The U.S. shale oil boom is recovering from the crash faster than almost anyone imagined, OPEC included.

OPEC's decision in late 2014 to pump oil at high levels launched a devastating price war. It sent oil prices to 13-year lows, dealing a big blow to the shale revolution. Dozens of American producers fell into bankruptcy and countless oil workers lost jobs.

But more recently, OPEC has retreated by putting a lid to its production. Crude prices have stabilized, and shale is coming back stronger than before. Oil companies are discovering that they can pump oil profitably from shale hotbeds, especially the Permian Basin of West Texas, profitably at even today's prices of $50 a barrel.

Now, some believe that the U.S. could soon be pumping more oil than ever, potentially deepening the oil glut that OPEC has so far failed to fix.

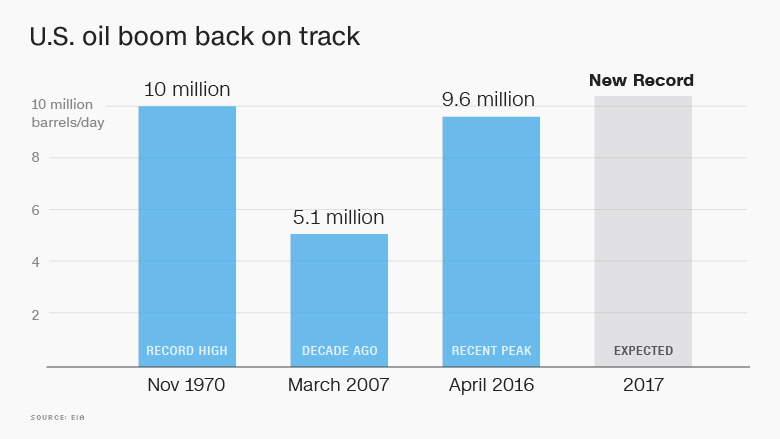

Rystad Energy is predicting that before the end of this year, monthly U.S. oil production will top the record of 10 million barrels per day that was set in November 1970.

"We call U.S. production the anti-fragile: Something that once shocked comes back stronger and more efficient than ever," said Michael Tran, director of energy strategy at RBC Capital Markets.

"OPEC grossly underestimated the ability of U.S. production," he said.

Related: OPEC and Russia have failed to fix the oil glut

The shale revolution has reshaped the global energy landscape, vaulting the U.S. to the upper echelon of oil producers behind only Russia and Saudi Arabia.

U.S. oil output shot up from just 4.7 million barrels per day in October 2008 to a peak of 9.6 million in April 2015. All of that U.S. crude caused a global glut. OPEC responded in late 2014 by launching a price war aimed at regaining market share by drowning high-cost producers like shale in cheap oil.

But America's oil boom didn't slow nearly as much as feared. Domestic production dipped to a low of 8.6 million barrels in July 2016, down 10% from the peak. Since then it's stabilized, and rebounded to 9.1 million barrels a day in March, the most recent month stats are available for.

"Based on proprietary and detailed well level data, Rystad Energy sees current U.S. production bouncing back twice as fast as it dropped," the firm wrote in a report this week.

U.S. shale 'dominating'

Goldman Sachs agrees that the U.S. oil boom looks to be back on track.

"The pendulum between shale and OPEC has shifted wildly over the past five years...In 2017, shale is dominating growth again," Goldman Sachs analysts wrote in a report this week.

So how high will U.S. production go? The EIA is calling for the U.S. to pump 9.74 million barrels per day in December. That would top the recent high but be just shy of the record.

Rystad Energy believes that U.S. shale will once again exceed expectations and output will reach the all-time high of 10 million barrels.

If that happened, the U.S. could surpass Saudi Arabia as the world's No. 2 oil producer. OPEC estimates the Saudis pumped 9.95 million barrels of oil a day in April, while Russia produced 11.2 million.

Related: OPEC 'no longer in control' of oil prices

'Drill, baby, drill'

One of the keys behind the revival of U.S. shale is how much more efficient producers have become, thanks to innovation and discounts on service contracts.

Nowhere is that more true than the Permian Basin, where Goldman Sachs estimates that wells have become 50% more productive over the past two years.

Another important factor is that U.S. shale companies have locked in higher oil prices when they occur by turning to hedging contracts. More and more oil companies are using hedges to give them certainty.

"That means regardless of where prices go, it's still drill, baby, drill," said RBC's Tran.

It's possible that Rystad's call for record U.S. oil production is too optimistic. Domestic output could be slowed by a new oil price slump. There are also infrastructure challenges in terms of transporting shale oil to refiners, some of which don't process that type of crude.

Of course, a more moderate pace of U.S. oil output might not be the worst thing for the industry. Too much pumping could deepen the oil glut OPEC and Russia are struggling to fix by extending their production cuts until March 2018.