India's economy is having a difficult year.

The South Asian nation's gross domestic product grew 5.7% in the quarter ended June, the government said Thursday. That's a big drop from the quarter before and much slower than the 7.1% growth it recorded in the same period last year. It's also the weakest rate of growth in three years.

The slowdown has ended India's claim to be the world's fastest-growing major economy and is being blamed on big reforms introduced by Prime Minister Narendra Modi: last year's sudden ban on 86% of the country's cash, and the recent introduction of a national goods and services tax (GST).

"There has been a hit to growth on the back of various disruptive changes," said Anubhuti Sahay, head of South Asia research for Standard Chartered. "Initially it was [the cash ban], now the GST impact has just hit and it's likely to persist for a couple of quarters at least."

Related: India's red-hot economy is losing steam

The goods and services tax marks a significant overhaul of India's tax system, replacing a complex web of local tariffs and uniting the country's 29 states into a single market for the first time.

It is widely expected to boost growth in the long run, but economists predict months of disruption as business gets used to the new system and more people are drawn into the tax net.

The self-inflicted cash crisis, meanwhile, had already helped slow growth to 6.1% in the quarter ended March, down from 7% in the previous quarter.

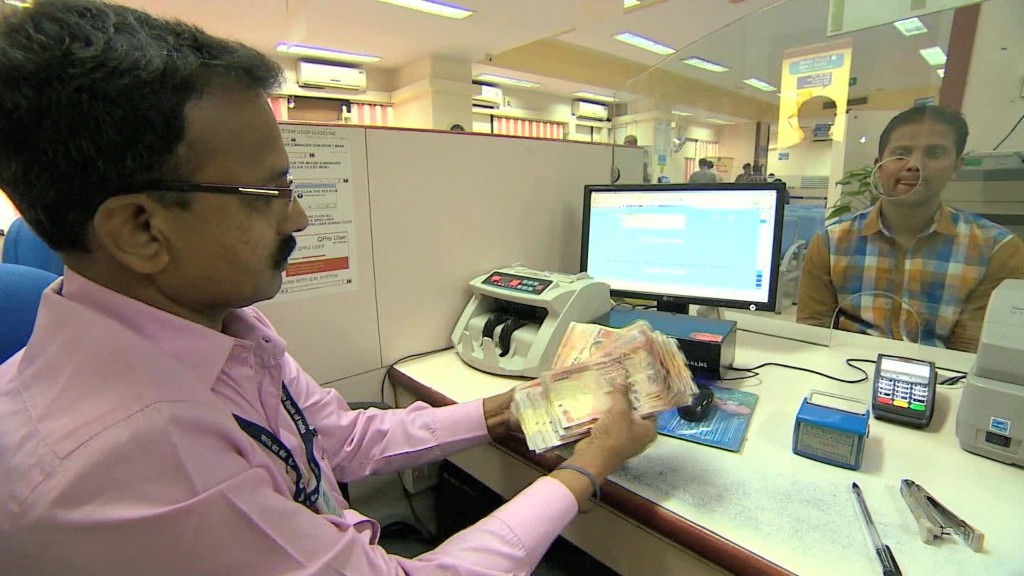

It was sparked by Modi's decision to take all 500 rupee and 1000 rupee notes -- the two largest denominations at the time -- out of circulation in November. Their removal led to widespread chaos as millions lined up to deposit their money and activity in parts of the economy came to a virtual standstill.

Related: What happened when India trashed its cash

The government says it wanted to crack down on tax evaders by rendering piles of hidden cash suddenly useless, and also to flush out fake currency from the economy.

But 99% of the banned notes have found their way back into the system, the central bank revealed this week, leading some to suggest that Indians had found ways to launder their so-called "black money."

India's finance ministry admitted that a "significant portion" of the deposited cash could represent illegal wealth. It said it had identified around 1.8 million accounts that "did not appear to be in line with their tax profile," and it continues to investigate the deposits.

Experts say that the government needs to show results fast if it wants to paint the cash ban as a success.

"99% of the cash has come back into the system, so extinguishing black money really hasn't worked," Pronab Sen, the India head for the International Growth Centre and the country's former chief statistician, told CNNMoney.

"The negative effects of demonetization are going to last at least another year, if not longer."