For more than a year, the stock market has been pretty boring.

Then came the past three days of trading.

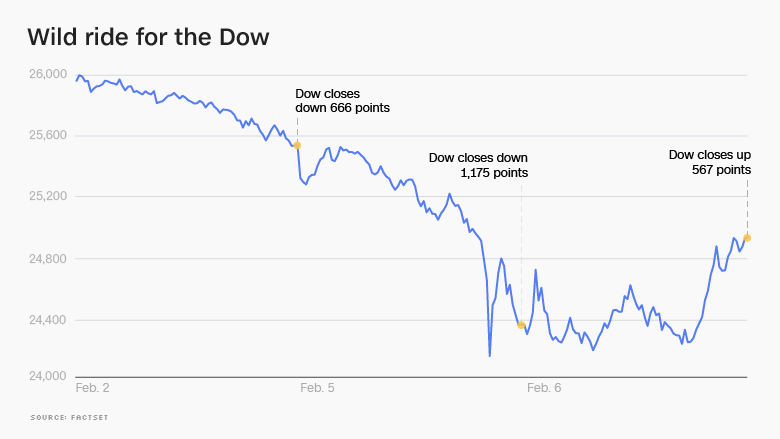

Calm gave way to incredible volatility. Stocks tumbled on Friday before nosediving on Monday, when the Dow notched its biggest-ever daily point decline. On Tuesday, after a rocky start, stocks soared, and the Dow finished the day up 567 points, or 2.3%.

Talk about a dizzying ride.

The Dow hit an all-time high of 25,000 at the beginning of January, only to reach 26,000 seven trading days later.

So just when did the trouble begin?

The first signs of turbulence came a little more than week ago.

On Monday, January 29, the Dow slumped about 100 points as the 10-year Treasury yield climbed above 2.7%, reaching the highest level in nearly four years.

Then, on Tuesday, January 30 -- hours before President Trump's State of the Union address -- the Dow plunged 363 points, or 1.4%. The two-day loss of 2% was the most severe since September 2016.

The situation seemed like it could be stabilizing on Wednesday and Thursday, when the Dow closed up modestly.

Then came Friday.

That's when the Dow fell 666 points, or 2.5% -- the biggest percentage decline since the fallout from Brexit in June 2016.

Related: CNNMoney Fear & Greed index is in Extreme Fear

The sell-off continued into this week. At one point on Monday, the Dow fell a head-spinning 1,597 points. It closed down 4.6%.

The rout spread to markets in Asia and Europe overnight.

Major markets in Europe lost about 2%. Stocks in Germany, Sweden and Spain fell into a correction, or a drop of 10% from their record highs. Japan's Nikkei took a 4.7% hit, while Hong Kong's Hang Seng tumbled 5.1%.

By Tuesday, U.S. markets were trending positive again, though they were anything but steady.

Stocks entered correction territory on Tuesday morning, before making a wild comeback. The swing made for the Dow's biggest point gain since August 2015, and its fourth largest in history.

There's no single reason for all the whiplash. But experts agree markets have been overdue for some disruption.

"It was well understood by most investors that we've had an amazing run, and the pace of the gains was bound to slow, or we could get a pullback," said Kelly Bogdanova, a portfolio analyst at RBC Wealth Management. "It's just incredibly difficult to gauge the timing of these things."

Bogdanova pointed to wage data released by the Department of Labor on Friday as one contributing factor.

Wages in January grew at the fastest pace in eight years, according to the U.S. Bureau of Labor Statistics. That fed concerns about inflation, which in turn spurred speculation that the Federal Reserve could raise interest rates at a faster pace than previously expected.

Related: This is why the Dow plunged

Then there's all the movement in the bond market, which is also tied to inflation concerns. The 10-year Treasury yield hit a four-year high of 2.85% in recent days, and ended Tuesday at 2.8%.

Still, the economy remains solid. Job growth has continued, and corporate earnings should remain strong.

The real takeaway is that markets no longer appear invincible, as they have since Trump's 2016 election.

"When volatility strikes, it usually doesn't dissipate right away," Bogdanova said. "We could see some outsize moves in both directions in coming days, coming weeks and even coming months."

-- CNNMoney's Matt Egan contributed to this report.