When his turn came to question Treasury Secretary Steven Mnuchin during a House Appropriations Committee hearing on Tuesday, Congressman David Young relayed a concern he'd just heard from a farmer in the hallway.

"He says, 'There's not a day on the farm when a farmer doesn't touch steel,'" the Republican from Iowa told Mnuchin. "The agriculture industry is worried about these tariffs on aluminum and steel. How much do you know about the proposed tariffs?"

"I know a lot about the proposed tariffs," Mnuchin answered. "And I can tell you the president loves farmers and the agricultural community."

"It doesn't seem so with some of the policies that are coming out," Young shot back. "There's great concern with folks in the heartland, and concern as well with retaliation and what that may mean to the economy."

Mnuchin received a lot of criticism that day — even from members of his own party. While farm-state conservatives praised Trump's tax cuts and regulatory rollbacks, they didn't hold back when it came to their disapproval of a tariff tit-for-tat.

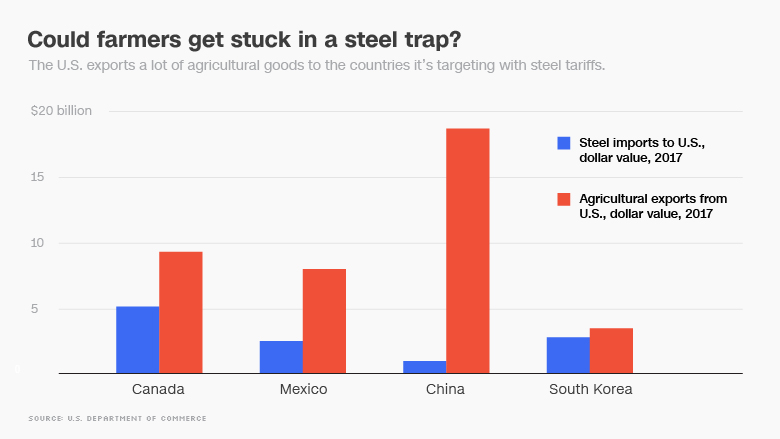

They have reason to be concerned. Historically, agricultural products take a hit when the US targets imports of industrial goods. Other countries have imposed countermeasures like tariffs on US goods and sometimes outright bans that have depressed sales.

The same thing may happen again now that Trump has carried through with his promise to impose tariffs of 25% on steel and 10% on aluminum.

In response to what it refers to as this "deeply unjust" plan, the European Union has said it is considering new tariffs on American products ranging from cranberries to peanut butter.

Related: Why steel and aluminum tariffs matter to the U.S. economy

This is a familiar pattern. In 1995, for example, the United States banned Mexican trucks from driving more than a short distance over the border, after it had agreed to let them do so under the North American Free Trade Agreement. In 2009, following a drawn-out protest, Mexico retaliated with hefty tariffs on scores of food items, from ketchup to frozen corn.

The United States eventually lifted its ban on trucks in 2011, and Mexico dropped the tariffs. But the damage had been done: A study later found that the retaliation decreased sales of those products to Mexico by 22%, or nearly a billion dollars.

And already in the Trump administration, China has announced an investigation into American sorghum imports after the United States imposed tariffs on Chinese washing machines and solar panels. The United States sold nearly a billion dollars worth of the grain to China in 2017. Should China choose to impose duties on those exports, US farmers could be forced to cut prices in order to attract another buyer for their supply.

"This indicates to me a very real-world example that tariffs on those washing machines and solar panels led to retaliation, to the detriment of American farmers, constituents of the President and mine," said Kevin Yoder, a Republican from Kansas, during Tuesday's hearing with Mnuchin. "Is the president aware that these retaliatory tariffs are already occurring?"

Yoder's home state of Kansas accounts for nearly half of US sorghum production.

Related: Big aluminum says the aluminum tariff won't work

Why do American farmers so often get tangled up in trade wars? For one thing, they already have access to many world markets. In places where the US has negotiated trade agreements, they face low or no tariffs. US farmers have also been prodigious exporters: While the United States runs a $566 billion trade deficit with the rest of the world overall, it has a trade surplus of $21 billion in agriculture.

With so much going their way, farmers don't want to upset the international trade apple cart.

"There's nothing to win," said Daniel Sumner, an agricultural economics professor at University of California, Davis. "There's only stuff to lose."

The United States' trading partners know that farm products are a good way to squeeze a politically powerful constituency, particularly for Republicans. To wield influence, countries may target US products they can get elsewhere, like wine from Chile or soybeans from Brazil.

"We want to get your attention so you'll change your policy," Sumner said of countries that want the administration to abandon the steel and aluminum tariffs. "So you've got to get an industry that will be hurt enough to talk to their representatives."

Agricultural margins have already been shrinking over the years. Global commodity prices have sagged and the United States' longstanding subsidy and insurance programs for certain crops have become less generous.

A new threat came from President Trump's opposition to the North American Free Trade Agreement. The trade deal may have hurt some US manufacturers, but it was a boon to the agriculture sector, which has become highly mechanized and is therefore less dependent on cheap labor than products like cars, for example.

Two separate lobbying groups, Americans for Farmers & Families and Farmers for Free Trade, which is co-chaired by retired senators Dick Lugar and Max Baucus, have formed in the past few months to advocate for preserving NAFTA.

Related: These American companies could be hurt by Trump's tariffs

"Farm country is Trump country," said Matt McAlvanah, a former spokesman for the US Trade Representative in the Obama administration who now represents Farmers for Free Trade. "Our engagement is more important than ever right now."

To head off the damaging tariffs, the groups have been seeking the support of lawmakers who aren't from farm states, and working with governors like Arkansas' Asa Hutchinson to declare Agricultural Trade Awareness days.

It may be working: After initially declaring that the tariffs would apply to all countries, the White House said Canada and Mexico would be exempt if a new NAFTA deal is reached.

Meanwhile, American farmers are losing out in a more subtle way. The Asian and South American countries that were part of the Trans-Pacific Partnership trade deal before Trump pulled out of it just signed a pact without the United States. That will create more favorable treatment for agricultural products like potatoes within the bloc, according to the USDA, disadvantaging US growers.

Although none of this has happened yet, Sumner said that the uncertainty chills investment in crops that take a long time to bear fruit.

"If I plant a walnut orchard, I'm looking to the next two to three decades," Sumner said. "If it's a crop that depends on exports, and you disrupt the potential for exports, that's a problem."

This story has been updated to reflect the signing of an order by President Trump to impose the steel and aluminum tariffs and the passage of the Trans-Pacific Partnership, which both occurred Thursday afternoon.