Déjà vu.

Shares of Sprint (S) and T-Mobile (TMUS) tumbled in midday trading Monday after reports that their widely rumored merger talks may be ending. It would mark yet another high-profile failure to combine the two carriers.

SoftBank (SFTBF), a Japanese conglomerate with a majority stake in Sprint, is said to be calling off the negotiations due to concerns about the ownership structure of the combined business, according to reports from Nikkei and The Wall Street Journal.

Reps for T-Mobile, Sprint and SoftBank did not immediately respond to requests for comment.

Sprint's stock fell as much as 11% in trading after the report. T-Mobile was down about 5%.

Related: SoftBank: The new kingmaker in tech

Sprint and T-Mobile previously gave up an attempt to merge in 2014 due to concerns about regulatory challenges from the Obama administration.

But the companies expected to have a better shot at the merger this year under the Trump administration.

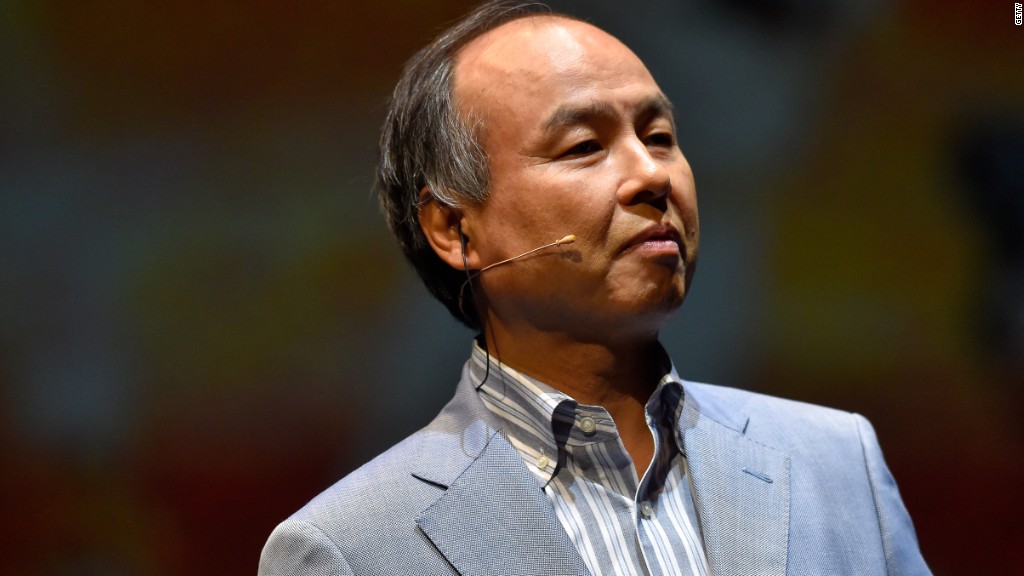

SoftBank CEO Masayoshi Son said in May that the Obama administration was "quite tough on business," and added "the door is open" for potential mergers with the new administration.

Son met with Trump the month before he took office to talk up an investment in U.S. businesses. The investment ignited speculation about Son and SoftBank trying to revive merger talks.

A few weeks later, T-Mobile CEO John Legere said he was open to "various forms of consolidation" when asked about a potential merger with Sprint and SoftBank under the Trump administration.