General Electric, once America's most successful conglomerate, could break itself apart.

A breakup would represent a further dismantling of an already-shrinking empire that still makes everything from light bulbs and jet engines to MRI machines and power plants.

John Flannery, the new CEO charged with engineering a turnaround at GE, signaled on Tuesday that the company is exploring a potential breakup as it continues to clean up messes from the past.

"We are looking aggressively at the best structure or structures for our portfolio to maximize the potential of our businesses," Flannery said during a conference call.

The comments are stronger than what GE has said in the past. The company continues to review its vast and complex portfolio.

The news comes after GE (GE) surprised investors on Tuesday by disclosing a larger-than-feared $6.2 billion hit from insurance problems at GE Capital, the financial arm that the company has mostly sold off. GE further warned it will have to devote $15 billion to boost insurance reserves at GE Capital.

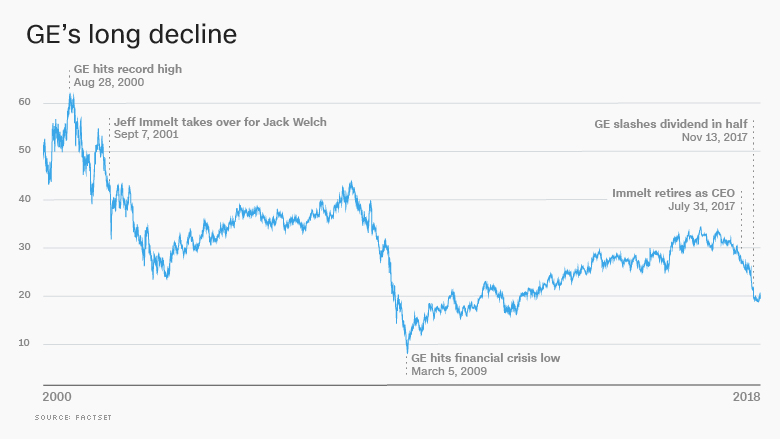

Flannery said the insurance hit along with last year's 45% stock price nosedive "further my belief that we need to continue to move with purpose to reshape GE."

Related: How decades of bad decisions broke GE

The new CEO said the review could result in many different outcomes, including "separately traded assets really in any one of our units if that's what made sense." A decision could be made by the spring.

After years of resisting, GE is likely to embrace a major breakup of the company, sources told CNBC on Tuesday.

GE did not comment on the report, referring questions to Flannery's comments.

Over the past decade, GE has already moved to shrink itself dramatically, including by selling off NBC Universal and most of GE Capital.

But now GE is suffering from a serious cash crunch caused by years of questionable deal-making, needless complexity and murky accounting. The turmoil forced GE to cut its coveted dividend last year for just the second time since the Great Depression.

Some analysts are warning that dismantling GE won't be a quick fix.

"It would be destructive relative to where the current stock price is," Cowen analyst Gautam Khanna said in an interview.

Khanna said GE's balance sheet is such a "mess" that it may be worth even less in a breakup scenario. He estimates the sum of GE's parts is just $11 to $15 per share, compared with the current stock price of $18.

The problem is that GE's various divisions in some ways benefit from being together. For instance, they enjoy easy access to cheap capital, GE's well-known brand, shared services and a deep management bench. A breakup would remove that and also include significant legal and tax costs. And GE has enormous debt and underfunded pension liabilities that must be accounted for.

The only way a breakup makes sense, Khanna said, is if GE fears it's worth even less kept intact because its businesses are in decline.

Deutsche Bank analyst John Inch thinks dismantling GE would be too messy. "I don't think GE can separate. If they could, they would have before. I think it's a red herring," Inch said in an interview.

Related: GE has a fossil fuels problem

Others believe a breakup makes sense, especially because the super-conglomerate model built by longtime CEO Jack Welch in the 1980s and 1990s has been cast aside as overly complex.

A breakup could allow bright spots at GE to shine through the dark clouds hanging over the company.

"I am more convinced than ever that we have substantial strengths and value that have been suppressed in the current context," Flannery told investors on Tuesday.

It's not clear what a breakup would look like, but GE has signaled a focus around three key business areas: power, aviation and healthcare. GE is already trying to sell off its iconic lightbulb division and the century-old rail business. GE is even thinking about ditching its majority stake in Baker Hughes (BHGE), which it merged its oil and gas business with in 2016.

Flannery has spoken about the need to "simplify" GE's portfolio, creating a more nimble company that's easier to operate and better at executing. One of GE's biggest problems is its fossil fuels-focused power division, which was caught badly off guard by the dramatic rise of renewable energy.