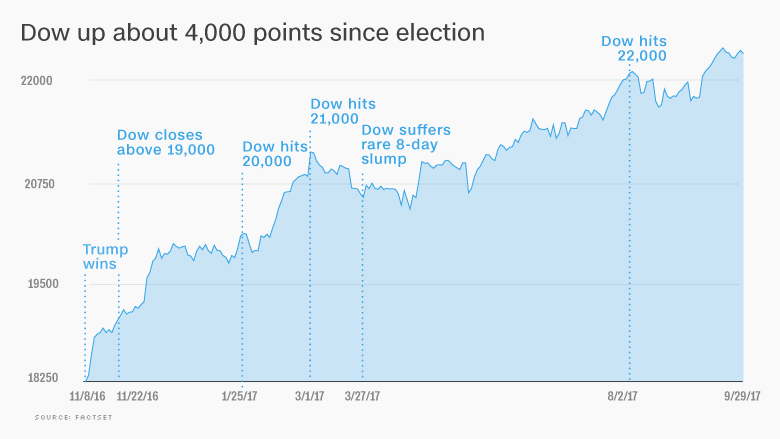

The stock market, undaunted by monster hurricanes, political tension and North Korea threats, keeps climbing to new heights.

The Dow soared another 5% during the third quarter, which ends for Wall Street on Friday.

The strong gains extend the Dow's streak of winning quarters to eight. It's the longest since an 11-quarter boom that ended in September 1997, according to FactSet stats. Back then, the U.S. economy was going gangbusters under President Bill Clinton at the start of the dotcom boom.

The current streak began during the final three months of 2015 and accelerated after last fall's election. For those scoring at home, that's five winning quarters on President Barack Obama's watch and three under President Trump, who took office in January.

Trump, who claimed as a candidate that the market was in a "big, fat, ugly bubble," brags about it now that he's in charge. He did that again on Friday, cheering the "RECORD HIGH" for the S&P 500.

It's true that the stock market soared after Trump's victory. Wall Street cheered his promises to revamp the tax code, slash regulation and ramp up infrastructure spending. (The market largely ignored the administration's less business-friendly trade and immigration policies.)

Stocks have continued climbing even though none of Trump's economic policies have gotten through Congress. That's because economic strength in the United States and overseas has kept corporate profits growing.

"The market is primarily up because earnings have been good. The tax reform proposal has been icing on the cake -- but that's not the ultimate reason," said JJ Kinahan, chief market strategist at TD Ameritrade.

Related: Obama-Trump bull market is now up 268%

Wall Street has been largely unfazed by the turbulence of the past few weeks and months. The GOP's repeated failure to repeal and replace Obamacare didn't dent the market. Nor did the hurricanes that ravaged the Gulf Coast and Caribbean. And escalating tension between Trump and North Korean leader Kim Jong Un caused just fleeting concern among investors.

If anything, September was a bore for the stock market despite its history as a rocky month. The S&P 500 had its least volatile September going back at least to 1970, according to Ryan Detrick at LPL Financial. That's based on how much the market moves from its high to its low each day.

The calendar ahead looks favorable for the stock market. Over the past 20 years, the Dow climbed 70% of the time during October, according to Bespoke Investment Group. The final three months of the year have historically been the best for the stock market.

Related: Warren Buffett: Dow will hit 1 million in 100 years

That could change this year if Corporate America lets Wall Street down. Investors are hoping third-quarter results, set to begin streaming in later this month, will continue to show healthy profits.

Wall Street may also have to withstand bickering over the GOP's plans to overhaul the tax system. Tax reform is complex, and many major questions remain unanswered.

"The bill's announcement, and its eventual passing, are and will be bullish for stocks. But what comes in between is not bullish, and that starts right now," Michael Block, chief market strategist at Rhino Trading Partners, wrote in a report.

Eventually, investors may grow impatient with Washington if it looks like the tax overhaul is being further delayed or watered down by politics.

"The markets are not going to ignore politics in 2018," said TD Ameritrade's Kinahan. "Washington has to get something done."