A hostile takeover of the chip maker Qualcomm is on hold while American regulators examine it for national security concerns.

The government late Sunday asked Qualcomm, based in San Diego, to delay its annual shareholder meeting by 30 days. The meeting, scheduled for Tuesday, was supposed to determine whether Singapore-based Broadcom could advance its bid to buy the company.

Broadcom's latest offer is $117 billion for Qualcomm. Qualcomm (QCOM) has warmed to the deal but says the offer is too low. In a bid to take control, Broadcom (AVGO) wants to elect six nominees to Qualcomm's board, giving it a majority.

Now the takeover attempt is on hold while an obscure government panel examines it from a national security perspective. It's an unusual intervention by US regulators at this stage in the takeover process.

Related: Amazon and Whole Foods. CVS and Aetna. A scorecard of the biggest deals

The Committee on Foreign Investment in the United States, a panel of federal agencies headed by the Treasury Department, has the authority to examine foreign investments in American companies to make sure they don't threaten national security.

The committee usually waits until after a deal is done to check it out. But CFIUS has been more active in recent years. And, if it goes through, Broadcom's bid for Qualcomm could be the largest technology deal in history.

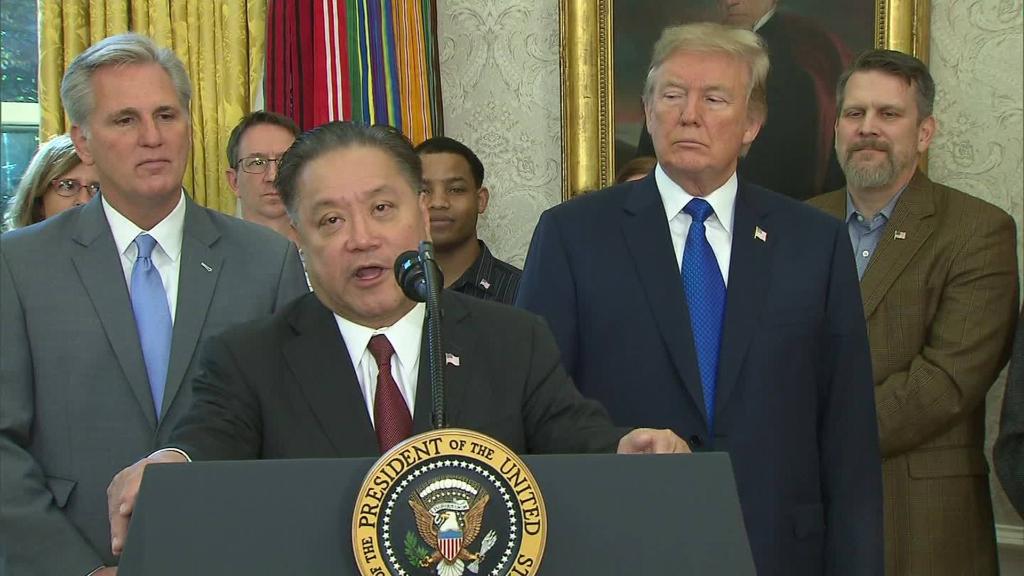

In November, Broadcom announced that it would move its legal headquarters back to the United States from Singapore. Four days later, it announced the bid for Qualcomm.

Related: Trump team backs tougher oversight on Chinese money in America

Broadcom says Qualcomm secretly asked for the regulatory review in January. Broadcom claims that it didn't find out until Sunday night, 48 hours before the board meeting.

"This was a blatant, desperate act by Qualcomm to entrench its incumbent board of directors and prevent its own stockholders from voting for Broadcom's independent director nominees," Broadcom said in a news release.

Qualcomm said Broadcom is trying to deceive shareholders and the public "by using rhetoric rather than substance to trivialize and ignore serious regulatory and national security issues." It also disputes Broadcom's claim that the government's inquiry was a surprise.

Qualcomm made its name inventing the 2G and 3G wireless network technology used by Verizon (VZ) and Sprint (S). Now the bulk of its sales come from mobile chips powering the brains in smartphones and the radios that enable cellular communications.

Broadcom primarily makes chips for wired broadband communications, including modems, Wi-Fi, switches and routers.

The deal comes just as every wireless carrier in America is about to unleash its 5G technology. 5G will rely on wired and wireless technology working in tandem.