Americans enjoyed their largest two-year raise in decades.

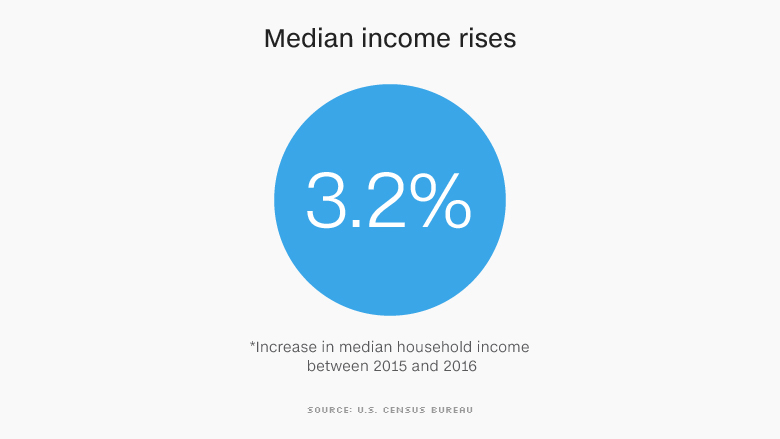

Median household income rose to just over $59,000 in 2016, up 3.2% from a year earlier, according to data released by the U.S. Census Bureau Tuesday. That comes on top of a 5.2% increase in 2015.

"This has been two consecutive years of very strong income growth," said Trudy Renwick, assistant division chief at Census.

The figures cap a long, slow road to improvement in middle class fortunes under the Obama administration. Median income declined and the poverty rate rose during former President Obama's first term as the nation struggled to recover from the Great Recession before starting to improve in his second term.

The strong job market drove the income increase, experts said. The U.S. economy added a total of 2 million jobs last year, ending with a 4.7% unemployment rate, down from 5% at the close of 2015.

Related: U.S. job openings hit record high, nearly 6.2 million

The income growth, however, likely stems from more people returning to work and more moving up to full-time jobs, as opposed to workers getting significant raises, said Jared Bernstein, senior fellow at the left-leaning Center on Budget and Policy Priorities.

The Census figures appear to show that median income is at an all-time high, surpassing the 1999 record of $58,665. But Census officials cautioned against comparing the figures because the bureau has changed its methodology over the years.

In fact, median income has not even caught up with its pre-recession level, according to the Economic Policy Institute, a left-leaning group, which crunched the Census data to account for the change. The 2016 median income figure remains 1.6% below its 2007 level and 2.4% below where it was in 1999, said Elise Gould, a senior economist at the institute.

Still, a wide swath of Americans have benefited from the strengthening economy. Black families saw their median income climb 5.7% in 2016 to $39,500, while Hispanic households had a 4.3% increase to $47,675. The median income of whites rose 2% year-over-year to $65,000. Asians, who have the highest median income of $81,500, did not see a statistically significant change in income.

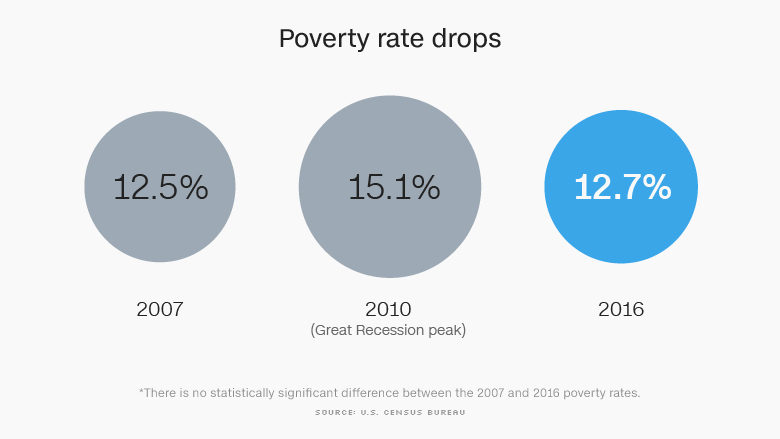

Also, the poverty rate ticked down to 12.7% in 2016 from 13.5% a year earlier. Some 40.6 million Americans were in poverty, 2.5 million fewer than a year earlier.

The poverty rate has returned to pre-recession levels. The 2016 figure is not statistically different than the 2007 rate, the bureau said. The lowest it has been in recent decades was 11.3% in 2000.

The share of blacks in poverty fell to 22% in 2016, down from 24.1% a year earlier. Hispanics saw their poverty rate fall to 19.4%, down from 21.4%. The rate for whites was 8.8% and for Asians 10.1%, both statistically the same as the year before.

And, the share of those without health insurance dropped to 8.8%, down from 9.1% a year earlier. The share of uninsured Americans has dropped in all 50 states since the Affordable Care Act went into effect in 2014.

There was a big difference in the uninsured rate between the 31 states (plus the District of Columbia) that expanded Medicaid under Obamacare and those that did not. Expansion states had an average uninsured rate of 6.5%, while the average rate in non-expansion states was 11.7%.

Related: 4 ways the White House says tax reform will put money in workers' pockets

Some 28.1 million people lacked health insurance in 2016, down from 41.8 million in 2013.

Of those with coverage last year, just over two-thirds of Americans had private insurance, mostly from their employers. The rest had Medicare, Medicaid or military coverage.

The Census Bureau also released its Supplemental Poverty Measure, which takes into account government assistance and certain expenses not factored into the official poverty rate.

It showed that Social Security benefits lifted 26.1 million people out of poverty, while refundable tax credits helped 8.2 million people and food stamps prevented 3.6 million from being in poverty.

But medical expenses increased the number of people in poverty by 10.5 million.