Quest's Profitable Moment

Does the Trump administration want a trade war with its closest allies? To see the way it has bullied and threatened close allies with steel and aluminum tariffs, one might conclude it doesn't care.

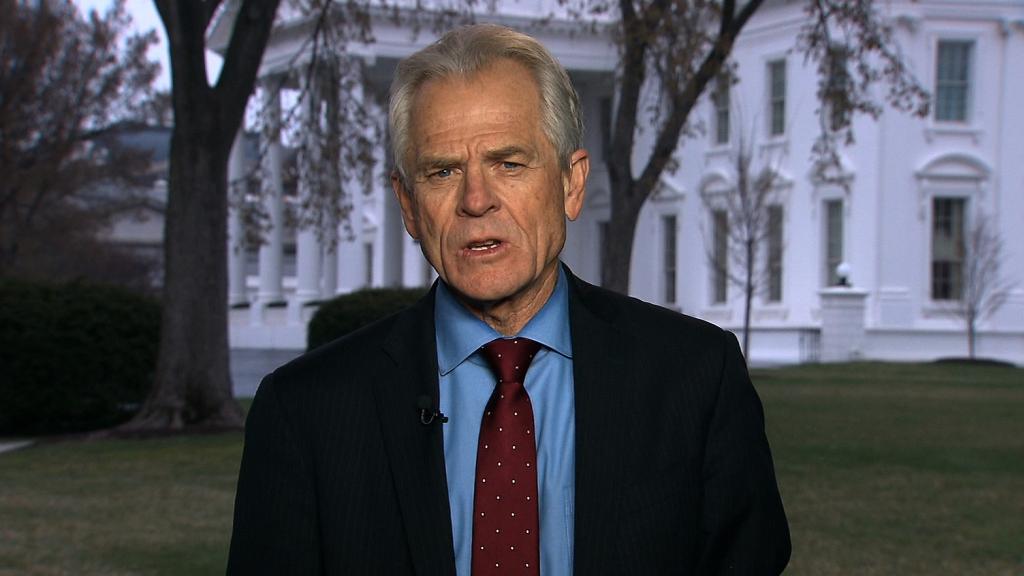

Not so, according to Peter Navarro, the president's top trade adviser. On "Quest Means Business," he told me that the administration was making great gains. He pointed to the new expanded free trade agreement with South Korea as an example of the strategy's success.

Navarro is the principal architect of Trump's more muscular trade policy. He claims the United States has been deeply disadvantaged by existing treaties. He expects other countries will also acknowledge the unfairness of the current situation and strike new deals with America.

Sign up for the weekly Quest newsletter in your inbox

But he denies being a protectionist, as the phrase is pejoratively used. Standing up for American companies is not, in his view, protectionist.

None of which is probably helpful to the markets. Stocks like Boeing (BA) and Caterpillar (CAT) continue to be hit hard because of the prospect of tariffs.

And to those surprised by the administration's measures, Navarro says they shouldn't have been. The president was very clear about what he was intending to do. Now he's simply getting on and doing it.

Can't argue with that.

Tech stock volatility has investors on edge

Facebook's stock is down nearly 17% in the wake of the Cambridge Analytica data scandal, denting Mark Zuckerberg's net worth. Amazon fell, too, after a report from Axios suggested President Trump may target the company for antitrust action. Trump followed that up by tweeting an erroneous claim about Amazon's paying "little to no taxes." The tech plunge hurt the broader market because the S&P 500 is now dominated by Apple (AAPL), Google (GOOG), Microsoft (MSFT), Amazon (AMZN) and Facebook (FB). International tech stocks weren't immune to the slump either. China's Tencent (TCEHY) also plummeted this week.

— Paul R. La Monica

Will Warren Buffett rescue GE (again)?

At first blush, it sounds crazy that Warren Buffett would touch General Electric (GE). The stock has been practically toxic for two years because of a series of bad decisions. But even GE's biggest critics concede the stock isn't going to zero. It's still a huge company that makes real things like light bulbs, jet engines and MRI machines. And the stock may finally be cheap enough for Buffett, who rescued GE in 2008, to kick the tires. The stock bounced this week on unconfirmed rumors that Buffett could make a play. An investment from Buffett would go a long way toward restoring confidence in GE.

— Matt Egan

Google could owe Oracle billions

An appeals court said this week that Google violated copyright laws when it used Oracle's open-source Java software to build the Android platform in 2009. The ruling could cost Google (GOOG) billions of dollars, and change how tech companies approach software development. It's also the latest development in an eight-year, topsy-turvy battle between Google and Oracle (ORCL). Now Google could be on the hook for damages. As of 2016, Oracle was seeking about $9 billion from Google. But because APIs have become much more widespread over the years, a court could decide that Oracle deserves more. And other companies could either have to pay to license certain software, or develop their own from scratch.

— Danielle Wiener-Bronner

Brexit is a year away

There's just a year to go before Britain leaves the European Union. The two sides are deep in negotiations on Britain's exit and have made some progress, including the rights of EU citizens living in the UK. Britain has also agreed to pay a large financial settlement to the EU. But the Irish border remains a major roadblock. Northern Ireland, which is part of the United Kingdom, is leaving the European Union. But Ireland is staying. The EU says there won't be a divorce without an agreement on Ireland. Crashing out of the European Union without a deal would be disastrous for the UK economy.

— Nathaniel Meyersohn

Quick takes

Wall Street bankers are taking home near-record bonuses, despite cries of overregulation.

Washington growers are vulnerable to Chinese apple tariffs — and the penalties could force them to hike prices in China to protect profit margins.

President Donald Trump has his first trade deal: an agreement with South Korea.

Susan Rice, a former UN ambassador and national security adviser under President Barack Obama, has joined Netflix (NFLX)'s board of directors.

The United States and China are acting tough over trade, but they're also busy talking to try to stop the situation from spiraling out of control.

What's next

Spotify's IPO: The music streaming service will go public on Wall Street next week. It was valued at about $8.5 billion the last time it raised money from investors. But one analyst thinks Spotify could be worth $43.5 billion once its stock starts trading.

Markets Now: Check out CNNMoney.com on April 4 at 12:45 p.m. ET for Markets Now, a new weekly live show from the floor of the New York Stock Exchange. CNNMoney's Richard Quest and Maggie Lake bring you exclusive access to a strategy session with investing legends.