Forget about boring stocks. Bitcoin is where it's at these days for investors.

The virtual currency is now trading at a record high above $8,200 -- just a little more than a month after bitcoin first passed the $5,000 level. If this keeps up, bitcoin could be trading at $10,000 before the end of the year.

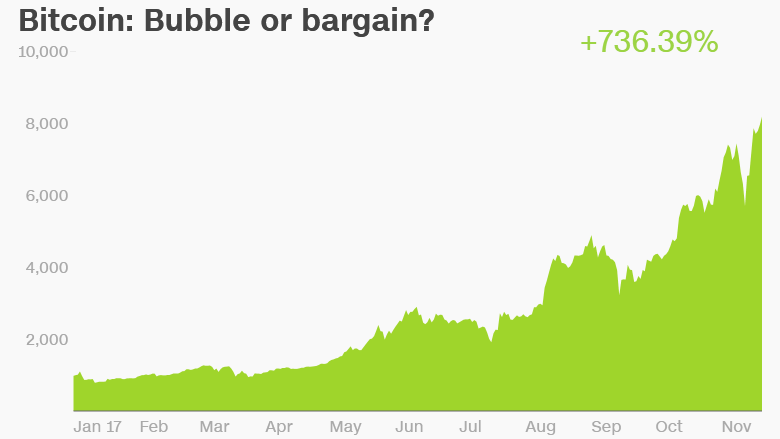

The price of one bitcoin (XBT) has surged more than 735% this year alone and has skyrocketed nearly 40,000% in the past five years.

Of course, bitcoin's meteoric rise has led to some skepticism. JPMorgan Chase (JPM) CEO Jamie Dimon has bashed it on numerous occasions, calling it a "fraud" that's better off being used by drug dealers and North Korea.

And Saudi Prince Alwaleed, a billionaire whose Kingdom Holding Company owns stakes in Apple (AAPL) and Citigroup (C), told CNBC before he was arrested in a sweeping anti-corruption probe that he thought bitcoin was an "Enron in the making" that will implode.

But while some see a bubble about to burst, others see opportunity. Lloyd Blankfein, the CEO of JPMorgan Chase rival Goldman Sachs (GS), took issue with bitcoin critics.

Blankfein tweeted last month that "folks also were skeptical when paper money displaced gold." Interestingly, technical analysts at Goldman also correctly predicted earlier this month that bitcoin prices would soon top $8,000.

Related: Bitcoin hits $13,000 on Zimbabwe exchange

Blankfein raises an interesting point though. Sure, some investors are likely flocking to bitcoin as a speculative bet because they've watched the price climb higher and higher.

But there's also a legitimate case to be made that bitcoin, ethereum, litecoin and other cryptocurrencies are the future of money and that more and more people will conduct actual transactions using these currencies.

To that end, Square -- the popular mobile payment service run by Twitter (TWTR) CEO Jack Dorsey -- recently announced a trial that will let some users of its Cash app purchase bitcoin.

"We're always listening to our customers and we've found that they are interested in using the Cash app to buy bitcoin," said a spokesperson for Square (SQ) in an email to CNNMoney.

"We believe cryptocurrency can greatly impact the ability of individuals to participate in the global financial system," the Square spokesperson added.

And CME Group, owner of the Chicago Mercantile Exchange, said earlier this month it plans to soon list bitcoin futures contracts. CME (CME) CEO Terry Duffy noted that there has been "increasing client interest in the evolving cryptocurrency markets."

Futures let investors buy and sell an asset at a specified price at a later date, They're popular bets for currencies, metals and agricultural commodities. In other words, CME Group is now treating bitcoin as a legitimate financial asset.

Related: Bitcoin prices have been incredibly volatile. What's going on?

Many others agree. Frank Holmes, CEO and chief investment officer of U.S. Global Investors, wrote in a recent note to clients that bitcoin prices should keep rising simply because more and more people are likely to use it.

"Bitcoin adoption could multiply the more people become aware of how much of their wealth is controlled by governments and the big banks," he said.

Holmes added that more startup companies are also looking to raise money through so-called initial coin offerings - the sale of digital currencies to investors instead of stock. That should lead to a further rise in bitcoin and other cryptocurrencies.

Dragonchain, a crytpocurrency startup originally backed by Disney (DIS), has held an ICO. Filecoin, a cloud storage company, raised more than $250 million earlier this year from an ICO -- the biggest ever.

And online retailer Overstock (OSTK) is even planning an ICO for its tZero blockhain unit.

"In an effort to bypass the rules and costs associated with getting listed on an exchange, many startups now are opting to raise funds by issuing their own digital currency based on blockchain technology," Holmes wrote.

Related: Cash is still king in the digital era

To be sure, bitcoin prices have moved wildly in the past couple of months. There have been several big crashes of at least 20%.

Still, the price has always come roaring back -- and analytics firm Meltwater has noted an interesting trend. Bitcoin prices have moved higher simply based on the sheer volume of news coverage... regardless of whether the reports or positive or negative.

In other words, there is no such thing as bad publicity for bitcoin, no matter how much Jamie Dimon and others bash it.

Have you been buying bitcoin? Do you view it more as an investment like stocks and commodities or as the currency of the future? Email me at paul.lamonica@turner.com or DM me @lamonicabuzz on Twitter and you may be included in a future story.