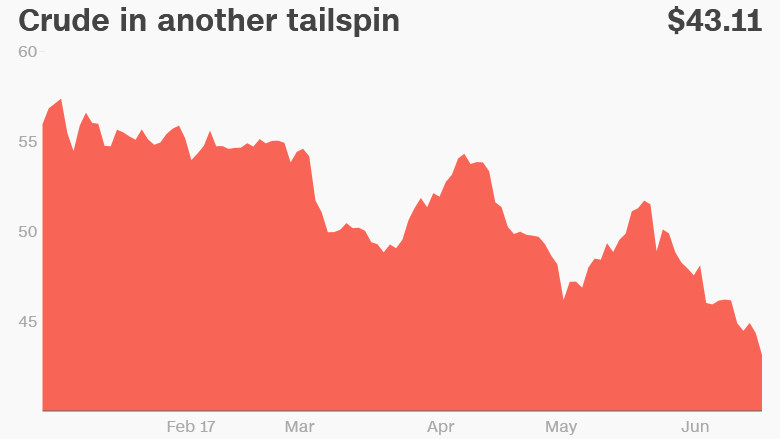

Look out below! The massive supply glut is once again sending crude oil prices into a tailspin.

Crude plunged into a bear market on Tuesday, sinking another 2.2% to settle at a nine-month low of $43.23 a barrel.

The sell-off leaves oil down 22% from early January, eclipsing the 20% needed to qualify for a bear market.

The big fear gripping the energy markets is that the world continues to have too much oil, despite the deal between OPEC and Russia to pump less.

If anything, the supply glut could be deepened by emboldened U.S. shale producers that have ramped up output in recent months.

"There is this bearish sentiment building into the market over what's happening in the U.S. There's a lot of concern the U.S. could offset OPEC's production cuts," said Jenna Delaney, senior oil analyst at S&P Global Platts.

The oil worries spread to Wall Street as energy stocks, already the biggest losers this year, took another hit on Tuesday.

Six out of the seven worst-performing S&P 500 stocks were oil-related, led by 4% declines of Hess (HES), Transocean (RIG) and Marathon Oil (MRO). Even ExxonMobil (XOM) and Chevron (CVX) retreated, leaving them each down more than 9% apiece this year.

The doom-and-gloom in the energy industry contrasts with the optimism in the stock market. The Dow hit a fresh record high on Tuesday and CNNMoney's Fear & Greed Index is sitting comfortably in "neutral" mode.

Much of the focus remains on the resilience of U.S. shale producers, especially in the Permian Basin of West Texas. Few anticipated the shale industry, which was rocked by the oil crash in late 2015 and early 2016, would rebound as strongly as it has.

OPEC's strategy of flooding the world with excess oil caused crude to crash as low as $26 a barrel in February 2016. Dozens of U.S. shale producers filed for bankruptcy. But shale companies have emerged from the downturn stronger than ever, allowing them to pump at far lower prices than before.

Related: Big Oil needs to spend $350 billion...on wind and solar

The shale comeback is displayed by the unrelenting rise in the Baker Hughes rig count. The closely-watched metric has increased 22 weeks in a row -- the longest streak since 1987, when the data first started being collected, according to BNY Mellon. The increased drilling activity led Rystad Energy to recently predict that monthly U.S. oil production could hit a new record before the end of the year.

All of this has an impact on the global picture. The International Energy Agency warned last week that the U.S. will lead a surge in non-OPEC supply next year that will outpace growth in global demand.

There's also concern about the amount of oil coming out of OPEC. Last week, OPEC said its output increased in May despite the agreement to curb production. The problem is the deal excluded Libya and Nigeria, two countries racing to ramp up output after periods of unrest.

Libya's oil production has jumped to nearly 900,000 barrels per day thanks to resolving a legal dispute, Reuters reported this week.

OPEC's "output curb failed to dispel market doubts about the global supply glut," Neil Mellor, BNY Mellon's senior currency strategist, wrote in a report on Tuesday.

Of course, all of this is good news for American drivers. A gallon of gas fetched $2.285 on Tuesday, down from $2.352 a month ago, according to AAA.