Dropbox wants to raise as much as $648 million when it debuts on the stock market.

The cloud storage company is selling 36 million shares for between $16 and $18, according to a regulatory filing released Monday.

Based on the number of shares of eligible for sale, Dropbox would have a valuation of about $7.4 billion. That's lower than the $10 billion Dropbox was reportedly valued at on the private market.

If there's more investor demand for the stock, Dropbox could sell another five million shares to bring the total to $745 million. Salesforce's (CRM) venture arm has agreed to buy $100 million in shares.

Dropbox will list on the Nasdaq under the stock ticker DBX.

Related: Dropbox files for a $500 million IPO

Dropbox became a leader in storing and sharing documents, photos and files online. The company says customers have added more than 400 billion pieces of content to its storage base to date.

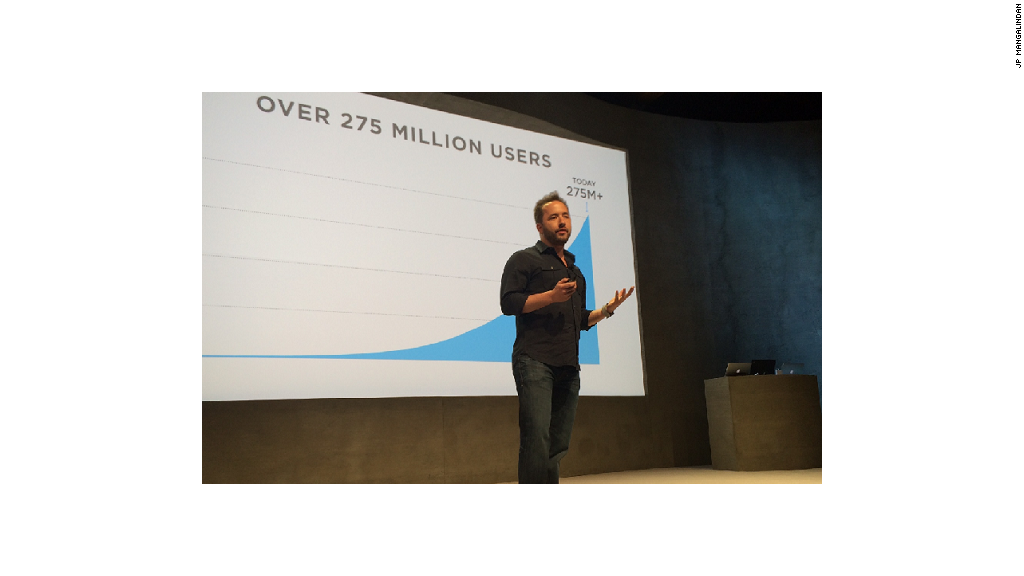

More than 500 million people have signed up for Dropbox, but only 2% pay for subscriptions. That's part of why Dropbox isn't yet profitable. Although Dropbox posted $1.1 billion in sales last year, it lost $112 million.

Dropbox's business model depends on maintaining its customer base and convincing more users to pay. "Our future growth could be harmed if we fail to attract new users or convert registered users to paying users," the company said as part of its risk factors in the filing.

In recent years, Google (GOOGL), Microsoft (MSFT) and Apple (AAPL) sharing services have emerged as major threats to Dropbox. Apple's late CEO Steve Jobs once vowed iCloud would kill Dropbox.

—CNN's Paul R. La Monica and Seth Fiegerman contributed to this report.