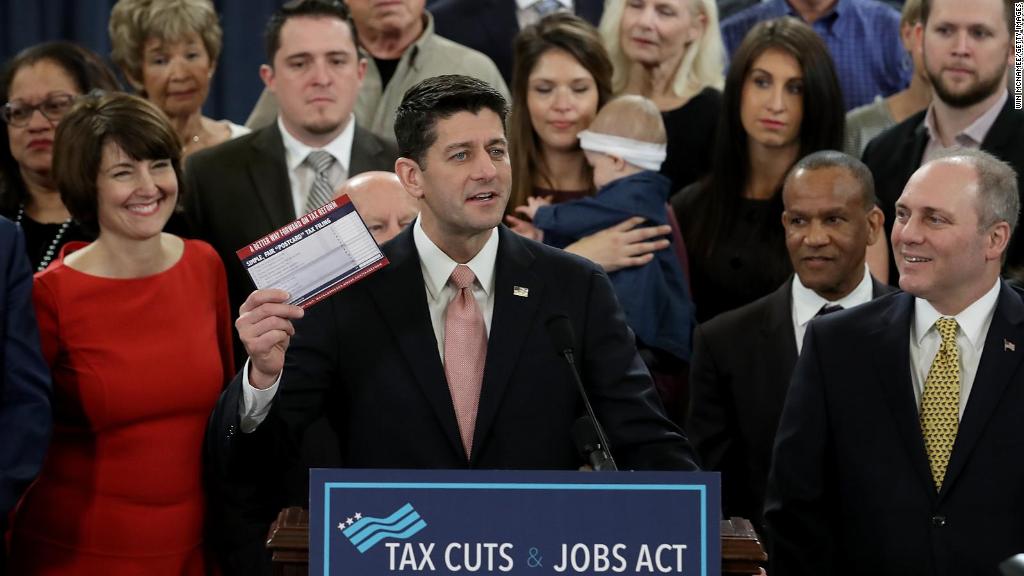

Get ready for a busy week on tax reform. The House Republican plan released last week will be tweaked and poked by lawmakers and experts.

The House Ways and Means Committee meets Monday to start debating and amending the legislation. Meanwhile, think tanks and wonk shops will crunch the numbers to see who wins and who loses with every change.

The first broad, independent analysis of the initial House bill came from the conservative Tax Foundation. It found that every income group would see a tax cut, but the top 1% of households would do considerably better than everyone else.

The after-tax income of the top 1% would rise by 7.5% in 2018 under the bill's provisions.

By contrast, groups in the bottom 80% of the income distribution would see their after-tax income increase by between 0.8% and 2.4%.

By 2027, the very highest income households -- generally people earning at least in the high six figures -- still do best, with an average 3.3% bump in after-tax income. The bottom 90% of households, meanwhile, would see a small boost, of between 0.4% and 1.1%.

These estimates are based on a conventional analysis of tax measures.

Related: What's in the House GOP tax bill for people

The results differed somewhat when the Tax Foundation did a so-called dynamic analysis, meaning they considered what the economic growth effects of the House GOP tax bill's provisions would be in addition to making assumptions about how people's behavior would change in response to the proposed measures.

Those dynamic effects, according to the analysis, could create higher growth, higher wages and 975,000 more jobs. That assumes, in part, that workers would benefit greatly from the big corporate tax rate cut in the bill, even though that's an area of disagreement among economists.

But if the premise is correct, the bill could lower everyone's tax burden by 2027, the analysis estimates. Those in the bottom 90% would see their after-tax incomes grow by between 4.1% and 4.8%. That's somewhat higher than the 3.6% to 3.9% of those at the top of the distribution.

The one thing all that estimated new growth won't do? Pay for the full cost of the tax cuts being proposed in the House bill. The Tax Foundation estimates the bill's provisions could result in GDP that is 3.6% higher than it would otherwise be over the next decade. In other words, it would be an additional 0.36% of growth per year. But even with that they would still add nearly $1 trillion to deficits.

Related: What's in the House GOP tax bill for businesses

Republicans have said they want tax reform signed into law by the end of the year. That's a very aggressive goal given how much work there is to do.

The House bill first must be amended. Tax writers in the Senate will produce their own bill. If each chamber passes its own tax bill, the differences between them will need to be reconciled. And a final reconciled bill must be voted on again. If passed, President Trump then has to agree to it all.

Christmas will be here before you know it.

Updated: The original version of this article reported that the Tax Foundation estimated GDP would increase by 3.9% (or 0.39% per year) over a decade if the House bill was enacted. But on November 9, the group said it had made an error in its analysis. It is correcting its report and preliminarily expects to revise its GDP forecast to approximately 3.6%, or 0.36% a year. This article has been updated.