Time is running out to sign up for Obamacare for 2018.

Open enrollment ends at 11:59 p.m. on December 15 for residents in the 39 states that use the federal exchange, healthcare.gov.

More people have signed up for policies than at this time a year ago, but Obamacare supporters fear that many potential enrollees may not realize that the Trump administration cut the sign-up season in half. In fact, 56% of those consumers shopping online for health insurance at eHealth said they are unaware that open enrollment ends Friday, the insurance marketplace said this week.

There is one exception: Those who live in areas affected by hurricanes -- such as Florida -- can qualify for a special enrollment period, which will give them until the end of the year to sign up.

Related: Obama tweets: Final days to enroll in Obamacare are here!

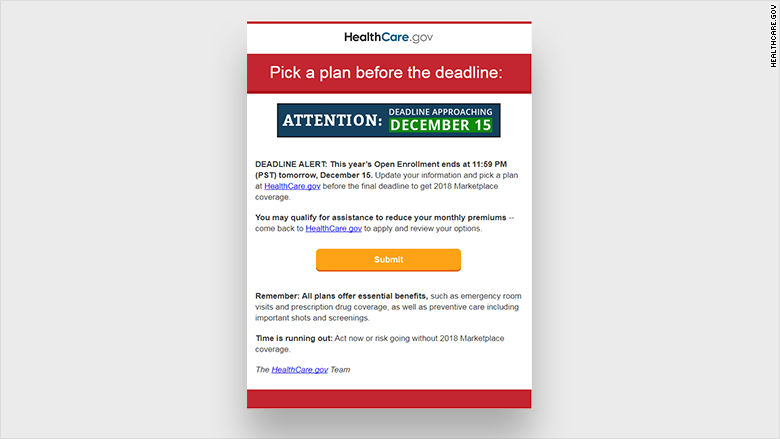

The federal exchange has been sending emails daily to some consumers warning them of the looming deadline. But the Trump administration ended television advertising, which advocates say was the most effective way to get people to enroll in time.

Some 4.7 million Americans selected policies on healthcare.gov through December 9, according to federal data. That's about 650,000 more sign-ups than at a similar point last year, according to Get America Covered, an advocacy group aimed at promoting open enrollment.

A flood of procrastinators is expected to pick plans this week. Visits to healthcare.gov soared on Thursday, hitting its highest point at midnight, Get America Covered said. And on Friday morning, people calling for help had to wait 30 minutes for a representative.

"The surge is real," said Lori Lodes, the group's co-founder and a former Obama administration official.

In prior years, consumers who started the enrollment process before December 15 -- the deadline to get coverage at the start of the new year -- were given a little more time to complete their applications. The Trump administration announced late Friday that it will do the same this year.

Even with the last-minute rush, it's unlikely that total enrollment will match last year's figure of 9.2 million.

Those in states that run their own exchanges may have more time to sign up. California and New York, for instance, have extended enrollment through January 31. Some 3 million people signed up for 2017 policies in state-based exchanges last year.

States have reported brisk activity in recent days. Maryland extended its deadline to accommodate the crowds.

"While enrollments have been very strong so far this year, we want to ensure that everyone in Maryland in need of 2018 health coverage has additional time to shop and enroll," said Howard Haft, interim executive director for the Maryland Health Benefit Exchange, which extended open enrollment to December 22.

Many of those signing up for coverage are new to Obamacare.

More than 182,000 new consumers have signed up for coverage in California, as of December 13. That's about 17% more than last year. Some 40,000 Washington residents picked plans for the first time, an increase of 47% from a year ago.

On the federal exchange, the number of new consumers is up about 14% from last year to just under 1.4 million.

Related: Obamacare enrollment could fall millions short for 2018

Current Obamacare enrollees who want to remain on the individual market should go to healthcare.gov to view their options and actively select a plan. If they don't, they will be automatically re-enrolled in their same policy. In previous years, this happened well before open enrollment ended so people could select another policy. But this year, they will not be able to switch plans since the enrollment season will have already ended.

Some 2.2 million people were automatically re-enrolled through healthcare.gov last year.

Those who shop around may find they can snag much cheaper plans. Premiums have soared for 2018, but so have federal subsidies.

A 40-year-old earning $25,000 will pay 75% less, on average, for the cheapest bronze plan and 21% less for the lowest-cost gold plan, according to the Kaiser Family Foundation. A 40-year-old earning $40,000 will see a 28% drop, on average, in the price of the cheapest bronze plan, and an 8% decrease in the least expensive gold plan's premium.

Some 80% of enrollees will be able to find a policy for $75 a month or less -- up from 71% this year and the highest share so far, according to federal data.