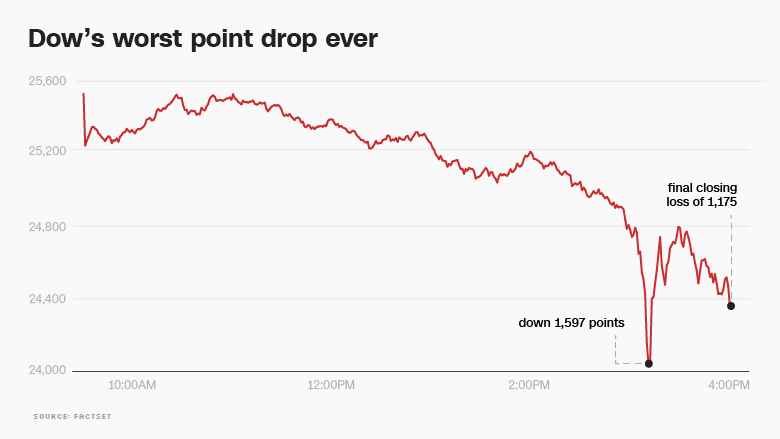

Just after 3 p.m. on Monday, the Dow went off a cliff.

Stocks were falling throughout the day, and just before 3 p.m. the Dow was down 600 points.

At 2:57, it was down 700. 3:01, down 800. 3:05, down 900. 3:08, down 1,000. 3:09, down 1,100. 3:10, down 1,400. 3:11, down 1,500.

At one point before 3:12 p.m., the Dow was down 1,597 points. It was the most points the Dow had ever fallen in a single trading day.

By the time the market closed at 4 p.m., the Dow had recovered slightly. But was still down 1,175 points. The Dow had never closed down by that many points..

The 800-point drop in the span of 10 minutes felt like the Flash Crash of 2010, when the Dow quickly plunged almost 1,000 points.

On May 6, 2010, fears about the European sovereign debt crisis sent the S&P 500 down 4%. But then the market plummeted almost another 6% in mere minutes before mysteriously rebounding about as quickly.

One of the culprits of the Flash Crash was high-frequency trading, where computers are programmed to trade a lot of stocks incredibly fast. It was a bizarre domino effect kicked off by rapid trading algorithms.

A NASDAQ representative told CNNMoney that the exchange didn't spot any technological problems on Monday. The New York Stock Exchange was also functioning without any apparent glitches or errors.

Flash crashes can happen even without glitches.

"We've created a stock market that moves too darn fast for human beings," said David Weild IV, founder and chairman of CEO of Weild & Co. and a former vice chairman of Nasdaq.

And because of that, he added, "we see shocking results."

Related: Dow plunges 1,175 -- worst point decline in history

People can make certain calls that computers can't, and explain to investors why they should or should not sell their stocks, he said. On a day like today, traders may have told their clients to sit tight.

Computer programs sold off stocks and scared investors.

Related: This is why the Dow is plunging

Jonathan Corpina, a senior managing partner with Meridian Equity Partners who was at the NYSE today, described a snowball effect that kicked in as the day came to a close. Some automated sell programs were likely triggered by the contraction in the market, he explained. Those, in turn, triggered others.

"They start playing leapfrog with each other," he said.

At a certain point, buyers who were looking for deals also pulled back, making matters worse.

"That's how you get these large swings in the market," he said.

Corpina didn't blame the volatility entirely on electronic trading.

He pointed out that regardless of whether a person or a program was making the call to ditch stocks, there was logic behind the decision.

"The sellers were really convinced at the end of the day that today was the day to sell," he said.

-- CNNMoney's Matt Egan contributed reporting to this story.