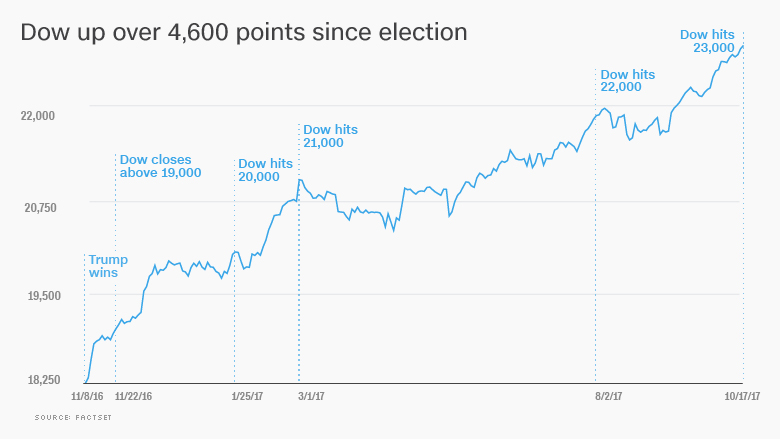

The Dow has rocketed through yet another milestone -- 23,000.

Wall Street's latest record shows how hot the stock market has become over the past year. The Dow was sitting at just 18,333 on Election Day.

But since President Trump's election, the average has spiked more than 4,600 points, or about 25%. The Dow has notched 66 record highs in that time. That's despite Trump's struggles to get his economic agenda, including tax cuts, through a Republican-controlled Congress.

Trump's political problems haven't fazed investors, in part because the market has been supported by healthy corporate profits as well as improved domestic and international economic growth.

The stocks of Wall Street titans Goldman Sachs (GS) and Morgan Stanley (MS) bounced on Tuesday after the companies reported earnings that impressed the market. That follows better than expected results last week from big banks JPMorgan Chase (JPM), Citigroup (C) and Bank of America (BAC).

"The U.S. economic fundamentals are pretty good. And the global economy is accelerating," said David Joy, chief market strategist at Ameriprise Financial.

For now, Wall Street is closely tracking the fate of Trump's tax plan, which has a long way to go before enactment by Congress.

The GOP's tax framework would cut the corporate tax rate from 35% to 20% and encourage U.S. multinationals to bring profits sitting overseas back home.

Related: How Trump's tax plan could backfire on Wall Street

Those proposals would be great news to tech titans like Apple (AAPL) and Microsoft (MSFT) that have hoarded lots of cash overseas. Banks and other high-tax payers like Disney (DIS) and McDonald's (MCD)would also be winners.

Emboldened investors have been more willing to pay up for risky assets like U.S. stocks. The S&P 500 trades at 18.7 times its projected earnings. That's well above historical averages.

Some worry that stocks have gotten too hot, setting the stage for an unsustainable "melt up" that could vanish once the market's mood changes.

"The higher we go, the more aware investors need to be about valuations, which are in rarefied territory. They don't typically stay there for long," Joy said.