Trump to stop an investigation of former National Security Adviser Michael Flynn's ties to Russia.

Stocks plunged due to rising levels of uncertainty about Trump's ability to get anything meaningful accomplished as he deals with this crisis. And the US dollar weakened too. But bitcoin (XBT) is a beneficiary of this turmoil. So is gold.

One of the reasons digital currencies like bitcoin and lesser known ones such as Ethereum and Ripple have soared this year is because they, like gold, are not backed by governments. Bitcoins are tracked in a public online record known as the blockchain.

There are a finite number of bitcoins that can be "mined" -- that is, made available after a complex math problem is solved. And even though the record of transactions is public, there is a level of anonymity about who is making the transactions.

Bitcoin prices have tended to pop over the past few years at times of geopolitical uncertainty -- and especially when there were significant questions or concerns about the health of a major country's paper currency.

Trump has already talked about wanting the dollar to be weaker to help make the products of big US multinationals more competitive overseas. So that may be helping to lift the price of bitcoin.

The president also has some known bitcoin bulls in his administration as well.

His budget director, former US House member Mick Mulvaney, had been dubbed the "Bitcoin Congressman" by some of the currency's backers.

Related: Billionaire says he has 10% of his money in bitcoin and other digital currencies

And vice president Mike Pence's chief economist Mark Calabria has given speeches in support of bitcoin as well. Calabria was formerly the director of financial regulation studies at the libertarian-leaning Cato Institute before joining the administration.

Many experts also think President Trump's fiscal spending plans could be highly inflationary. That could further weaken the dollar and fuel the rise in bitcoin and gold prices.

But concerns about just what Trump will actually be able to accomplish in the wake of the Comey allegations are another big reason for the dollar's recent slide and accompanying rise in bitcoin.

There is even some speculation about whether or not Trump's presidency could end prematurely due to him resigning, being impeached, or removed via the 25th Amendment of the US Constitution.

Add it all up and it appears that bitcoin prices could continue to climb higher. But some are worried that the party could end soon.

I asked my followers on Twitter what they thought was next for bitcoin.

Several expressed concerns that prices will come tumbling down since bitcoin has been an extremely volatile investment over the past few years. When bitcoin topped the $1,000 level in January, it was the first time it had done so in three years.

Those are great points. It is debatable whether bitcoin can ever become a mainstream form of payment. Just look at how little money the hackers behind the recent WannaCry ransomware made by demanding payment in bitcoin.

But Ross Gerber, CEO of investment firm Gerber Kawasaki and a frequent guest on CNNI's business programs, noted that bitcoin may be the perfect currency for these crazy and tumultuous times.

In other words, bitcoin and its smaller digital currency siblings could continue to benefit from all the turmoil in Washington.