Repealing Obamacare's individual mandate would give GOP lawmakers an additional $338 billion over 10 years to help pay for their proposed tax cuts.

The Congressional Budget Office updated its estimate Wednesday in response to lawmakers' interest. Republicans are considering axing the unpopular provision -- which requires nearly all Americans to have coverage or pay a penalty -- though it's not included in the current House tax reform bill.

While the federal government would lose some revenue from the penalty's elimination, it would make up that amount and more because fewer people would have federally subsidized policies, the CBO says.

Also, some 4 million fewer people would be covered in 2019, the first year the change would take effect, CBO estimated. That number would rise to 13 million by 2027, as compared to current law. Meanwhile, premiums would rise by about 10% in most years of the decade.

All this would occur because healthier people would be less likely to obtain coverage without the mandate in place. This, in turn, would cause premiums to rise, which would prompt more consumers to forgo buying policies.

The new CBO score differs considerably from the one published in December, which found nixing the mandate would save $416 billion over a decade but result in 16 million fewer Americans being covered by 2026 and rates rising by 20%, on average. as compared with current law.

The difference stems largely from the fact that CBO updated its baseline estimate this year, reducing the number of people it projects will be covered by the Affordable Care Act and the amount the federal government will pay in subsidies. The figures released Wednesday derive from the agency's 2017 projection, versus the one issued in March 2016.

Also, CBO expects that individuals' and employers' reaction to the elimination of the mandate would phase in more slowly than previously forecast.

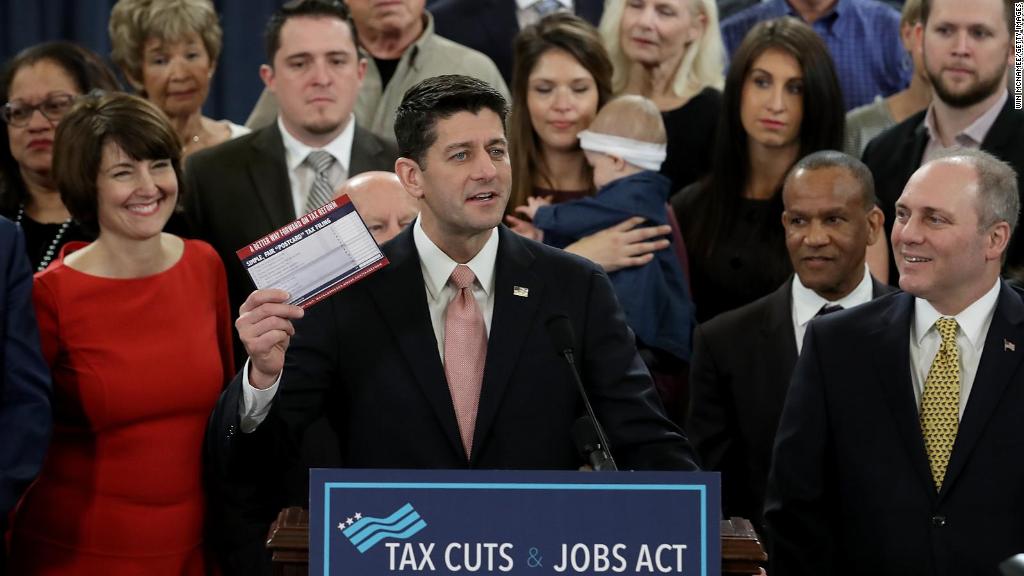

Related: Tax reform could have major implications for your wallet. Here's how

GOP leaders and most lawmakers have been cautious about including the mandate's repeal in their tax efforts out of fear that the politics surrounding Obamacare would further complicate the overhaul. But some are still pushing for it.

"We haven't been given a rational reason for why not," said Rep. Dave Brat, a Republican from Virginia who would like to see the Senate include a repeal of the mandate in its bill.

The money generated by repealing the individual mandate is a major reason why Republicans haven't entirely ruled it out. Republicans have long argued they could go even further to cut taxes for individuals, but the Senate instructions for the bill outline that the GOP cannot increase the deficit by any more than $1.5 trillion over the next decade. And tax writers in the House are already having a hard time trying to stick to that yardstick with the rate cuts they have already proposed.

Related: Top White House aides to sell Senate Democrats on tax reform

Repealing the individual mandate, meanwhile, could make it harder to get Democratic votes for the tax bill. A handful of Senate Democrats huddled with chief economic adviser Gary Cohn and White House legislative affairs director Marc Short Tuesday afternoon at the Library of Congress. The meeting, which President Trump called into from Asia, was an attempt to get Democratic support for the Senate tax bill before it is rolls out later this week.