If you've missed out on the booming stock market, you could be in luck.

Some Wall Street analysts think the red-hot rally will finally take a breather soon, giving investors on the sidelines a chance to jump in.

The S&P 500 is "very likely" to retreat about 5% from its all-time highs in February or March, Bank of America Merrill Lynch strategists wrote in a report on Friday.

Why? Because investors may be overly exuberant right now. When that happens, prices get out of step with reality.

Bank of America chief investment strategist Michael Hartnett called the run-up a "nonstop euphoric cabaret." He cited a record $33.2 billion of cash plowed into stocks last week. That included a record amount of money going into tech funds.

Other signs of euphoria: Bank of America's rich private clients are putting money into stocks at the fastest clip in a decade, and their cash balances have dropped to a record low of 10%.

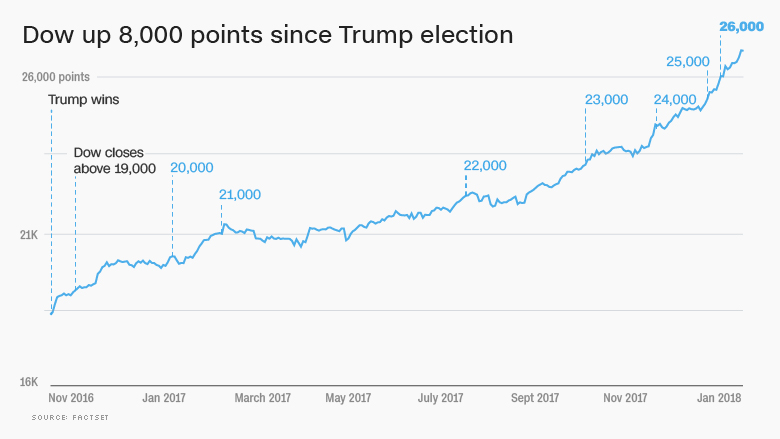

That buying binge has driven the Dow to one record after another. It's above 26,500, up from about 18,300 when President Trump was elected in 2016.

Related: This is the calmest stock market in history

It's been a relentless climb: The S&P 500 hasn't dropped 5%, either in a single day or over several, in 400 trading days. That's the longest streak on record.

Also, the S&P 500 has gone 111 trading days without a 1% down day. Monday would tie the all-time record set in 1985, according to LPL Financial.

Pullbacks can be healthy because they prevent the market from overheating and give investors who missed the move a potential entry point.

Bank of America thinks a pullback could come soon. The firm's bull-and-bear investor sentiment indicator is flashing extreme optimism right now. In the past, that's proved to be a warning sign that a sell-off is coming.

The indicator climbed last week to the most euphoric level since early 2013. Any higher and it would be signaling outright "sell."

Of course, many market analysts have been burned betting against this incredible stock market rally.

And there are good reasons for stocks to be up.

The U.S. economy is in good shape. Gross domestic product, the broadest measure of economic activity, rose 2.3% in 2017. Confidence has soared for consumers, small businesses and CEOs, thanks in part to Trump's deregulation agenda and the sweeping corporate tax cuts he enacted.

Another huge factor: The global economy is on a roll. Every major country or region grew last year. The IMF estimates 2017 growth at 3.7%, the best since 2010.

With that economy and policy backdrop, companies are flourishing. Wall Street analysts are falling over themselves to ramp up their estimates for earnings, which power stock prices. S&P 500 profits are now expected to surge 16% during the first quarter, according to FactSet.

"It's hard to see how U.S. stocks retreat in the face of further upside revisions to come," Nicholas Colas, co-founder of DataTrek Research, wrote in a report on Monday.

Related: The stock market is on fire. What could go wrong?

But good times don't last forever. Even if the eight-year bull market in stocks continues for some time, it's overdue for a pause.

Barry Bannister, head of institutional equity strategy at Stifel, wrote in a report on Monday that he expects the S&P 500 to pull back by 5% in the first quarter.

If trouble comes to the market, many analysts think it will start in bonds. If investors sell bonds, their interest rates will rise sharply from their current historic lows. And when investors can get better returns from bonds, risky stocks start to look less attractive.

Stocks will slide as bond yields "rise abruptly to reflect growth as well as inflation," Bannister wrote.

The Dow slumped about 100 points on Monday as the 10-year Treasury yield climbed above 2.7% to the highest level in nearly four years.

Bannister warned that Wall Street "may soon collide" with a Federal Reserve worried that the "asset price bubble builds further and then bursts."