Most homes in the path of Tropical Storm Harvey don't have the flood insurance that owners would need to rebuild if their homes are damaged or destroyed.

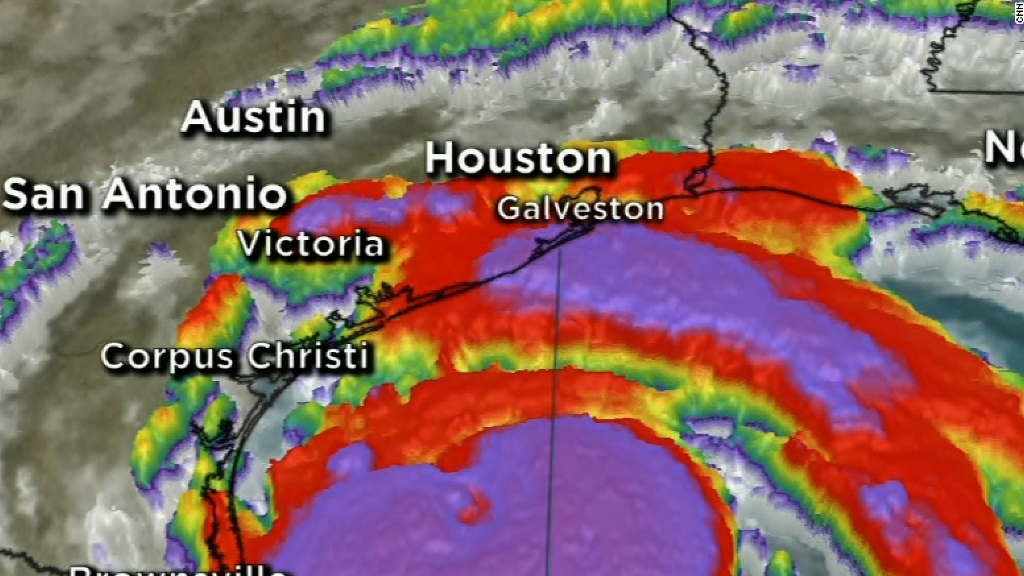

Standard homeowners insurance policies cover damage from the high winds that are associated with a hurricane, but they don't cover damage from rain or flood waters, such as storm surges or overflowing rivers. But the National Hurricane Center is forecasting up to 35 inches of rain in some locations by the middle of next week due to the storm, which could bring flooding far beyond the Texas coastline.

Related: Hurricane Harvey could cause $40 billion worth of damage to Texas homes

Figures from the National Flood Insurance Program show that only 15% of homes in Harris Country, which includes Houston, have flood insurance, while only 20% of homes in Nueces County, where the coastal city of Corpus Christie is located, are covered. Coverage rates are higher in the area's flood zones, but many homes still aren't covered.

"If the homeowner is not required to buy flood insurance by their mortgage lender, they often chose not to," said Michael Barry, spokesman for the Insurance Information Institute, a consumer education group funded by the insurance industry. He adds that there is a widely-held misconception that homeowners who aren't in floodplains can't get coverage. "Almost all homeowners can get coverage," he said.

Related: Hurricane Harvey could hit the Texas economy

The federal flood insurance program is facing its own challenges, beyond the payments it might have to make for Harvey. The problem is that the premiums that homeowners pay simply don't cover the cost of the claims that have to be paid out.

"The National Flood Insurance Program's exposure to major floods is on the rise, as evidenced by Hurricanes Katrina and Sandy," the program director Roy Wright said earlier this year in a blog post. "These events generated claims of approximately $24.6 billion, leaving the NFIP $23 billion in debt to the U.S. Treasury."

Bills have been introduced in Congress to close the funding gap by hiking premiums. But lawmakers worry about angering homeowners who are required to buy flood insurance, and that expensive policies would only discourage other people from buying them.